Stimulus expected to give stocks lift

Government measures likely to focus on infrastructure investment, consumption

The mainland stock market is likely to move higher this month amid investors' expectations that the country's top legislature will unveil a massive stimulus package by the end of the month, experts said on Friday.

The market ended April's trading with a surge on Thursday, as the key Shanghai Composite Index closed up 1.33 percent at 2,860.08 points, the highest level in six weeks.

The market's rise came despite pressure from the bleak first-quarter earnings results and investors' cashing-out before the five-day May Day market closure.

Mainland-listed firms, whose profits as a whole dropped by 24 percent from a year earlier due to the novel coronavirus outbreak, finished first-quarter earnings reporting on Thursday.

The market's increase against the negatives has reflected the solid upside momentum of A shares, which is expected to continue into May, said Hu Yunlong, a Beijing-based private fund manager.

Hu said he foresees growing expectations over economic stimulus as the annual session of the top legislature approaches, which will fuel the uptrend in May, with financials and sectors related to infrastructure to outperform.

China announced on Wednesday that the third plenary session of the 13th National People's Congress, the country's top legislature, will open on May 22. The session is set to unveil details of this year's stimulus package to help the economy cope with the impact of the virus.

The expansion of infrastructure investment and consumption will be the focus of the package and will help create key market outperformers in May in sectors such as 5G, chemicals, machinery and automobile, analysts said.

The session would only be a catalyst for the market rally, while the key backbone would be the recovery in economic fundamentals and corporate earnings from the trough caused by the pandemic, according to Chen Guo, chief strategist with Shenzhen-based Essence Securities.

"We believe the A-share market has hit the bottom in the short term and will be followed by an uptrend with fluctuations," Chen said, adding that an accommodative liquidity condition will also help underpin the market.

China's manufacturing sector has sustained expansion for two consecutive months as of April after a deep contraction in February.

The Shanghai index rallied by 3.99 percent in April, while overseas investment has returned. The stock connects between mainland and Hong Kong bourses saw net overseas capital inflow of 53.2 billion yuan ($7.5 billion), according to market tracker Wind Info.

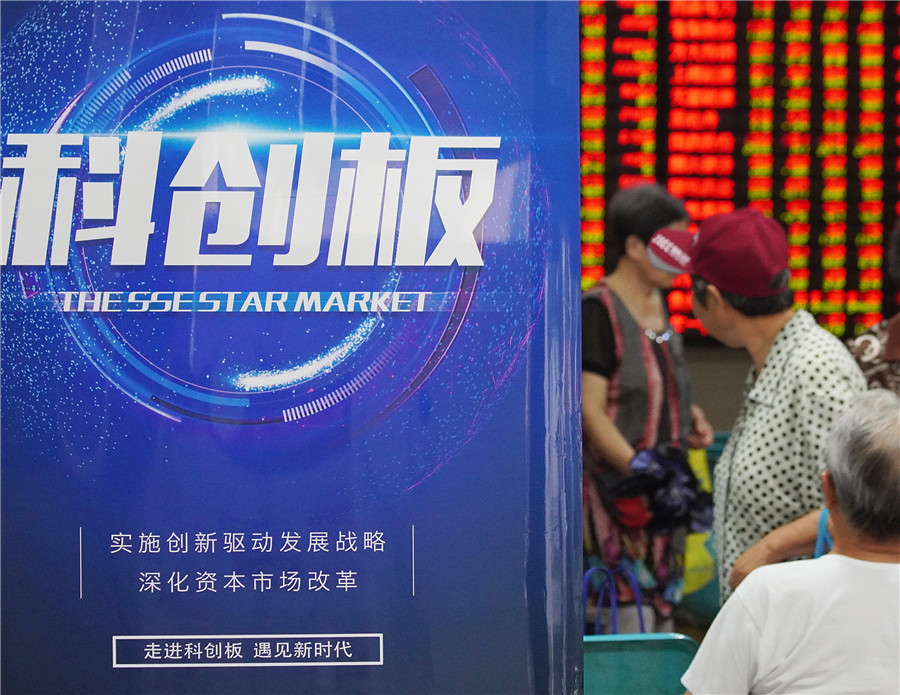

The accelerated steps in capital market reforms have also helped to boost risk appetite, said Wang Yi, chief strategist with Great Wall Securities, citing the launch of market-based initial public offering reform on the innovation-focused startup board ChiNext on Monday.

In its latest reform move, China loosened the requirements for redchip firms-innovative enterprises that are based on the mainland but are incorporated overseas-to get listed on mainland bourses on Thursday.