Bairong sees strong rebound in Q1

Bairong Inc, a Chinese provider of financial big data analytics and other services, has gained strong business momentum by earning a total of 409 million yuan ($62.58 million) in revenue in the first quarter of this year, registering a significant 92 percent year-on-year increase according to its latest fiscal report.

Although the financial industry was affected by the pandemic last year, the continuous improvement in the economy and consumption after the COVID-19 pandemic, as well as the quick rebound in demand for marketing from the financial industry in the first quarter of 2021, have driven higher year-on-year growth in the company's precision marketing and insurance distribution services in the first quarter of this year.

The company's precision marketing services gained 122 million yuan in the first quarter, which soared 293 percent year-on-year. Insurance distribution and data analysis services also saw 93 percent and 33 percent year-on-year growth during the period.

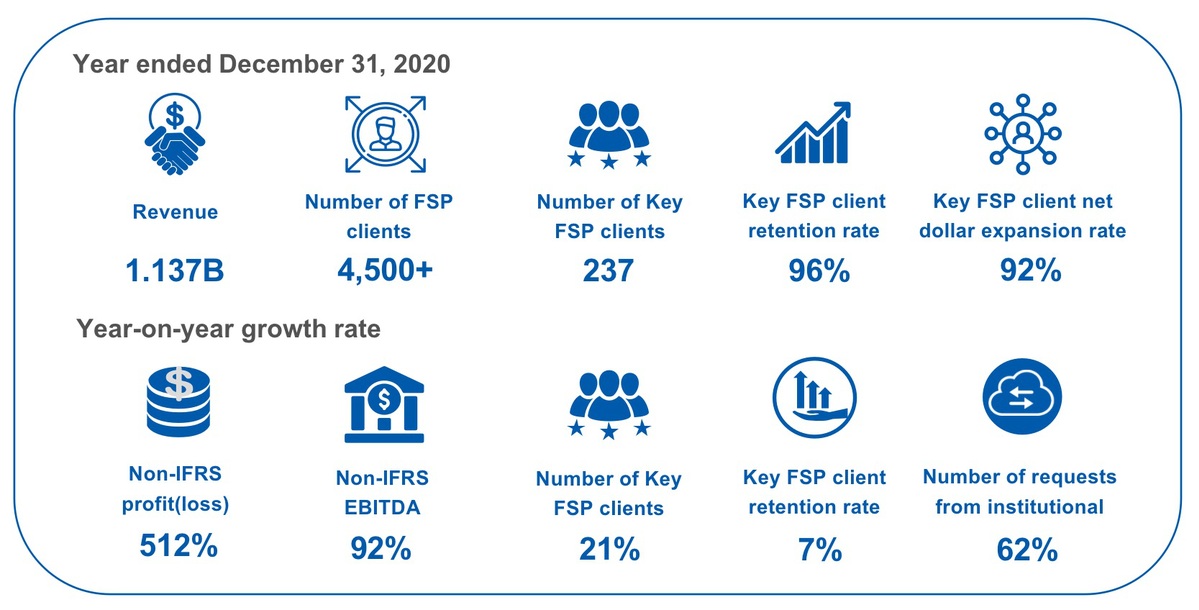

Despite the challenges brought by the COVID-19 pandemic for the financial industry, the company achieved revenue of 372 million yuan in the fourth quarter of last year, up 10 percent year-on-year. It ushered in a strong rebound last year, with total revenue of 1.13 billion yuan, which narrowed the year-on-year decline mainly caused by the pandemic to 9.9 percent.

Bairong is a leading independent AI-powered technology platform in China serving the financial services industry. As of December 2020, it has served more than 4,500 financial institution clients, including 2,602 paying financial institution clients, China's national banks and more than 700 regional banks.

Industry insiders said Bairong's financial performance showed rocketing growth in the first quarter following a rebound last year, which indicates the company's long-term value and future prospects for financial digitalization.

Data from Frost & Sullivan showed Bairong has become the country's largest independent provider of financial big data analysis solutions, with a market share of approximately 8.7 percent in 2019, expected to further increase to 9 percent in 2020.

The latest fiscal report also showed its net profits continue to grow over the past year. Its non-IFRS profit hit 80 million yuan last year, a 512 percent increase compared with the previous year.

As the company expands its products and services for more diversified needs, its key client retention rate hit 96 percent last year, which soared 7 percent year-on-year.

The company made its debut on the Hong Kong stock exchange earlier this month. Trading under the stock code 06608.HK, the company priced its IPO at HK$31.8 ($4.09) per share, the upper end of its indicated range.

A wide variety of State-owned funds and leading investment firms have invested in the AI fintech firm. According to its prospectus, Hillhouse Capital holds 12.39 percent, while State-owned China Reform Holdings Corp holds 12 percent. Sequoia Capital China, China International Capital Corp, China Renaissance and IDG Capital are also among the investors.

Its cornerstone investors for the IPO include Cederberg Capital Ltd, Franchise Fund LP and China Structural Reform Fund Corp, a State-owned private equity fund that offers State-owned enterprises support in development and industrial consolidation.

The digital economy is a key focus in the 14th Five-Year Plan (2021-25), during which China aims to push forward the digitalization of a raft of industries. The plan also highlighted the necessity to promote financial digitalization to be safe and controllable.