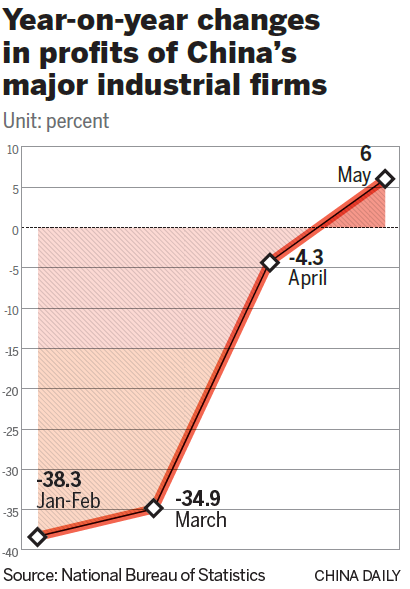

Industrial firms' May profits grow by 6 percent

The profit growth of Chinese industrial firms turned positive for the first time this year in May as cost pressure due to the COVID-19 epidemic eased, the National Bureau of Statistics said on Sunday.

Analysts said the country should ramp up its efforts to revitalize domestic demand to sustain the improvement in industrial earnings amid mounting uncertainties.

The total profits of major industrial firms increased by 6 percent year-on-year to 582.34 billion yuan ($82.29 billion) last month, compared with a 4.3 percent fall year-on-year in April, the bureau said.

For the January-May period, industrial profit growth remained in negative territory but the decline narrowed for the third consecutive month to 19.3 percent year-on-year, recovering from a 27.4 percent plunge over the first four months.

Zhu Hong, a senior statistician at the NBS, cited the easing pressure from rising costs as a key reason for the improving industrial profits, with the cost-revenue ratio dropping to 84.77 percent for the first five months, versus 84.91 percent for the January-April period.

Zhu also attributed the industrial profit improvement to the deeper drop in industrial material prices compared with that of finished goods prices, the significant recovery in the profits of key industries such as petroleum processing, power, chemicals and steel, as well as higher investment returns by industrial firms.

"Although industrial profits achieved positive growth for the first time this year in May, market demand was still weak due to the impact of COVID-19. The sustainability of profit recovery remains to be seen," Zhu said.

Zhu urged putting into place policy measures to ensure stability and security in a wide range of fields, referring to government policy priorities aimed at bolstering the corporate sector and the overall economy, such as safeguarding employment and supporting business growth.

The easing cost pressure shows that the policy measures to help business keep afloat have started to take effect, according to a CITIC Securities report.

In the latest effort to reduce the cost pressures faced by enterprises, the National Development and Reform Commission, the country's top economic planner, released a notice on Sunday that extends the 5 percent electricity discount for businesses to the end of the year.

Favorable policies such as the reduction of electricity costs and broadband prices and tax and fee cuts are expected to help industrial sectors to continue to recover, the report said.

But there could be setbacks in the industrial profit rally as uncertainties continue to plague the recovery in demand, said Zhang Deli, chief macroeconomic analyst at Yuekai Securities.

The NBS data showed the growth in the revenue of major industrial firms fell to 1.4 percent year-on-year last month from 5.1 percent in April, pointing to a slower recovery in demand.

"Domestic demand remained anemic while external demand may further drop and weigh on the profits of export-oriented businesses," Zhang said, citing the continued spread of the coronavirus across the world and the uncertainties surrounding China-US trade relations.

The textile, clothing and home appliance industries could bear the brunt of shrinking external demand, said an Everbright Securities report.