There'll be a reward for vouchers

External uncertainties, like the ongoing Russian-Ukrainian conflict, together with the difficulty of containing the recent domestic COVID-19 resurgence, have added to the challenges for China in achieving a GDP growth of more than 5 percent in the second quarter.

To pull the economy back to its normal growth track, bringing the COVID-19 situation nationwide under better control is of paramount importance. Take Shanghai for instance. Apart from the megalopolis' role as the main economic driver of the Yangtze River Delta region, the city is also a key financial and trade center for the world. As the COVID-19 pandemic has forced China's main commercial and financial hub to shut down production in some sectors, this has had an impact on many regions and industries.

There are several other places in addition to Shanghai where production and social activity have not yet returned to normal. Under such circumstances, achieving a quarterly growth rate of over 5 percent is by no means easy.

Also, if one takes a look at the official first-quarter data, it is evident that real estate and consumption in China were still relatively weak during the period. As for exports, since the COVID-19 situation has been gradually getting under better control globally, the new export orders subindex under China's manufacturing purchasing managers' index, or the PMI, is declining. This suggests that the nation's strategic advantages in exports seen over the last two years-attained with superior pandemic containment measures-are weakening. With its peers taking back market share in their respective sectors, China may see a negative impact on exports this year.

As a result, China's three key growth drivers are all facing challenges. Investment looks good in terms of amounts but needs structural upgrades. Consumption is registering a flat performance. Finally, exports are facing many lingering downside drivers both internally and externally. To this end, the International Monetary Fund recently lowered its full-year forecast for China's economic growth, and also for the world.

Facing the above challenges, it's even more urgent for China to stick to the buzzword-stability-which has been underlined in most high-level meetings recently as the nation strives to achieve this year's growth target. As for the focus on stabilizing work this year, I suggest there be ample attention paid to consumption, employment and development of private enterprises.

First, it is necessary to further stimulate consumption.

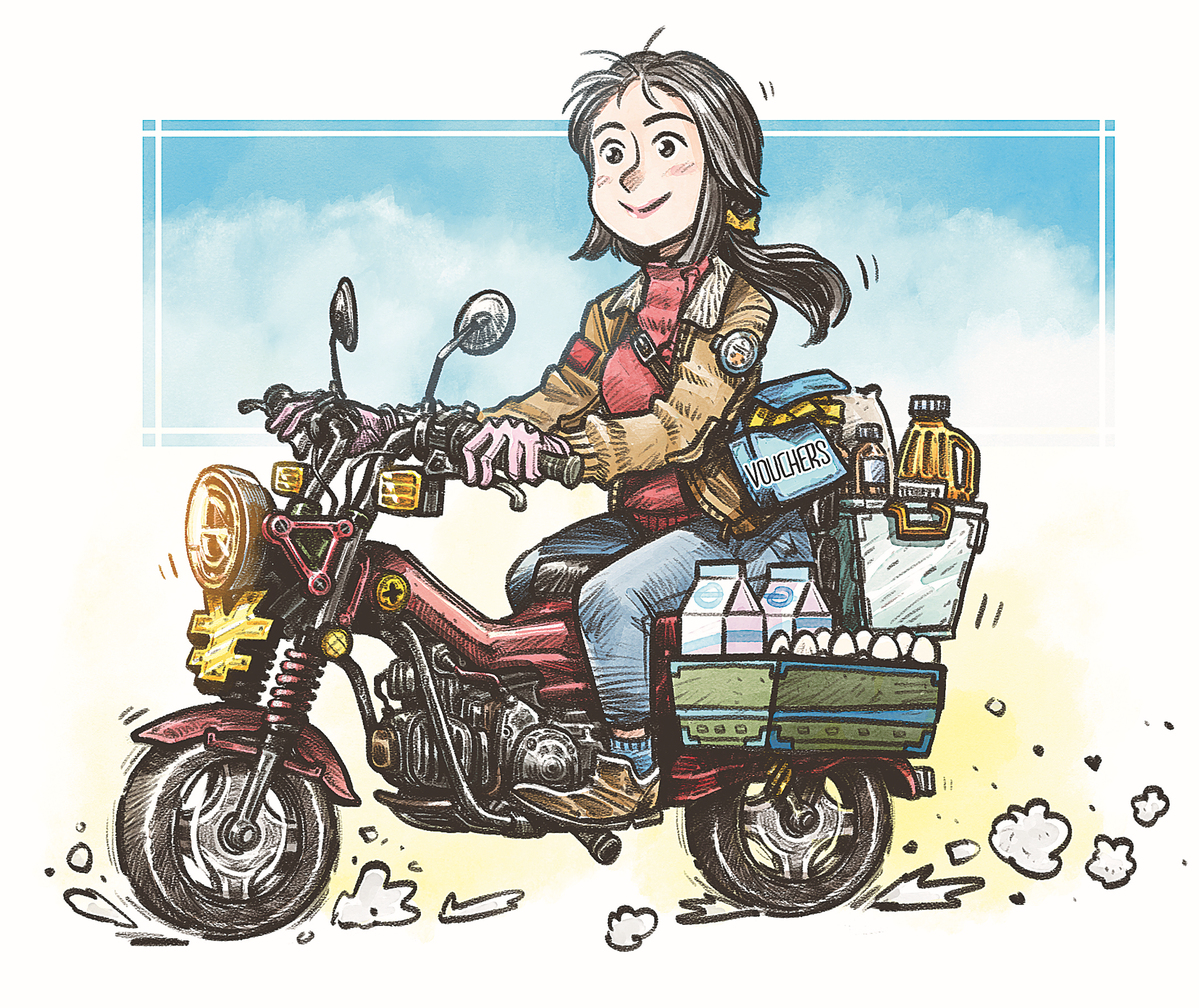

With an eye on China's COVID-19 situation and countermeasures underway, it's now time to issue more vouchers. The negative growth in consumption in March was mainly due to the slowdown in the growth rate of household incomes. Looking at the consumption structure, one may find that the differentiation issue is becoming more obvious now, and one phenomenon worth noting is that regarding domestic consumption, the proportion of consumption by middle and low-income earners is declining, while that by high-income groups is increasing. With middle-income earners playing a major part of total consumption, the government should step up efforts to boost consumption by lower-income groups to help them further improve their livelihoods, which will help smoothen the domestic circulation of the overall economy.

Supporting middle and low-income earners by issuing vouchers can help stimulate consumption, and supporting consumption can trigger more production by enterprises. It is a way to stimulate the economy with a relatively high multiplier effect. In the past two to three years, some places have indeed issued vouchers, but on a small scale and only occasionally.

The government can plan various kinds of vouchers, and bring different benefits to various consumer groups. There can be certain vouchers tailored for low-income groups. It is estimated that by the end of the year, total disposable income of high-income groups in China will exceed 25 trillion yuan ($3.68 trillion). If earners of the very-high income group donate 0.5 percent of this amount, that is, 125 billion yuan, and another 125 billion yuan is arranged by the government for voucher issuances, a total of 250 billion yuan worth of vouchers can be issued for other designated consumer groups, especially low-income groups whose population stands at around 280 million. And low-income groups can also see their disposable income surge by more than 10 percent this year. It could also be a testing ground for further efforts at tertiary distribution.

Such moves, if well implemented annually, will not only effectively narrow the income gap and prevent the recurrence of large-scale poverty, but also promote overall consumption. If calculated in accordance with the multiplier effect of the vouchers, vouchers with amounts mentioned above can bring some 750 billion yuan in incremental consumption.

There can also be inclusive vouchers that benefit all Chinese consumers, which may be challenging due to larger amounts required, but at the same time easier as the principles of implementation will be simpler.

Hong Kong has set a good example of this practice. The value of the latest round of vouchers issued reached HK$60 billion ($7.64 billion), which led to good results. Basically, each HK$100 yuan voucher can create HK$80 yuan in consumption.

If there are any moves related to voucher issuances, (the sooner the better as there is a process before moves start to take effect, and the earlier they are issued, the better the effect on stable growth this year), it should be noted that the vouchers should be issued by the central government and funded by central finance, as vouchers issued by local governments will face more restrictions when being used nationwide.

In terms of sources of funds, they can be raised through the issuance of special government bonds. The Chinese government's leverage ratio is relatively low but the scale of assets is relatively large, so issuances won't inordinately affect credit.

Secondly, in addition to consumption, the government must also pay close attention to employment data, especially youth employment. In the context of the COVID-19 pandemic, and with the number of college students graduating reaching a record high, it is a key and urgent question to be answered and addressed-if some new grads fail to find a job, what is to be done? Solutions can be, but are not limited to, arranging delayed graduations or vocational training for a certain period of time, etc.

Most employment in China relies on private enterprises and the services sector. The private sector, in particular, provides jobs for some 80 percent of the total employed population in the country. Therefore, more support should be given to the development of these sectors.

Last but not least, the government should work to help the real estate market accomplish a "soft landing". The downtrend witnessed in the real estate sector recently, if seen from the perspective of its development trend, is because the upside had reached an inflection point. To achieve a soft landing in the property industry, more stringent control measures should be avoided from now on. There currently are measures such as loosening development loans and lowering housing loan interest rates. But their effectiveness may not be enough. And it may still be necessary to increase the willingness of developers to invest by having them enjoy more benefits provided by the government, such as land price reductions. Lower land prices can reduce costs for real estate companies, and selling prices of houses will also be reduced, which is conducive to the stability of the real estate market.

To sum up, one may notice that all the recommendations above all involve reducing pressure on residents and businesses by leveraging measures from the government. Fiscal policy should be problem-solving-oriented for current situations. Also, economies surge and struggle, and repeat the process. It is indeed good to see more high-tech innovations and solutions, which are replacing old machines that once drove the economy. But policies should be well balanced to this end, especially when they concern with promoting common prosperity-an important goal to achieve.

The views don't necessarily reflect those of China Daily.

The writer is chief economist at Zhongtai Securities.