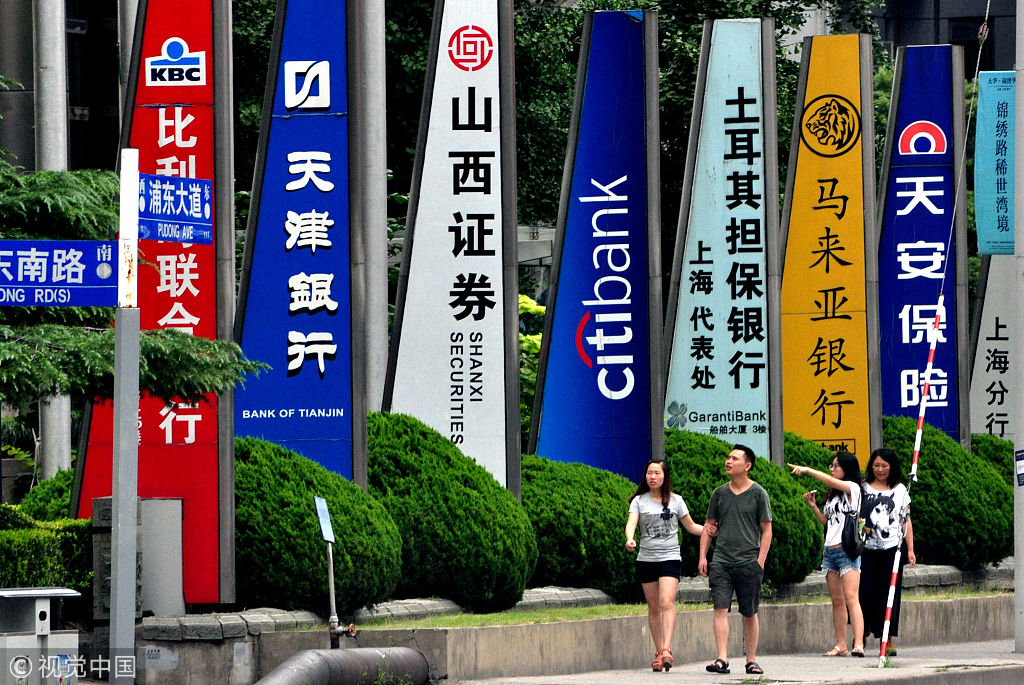

China to revise rules on foreign banks

BEIJING - China Banking and Insurance Regulatory Commission (CBIRC) on Wednesday unveiled a draft instrument on the regulation of foreign banks to solicit public opinions.

The revision on the detailed rules for regulating foreign banks aims to expand the opening-up of the banking industry, enhance the competitiveness of banks, increase the risk-prevention capabilities of foreign banks and beef up the protection of financial consumers' rights and interests, a CBIRC statement said.

A total of 18 items have been modified, including the calculation of working capital appropriated by foreign banks to their branch banks in China and the application of a reporting system when business branches of a foreign-funded bank conduct the business of agency marketing, agency distribution, proxy cashing and government bonds underwriting.

The revision also touches on some business requirements. For instance, the branch banks of a foreign bank which has also set up wholly-owned foreign banks or joint-venture banks in China can only engage in wholesale business.

Since early this year, CBIRC has gradually advanced the implementation of a variety of market opening measures and approved several market access applications.