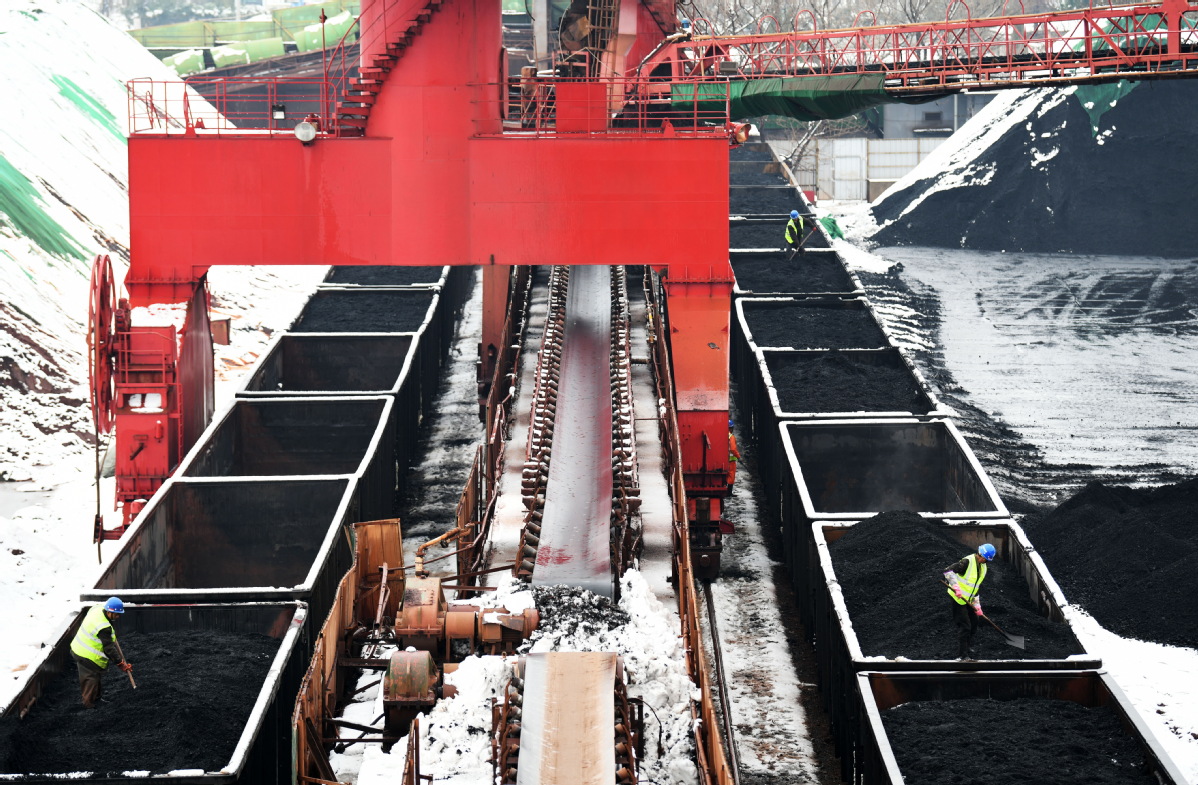

Experts: With govt efforts, coal prices to ease as heating season ends

Rising coal prices in China are likely to ease gradually after the winter heating season concludes, while the government has also pledged to implement necessary measures to ensure both stable supplies and the prices of coal, industry experts said on Thursday.

While China's coal prices have crept up again this year partly due to tight supplies during the Spring Festival holiday and a recent ban on coal exports by Indonesia, they expect domestic coal supply to grow steadily in the short term and prices will gradually stabilize this year.

Thermal coal, which is mainly used to generate power, saw futures prices dive more than 2 percent on Thursday. The most-traded thermal coal futures on the Zhengzhou Commodity Exchange for May delivery ended at 843.6 yuan ($133) per metric ton in Thursday trade.

Chinese thermal coal futures dropped on fears of government intervention over escalating coal prices, as the country's top economic regulator reiterated the stance of stabilizing the coal market on Wednesday.

The National Development and Reform Commission and the National Energy Administration jointly held a meeting to arrange for stabilizing the coal market on Wednesday, warning some coal enterprises about inflated prices and urging producers to resume production as soon as possible, the NDRC said in a statement.

"Since mid-January, the price of thermal coal has risen by more than 25 percent," said Tao Jin, deputy director of the Macroeconomic Research Center at the Suning Institute of Finance.

Accelerated resumption of work and production of coal producers is expected after the meeting, Tao said, adding the domestic coal supply will expand and prices should stabilize. "As the weather warms up, coal consumption will also fall, leaving less room for swings and rallies in prices."

The NDRC said coal production in various regions rebounded rapidly since Feb 3 and has recovered to the pre-Spring Festival level. So far, coal stockpiles at the country's major power plants have hit over 165 million tons, up over 40 million tons over the same period last year.

Dong Xiaoyu, a researcher at the policy research center of the China Energy Research Society, said the meeting marked the government's latest move to guide market expectations in a timely manner and ensure coal market stability.

He attributed the recent price spike to factors including reduced market supply during the holiday, rising demand for power generation and heating, and the impact of the recent Indonesia coal ban.

However, Dong said the recent round of coal price increases is not supported by fundamentals, saying coal prices should gradually ease after the winter heating season.

Citing the NDRC's announcement on Wednesday to keep iron ore prices stable for the second time this year, Dong said the government's recent moves came over concerns that rising commodity prices will drive up China's producer prices and increase the cost for economic operations.

He said the moves will leave room for policies in the future, which will help effectively reduce the price of upstream raw materials, boost profitability for midstream and downstream firms and stabilize the overall economy.

Bai Wenxi, chief economist at IPG China, also said the meeting will help curb price gouging in the market as well as stabilize coal prices and supplies.

Looking into 2022, Bai said the country may face mounting pressures on rising commodity prices such as iron ore, coal, crude oil and agricultural products this year.

Considering the high base in the early stage and the gradual supply-side improvement, Dong forecast commodity prices will gradually ease this year.