Credit insurance to lend a hand to export businesses

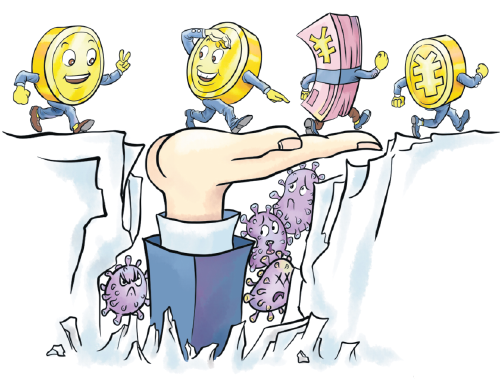

China will enhance support for trade financing and give full play to the role of export credit insurance to help companies cope with the impact of the novel coronavirus epidemic, according to the Ministry of Commerce.

The country encourages export-oriented firms to flexibly use policy tools like export credit insurance to develop their business, a circular unveiled by the ministry and China Export and Credit Insurance Corp said late Friday.

The document asserted it is necessary to further expand coverage of short-term insurance, introduce targeted professional services, improve underwriting efficiency and innovate underwriting modes to help companies strengthen export risk management and cut potential corporate losses amid the epidemic.

The circular required service branches of China Export and Credit Insurance Corp to offer more support to enterprises affected by the epidemic, adding they should provide full insurance coverage service, strengthen the protection of risks such as the cancellation of orders, open up a green channel for claims settlement for companies at home, especially small- and medium-sized enterprises.

China Export and Credit Insurance Corp is a state-funded and policy-oriented insurance company to promote China's foreign trade and economic cooperation.