How to prepare for competition amid globalization

Since World War II, globalization came in two stages. From 1945 to roughly 1975, the United States, Western Europe, and Japan achieved steady economic growth, with the benefits of that growth spread widely throughout the population. In France, this period is called "30 glorious years" and in Germany it is known as the "economic miracle".

The second stage of globalization started in the late 1970s and has continued until today with a process of reform and opening-up not only in China but in countries of the former Soviet Union and in India.

This has been great for the world. China alone has lifted more than 850 million people out of dire poverty. But it has also increased competition faced by workers and companies.

The partial globalization of 1945-1975 worked great for average workers in the West. For much of this period, a young person could get a high-paying and apparently secure job in a factory that would allow him to live a middle-income lifestyle.

It's very hard to believe now, but in 1980, the US city with the highest average wage was Flint, Michigan, followed closely by Detroit. Other leading cities in terms of wages were Chicago, Houston, Milwaukee, Youngstown and Cleveland - all of which were centers of industry and manufacturing. At that time, San Jose, the center of then quite small Silicon Valley was fourth, San Francisco sixth, and capital Washington was eighth. New York City did not make the top 10.

Many people in the US and Western Europe look back nostalgically on those 30 years after WWII when artificial limits on global competition protected extremely high-paying manufacturing jobs. It is very sad to see only empty, rusting factories where thousands of people used to work.

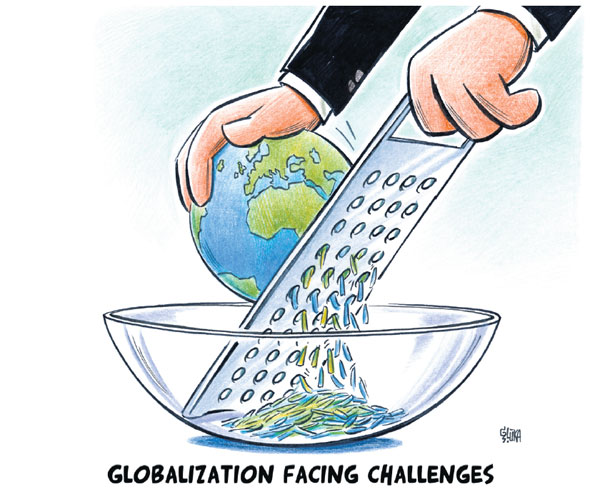

It's tempting to use tariffs or other protectionist measures to try to retain the companies that provide these high-paying manufacturing jobs. But, most often the protections just lead to unproductive companies, declining innovation, and slowing GDP growth.

In the 1950s, the American car industry was seen as the prototype of how business should be run. Car company executives were seen as the most capable managers. In 1953, president Eisenhower chose Charles Wilson, known as "engine Charlie," to be his Secretary of Defense.

Then, in 1961, president Kennedy chose Ford president Robert McNamara for the same position. (Of course, McNamara's incredible mismanagement of the war in Vietnam reduced any confidence that car company executives were especially competent.)

By the late 1960s, the "big three "car companies in the US - General Motors, Ford, and Chrysler - formed a virtual oligopoly and turned lazy.

I remember American cars my father bought in these years often overheating and breaking down by the side of the road. Dad would have to stay by the car with my mother and sisters while I walked a long way to find a service station and arrange a tow. (This was long before mobile phones.)

So, American consumers were ready for more competitive Japanese-made cars, which had consistently higher quality, to enter the market. My father switched to Japanese cars in the 1970s, and never bought another American-made car.

American car companies saw their profits fall and were not able to pay their workers the very high wages made possible by a closed, non-competitive market. The US government responded by imposing quotas on the import of Japanese cars and by pushing Japan to rapidly raise the value of the yen.

Obviously, there was a conflict. American consumers benefitted from the cheaper, better cars while workers at the big three saw their jobs become less secure and their wages fall. Fortunately, the protection was only partial and temporary, so the competition eventually forced US carmakers to improve.

Competition is at the heart of the current disputes over globalization and technology. On net, the spread of economic opportunities around the world has been a great boon. Many products are more widely and cheaply available than ever before.

Many countries, including China and India, have greatly reduced poverty and given opportunities to their people that would have been undreamed of by earlier generations. American and Western European companies and consumers have greatly benefitted.

But nobody really likes competition against themselves. Most people like some degree of stability and protection. A worker who has put in 20 or 30 years in an industry will definitely feel that it is unfair to have to move to a much lower-paying service job. A company facing new competitors will try to convince its home government to stop the competition.

Americans saw many benefits from the second globalization period. As Japanese and, later Chinese, manufacturers began to export to the US, many consumer goods became a lot cheaper in US stores. Many American companies made good profits by exporting to the newly open markets or by outsourcing manufacturing to cheaper and/or better factories outside the US.

In 1945-1975, workers in the US and Western Europe became used to steadily rising real wages. But those wages have been stagnant since the 1970s. Why should a worker in the US or Western Europe be paid more than an equally skilled person in China, or India, or Ethiopia?

The lack of wage growth is not all due to globalization. The access of women and minorities to jobs, which was absolutely a needed and just change in policy, increased the domestic supply of labor. A boom in building infrastructure and houses in both the US and Western Europe had largely played itself out by the 1970s.

Some technological changes reduced the need for even highly skilled labor. For example, radiologists - doctors who read X-rays - are among the highest-paid professionals in the US. But, recent studies have shown that AI is able to make correct diagnosis much more often than human radiologists.

Nevertheless, the radiologists are lobbying the government to pass laws preventing competition from AI. If they succeed, the radiologists will keep their very high incomes, but Americans will face higher healthcare costs and worse outcome than people in countries that allow the competition.

Many of the things that have people upset in the West have nothing to do with trade - though they are lumped into a general feeling that things aren't fair. Many of the current high-income jobs in the US are in fields that have found ways to protect themselves against either foreign or technological competition.

Government workers and contractors make significantly more than an equivalent worker in the private sector. Lawyers and financiers in New York are protected from competition. High-tech sector salaries are protected by the monopolization of the software industry, in much the same way that the big three carmakers once made oligopolistic profits that allowed them to pay their workers more than the market wage.

So, according to 2016 income data, the top three highest per-household counties in the US, and four of the top six, are suburbs of Washington - an almost purely government center that produces little of commercial value.

Other high-income counties are based on monopolistic income from tech companies in the San Francisco region and on big banks in the New York area. The manufacturing centers of the Midwest are now nowhere near the top 10.

Many of today's young adults will live to see the start of the 22nd century, which seems to me to be a science-fiction date. Of course, no one can predict what the next 100 years will bring, but it does seem clear that we'll see further globalization - the spread of economic competition around the world.

Some currently high-paying jobs will go away. The only way a young person today can prepare for this competitive world is to learn new skills and be adaptive.

For good reasons, people also need some stability. Governments will try to provide this stability, but must be careful to provide industrial protection only for a transition period. Competition is tough, but the only long-term alternative is declining incomes and stifled innovation.