Power of long-term investment opportunities

Foreign players make a beeline for China's capital market, financial services industry

China's higher-level opening-up and reform of caps on business ownership are producing rich dividends for the country's financial services industry in general and the capital market in particular, experts said.

More foreign entities like securities brokerages and investment banks are expanding their global footprint into China even as Chinese companies tap foreign bourses for additional funds. All this is causing a healthy trend in two-way capital flows, besides boosting related market segments like derivatives. What is more, existing foreign players in China are increasing their financial product portfolios, they said.

There is good reason for foreign firms to do so, market mavens said, underlining that in the current fraught global scenario, the Chinese market represents a solid opportunity to earn decent returns on big-ticket investments.

Take Bridgewater Associates, for instance. In the first half of this year, the world's biggest hedge fund notched up an impressive 4.76 percent gains on its investments in China's stock market. What makes Bridgewater's performance outstanding is that during the same period, the local benchmark, the Shanghai Composite Index, shed as much as 6.63 percent, with comparable global indexes abroad not faring much better either.

Small wonder, foreign players are making a beeline for a slice of the Chinese market pie. Their rush coincides with the larger trend of the deepening of financial reform and opening-up, which is also expected to facilitate the renminbi's internationalization and enhance China's influence on commodity pricing.

On Sept 15, the China Securities Regulatory Commission, the country's top securities watchdog, accepted an application from Intesa Sanpaolo, Italy's largest banking group by total assets, to set up a foreign-controlled securities brokerage in China.

If the application proves successful, the proposed joint-venture securities firm would be set up in Qingdao of East China's Shandong province. Intesa Sanpaolo will take a 51 percent stake while the rest will be shared by three local companies.

Intesa Sanpaolo is tipped to emerge as the 10th foreign financial institution to set up a securities brokerage with a controlling stake in China.

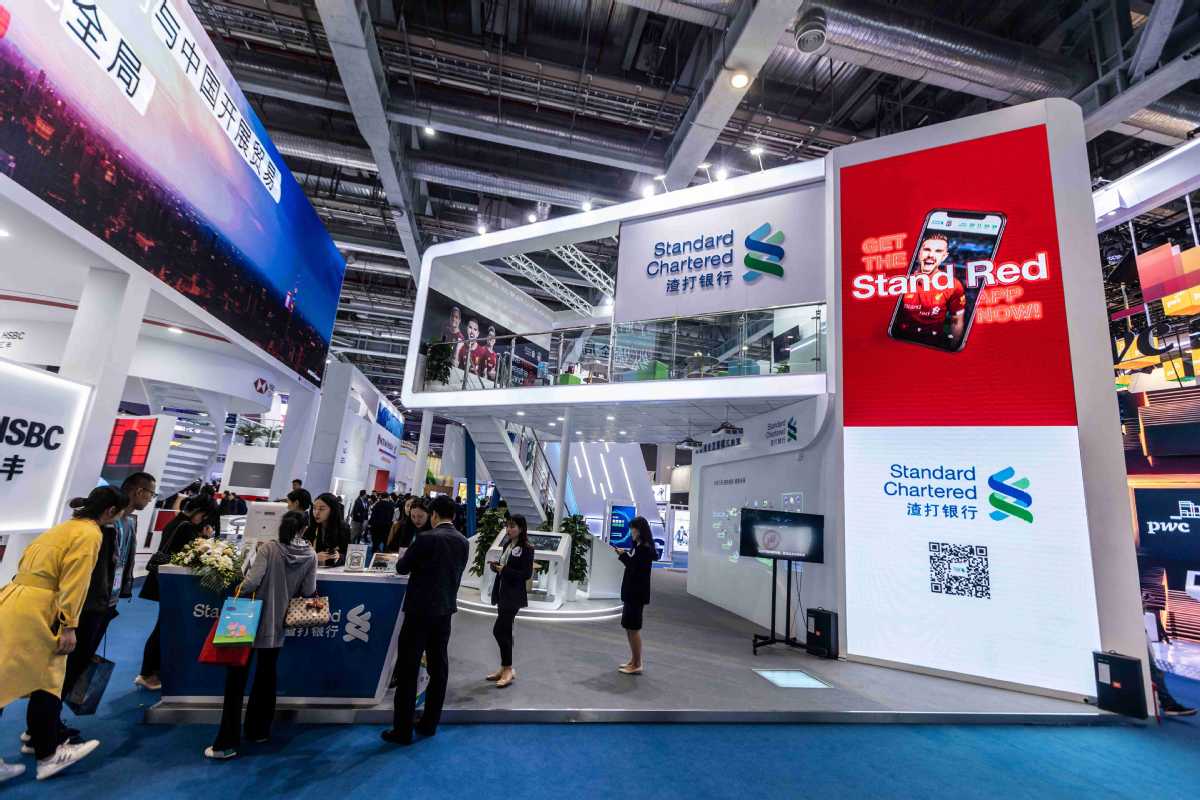

Many other foreign players are lining up for a piece of action in China. Among them are well-known names such as Standard Chartered, SMBC Nikko Securities and BNP Paribas, all of whom have submitted similar applications earlier and are awaiting CSRC approval.

For foreign players yet to get a taste of the China market, Bridgewater has been a revelation. The latter's new product, launched in a low-key manner in association with local partner CITIC Securities in June, sold like hot cakes among investors. Its 200 million yuan ($27.85 million) quota sold out instantly.

Investors in China, market experts said, have taken a shine to Bridgewater's overall eye-catching performance in the first half of the year, led by its multi-asset, all-weather portfolio.

In an online forum in May, Ray Dalio, Bridgewater's founder, expressed confidence in the investment outlook in China. Given the relatively lower asset prices in China at present, long-term investment opportunities are implied here, he said.

Similarly, in early August, Black-Rock, the world's largest asset manager, released a new product focusing on advanced manufacturing companies listed on the A-share market. It is the industry giant's third such product in China since its emergence in June 2021 as the country's first wholly foreign-owned mutual fund company.

"The launch of BlackRock's wholly foreign-owned enterprise in China, and the release of (its financial) products, can prove to overseas financial institutions the effectiveness of the continued opening-up in the Chinese capital market. The Chinese government is willing to facilitate foreign institutions' access to China by rolling out necessary policies and making necessary resources available. Entry into China is sure to prove a success under such circumstances," said Zhang Chi, general manager of BlackRock Fund Management Co.

Many experts agree that the deepening of the opening-up policy has not slackened in spite of the resurgence of COVID-19 cases this year.

For instance, on July 4, trading via exchange-traded funds — ETFs — under the stock connect mechanism between Shanghai, Shenzhen and Hong Kong commenced officially. Chinese mainland investors thus gained access to four ETFs listed on the Hong Kong bourse while 83 ETFs listed on the Shanghai and Shenzhen exchanges became available to international investors via the northbound leg of the connect programs.

As of Sept 1, about 1.04 billion yuan worth of trading was completed under the northbound leg of the ETF connect, while the trading value under the southbound leg was HK$12.5 billion ($1.59 billion).

Abby Wang, head of China asset management for KPMG in China, said the inclusion of ETFs in the connect programs is another major landmark in the high-level two-way opening-up of the Chinese capital market.

The connect programs, which started by linking the stock exchanges in Shanghai and Hong Kong in 2014, have been extended to the London Stock Exchange in 2019.This has facilitated Chinese companies to issue global depositary receipts or GDRs on the Frankfurt and Zurich bourses in February as per the CSRC's latest guidance.

In less than half-year, as many as six A-share companies have issued GDRs successfully on the SIX Swiss Exchange.

The expanded scope of the connect programs is another breakthrough in the Chinese capital market's opening-up, as it succeeded in attracting resources from all over the world, said Tian Xuan, associate dean of Tsinghua University PBC School of Finance.

Apart from the traditional equities sector, China's financial opening-up has been extended to derivatives trading. On Sept 5, the CSRC announced that Qualified Foreign Institutional Investors and Renminbi Qualified Foreign Institutional Investors can trade in 23 designated commodity futures, 16 option contracts and stock option contracts in China.

This move was highly anticipated as part of the opening-up policy, said Luo Xufeng, chairman of Nanhua Futures, adding it will facilitate the renminbi's internationalization and strengthen China's say on prices in the global commodity markets, which have been rocked by geopolitical tensions for much of this year.

Besides capital markets, China's larger financial services industry has been a beneficiary of the process of deepening opening-up. China has lifted the ownership limits on securities firms, banks and insurance companies.

China's top banking and insurance regulator approved the establishment of over 120 foreign banking and insurance institutions in China between 2018 and 2021. Another 11 foreign banking institutions opened in China last year, with 929 foreign banking institutions operating in all. Their total net profit approached 21.28 billion yuan in 2021, up nearly 25 percent year-on-year, said the China Banking Association.

China Economic Information Service calculated that Shanghai was home to 1,707 licensed financial institutions last year. The total number of financial institutions in the city exceeded 10,000, of which foreign financial institutions accounted for 30 percent.

Consequently, competition has stiffened and investment strategies have diversified, adding both width and depth to the market.

The change in investment style can be seen in the faster shifts this year in the direction of northbound capital — the funds overseas investors use to buy into the A-share market via stock connect programs.

While northbound capital reported a net inflow of 74.2 billion yuan in June, the scene changed to a net outflow of 21 billion yuan in July. One month later, another U-turn led to a net inflow of 12.7 billion yuan.

Wang Chunying, deputy head of the State Administration of Foreign Exchange, said short-term volatility in cross-border securities investment can be seen globally. It is quite normal for an increasingly open financial market like China to experience such volatility, she said.

Overall, northbound capital reported a net inflow of 52.2 billion yuan in the first nine months of this year, CSRC data showed. As of Aug 26, overseas investors invested nearly 21.3 billion yuan in international futures products like yuan-denominated crude oil futures.

At the China International Finance Annual Forum 2022 held in early September, CSRC Vice-Chairman Fang Xinghai said foreign investment in the Chinese capital market has shown strong resilience over the past few months. The continued inflow of foreign capital has confirmed international institutions' confidence in China's long-term economic growth.

At Nomura's 14th China Investor Forum earlier this year, Toshiyasu Iiyama, executive managing director of Nomura Holdings Inc and chairman of its China committee, said they are preparing to apply for an investment banking license in China, a business line that will be the next focus for the Japanese securities company.

"The best is still ahead of us as we steadily increase our presence and build a sustainable business in China. We are optimistic about growth prospects for the market and our business as we support financial sector reforms and the opening up of the financial market," he said.