Fonterra to trim Beingmate stake

Move part of NZ dairy giant's plan to turn around business in the Chinese market

New Zealand-based global dairy giant Fonterra on Wednesday announced its intention to sell part of its stake in Beingmate Baby and Child Food Co Ltd, which market insiders believe may lead to the end of their four-year collaboration.

Fonterra's Chief Executive Miles Hurrell said the decision is part of the company's plan to turn around its business. Fonterra currently has an 18.8 percent stake in Beingmate.

"This started with a strategic review of our relationship with Beingmate, which has been disappointing. The first action in this review was bringing the distribution of Anmum in China back in-house under our management," the Fonterra CEO said.

Hurrell said they ended the Darnum joint venture with Beingmate, bought back Beingmate's share of the Darnum facility in Australia, and entered into a multi-year agreement for Beingmate to purchase ingredients from Fonterra.

He said the company has talked to a number of parties regarding the potential sale of their entire stake in Beingmate, but has been unsuccessful in finding a buyer.

Fonterra's global financial performance has been dragged down by its investment in Beingmate. In the 2017-18 year, Fonterra reported a net loss after tax of NZ$196 million ($125.5 million), with a NZ$439 million write-down on its investment in Beingmate.

Beingmate reported a loss of 1.05 billion yuan ($148.9 million) in 2017 and has just recovered to post a profit of 41.1 million yuan in 2018.

Song Liang, an independent analyst covering the dairy sector, said Fonterra's business in China has been thriving in recent years despite the decision at this time to end its investment in Beingmate. He said Fonterra should continue to localize its business in China to reduce market risks and consolidate its growth in the Chinese market.

"For Beingmate, this would serve as an opportunity to secure new strategic partners and strengthen its financing channels to keep its independence in terms of operations," Song said.

Another dairy analyst, Zhu Danpeng, said it is inevitable for the two parties to grow apart, especially when Fonterra has developed its own supply chain and marketing capacities so that it became less dependent on its domestic partner's distribution channels.

Hurrell said China will always be one of their most important markets. "We have a strong business in China and are still very much focused on the market," he said.

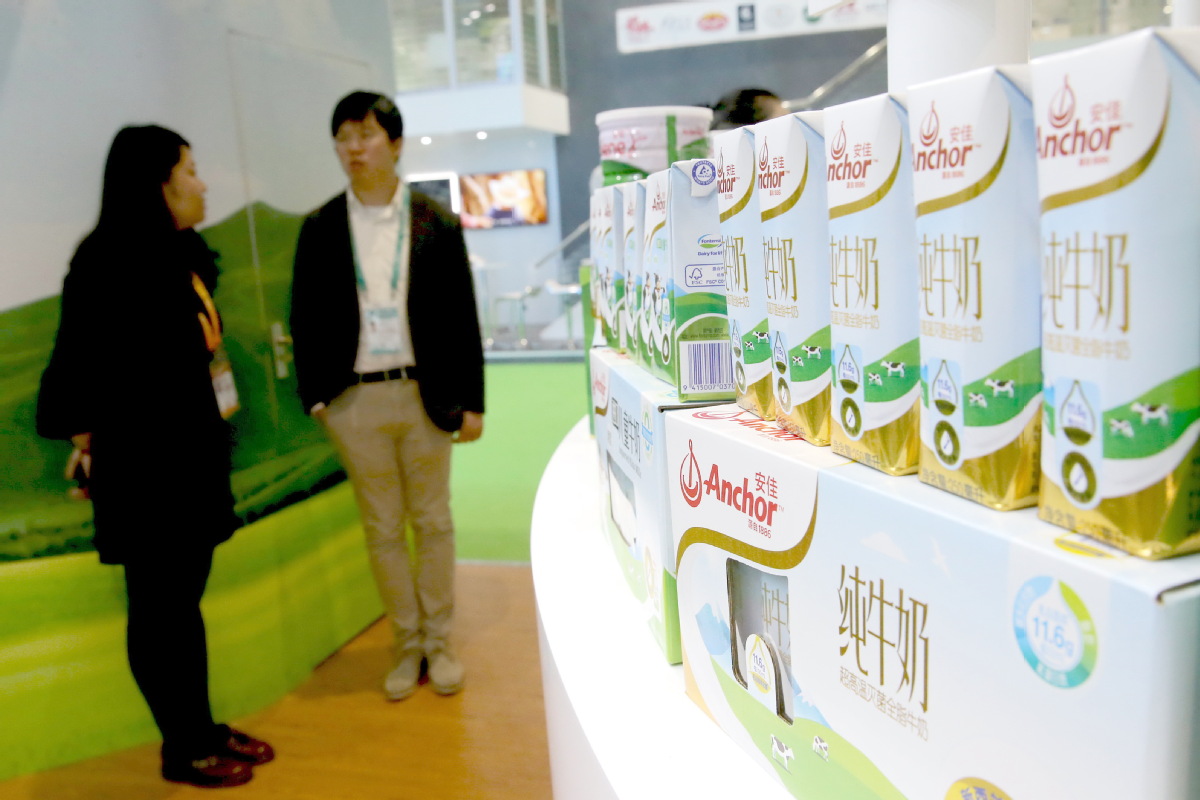

In the 2018 fiscal year, the Chinese market contributed 18 billion yuan of Fonterra's total revenue. Its Anchor UHT (ultra high temperature) milk, which has entered China for six years, ranked as No 1 among imported milk brands in terms of product sales volume last year. Its food business, which includes cheese and butter, has almost 50 percent of the market in the sector in China.

In June, Fonterra started a strategic review of its two wholly owned farm hubs in China, which might lead to the sale of the two farms and possibly pose a threat to its growing fresh milk and food service businesses in the country.

"Fonterra has contributed to China's dairy industry by developing high quality farms and showing there is a valuable opportunity for fresh milk in China's consumer market. However, we don't shy away from the fact that we've invested heavily in our China farms over the past 10 years. We will consider whether we still need to have large amounts of capital tied up in the farms," Hurrell said in replying to a question from China Daily.

He said it is too soon to speculate on potential outcomes. Their fresh milk products will continue to be sold in retail stores such as supermarket chains Hema Fresh and Carrefour.

"The farm-to-table concept remains viable and in the future our fresh milk could be sourced from our two joint venture farms in China that are not subject to the strategic review," he said.

But lack of control of dairy sources such as self-operated farms could lead to risks in Fonterra's fresh milk and food service businesses, said market analyst Shen Meng.