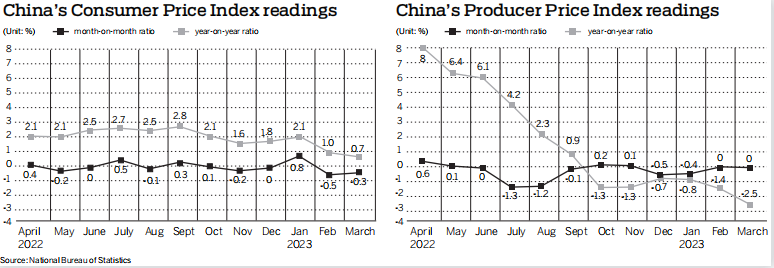

Higher CPI, lower PPI require nuanced understanding

From an economic perspective, the economy is currently experiencing sustained recovery rather than recession.

The Chinese economy has returned to a market economy mode from a pandemic mode and the services sector, especially catering, has recovered quickly. Value-added industrial output, consumption and investment are all on the rise.

Of course, the foundation of economic recovery is still not yet solid. Durable goods consumption still shows significant negative growth, reflecting a sluggish consumption climate, mainly due to damage to the household asset-liability structure and the downward trend of household income growth. The private sector also lacks confidence in the future and stable economic growth mainly relies on infrastructure investment by State-owned enterprises. While the real estate market is in continuous recovery and risks are gradually easing, unsold housing floor space is still increasing year-on-year and employment challenges will in turn constrain income and consumption growth.

From the perspective of policy measures, the immediate task is to boost confidence of market entities rather than implement a strong stimulus.

The economy is currently in the process of recovery. Given the strong credit and social financing figures in the first quarter, there is no need for a strong stimulus akin to that which China offered after the 2008 crisis.

The current situation points to insufficient overall demand and weak market confidence. We need to continue to do a good job in stabilizing growth, encouraging employment, promoting consumption, shoring up investment and instilling confidence.

Luo Zhiheng is chief economist of Yuekai Securities. Ma Jiajin is an analyst of Yuekai Securities.

The views don't necessarily reflect those of China Daily.