Finance chief offers reassurance amid HK stock market rout

Financial Secretary Paul Chan Mo-po on Tuesday offered his reassurance on Hong Kong's financial strength and the Chinese mainland's economy to combat negative narratives, as growing bearish sentiment is driving global investors to vote with their feet.

"The special administrative region government has been closely monitoring the market situation in a cross-market and round-the-clock manner. So far, we have not observed any abnormal conditions," Chan told the Hong Kong Capital Markets Forum 2024.

"The financial market continues to operate in an orderly and efficient manner, the financial system remains robust, and the linked exchange rate system is functioning well," he added.

Chan's remarks came amid a global selloff of Hong Kong stocks. The Hang Seng Index slid 2.32 percent to end at 15,703.45 points on Tuesday, cutting short a much-needed rally trend and bringing the benchmark below 16,000.

The finance chief explained that the performance of the city's stock market, with half of its listed companies being from the mainland, is not only influenced by the international environment but also reflects to some extent investors' sentiment towards the mainland economy and market trends.

"In fact, if we objectively look at the data from the mainland, we can see that their economic development is steadily progressing according to their plan," Chan said.

China's GDP grew 5.2 percent year-on-year in 2023, exceeding the government's official target of around 5 percent, the National Bureau of Statistics announced this month. The performance represented a rebound from COVID-battered 2022, when the world's second-largest economy grew by 3 percent.

Confidence in the national real economy also lies in indicators such as the scale of social financing, monetary credit, electricity consumption, passenger flows, and freight volume — all of which recorded strong growth, Chan told the forum.

Today, a top priority in the nation's new development paradigm is the drive for "high-quality development" — a model aimed at making the economy more innovative, efficient and sustainable.

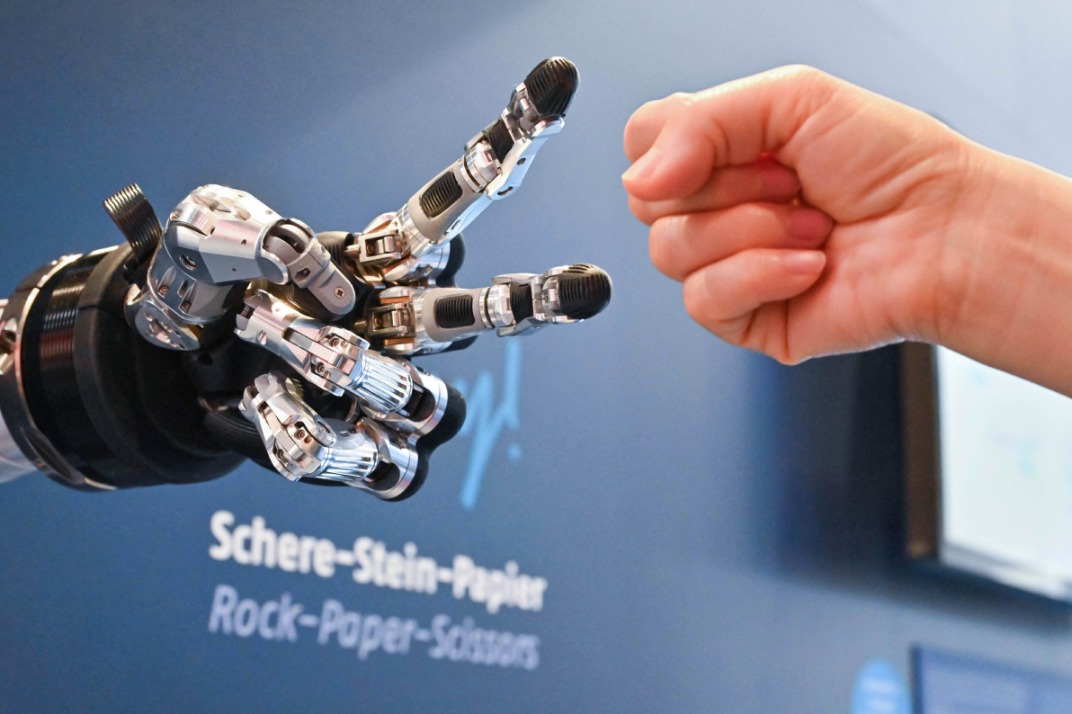

During this process of economic structural adjustment, the mainland will continue to generate new development momentum in areas such as high-end production, artificial intelligence, and green transformation given its strong industrial and capital foundation, innovation capabilities and talent, Chan said.

He also shed light on some other areas of Hong Kong's financial market, which he said had "performed well" in 2023.

"Hong Kong's bank deposits grew by over 5 percent last year, proving that although funds flow in and out, the overall trend is a net inflow," Chan said.

In the first nine months of last year, Hong Kong issued bonds worth $507 billion, an increase of approximately 7 percent compared to the same period a year earlier. Also, total assets under management amount to about $4 trillion, placing the city in a leading position in Asia.

To quell concerns over a potential decline in the attractiveness of Hong Kong to capital, Chan said funds from the deep-pocketed Middle East region are expected to offset a loss of inflow from Western economies.

"Due to the global political landscape, capital from the Middle East, including sovereign wealth funds and family offices, are actively seeking investment opportunities outside of Europe and the United States," he said,

Citing the fact that the total assets of sovereign wealth funds from the oil-rich region reached $3.6 trillion as of the end of 2022, Chan said "a significant amount of funds would flow into China" if the investment proportion is based on the global GDP ranking.