China acts on improving supervision of systemically important financial institutions

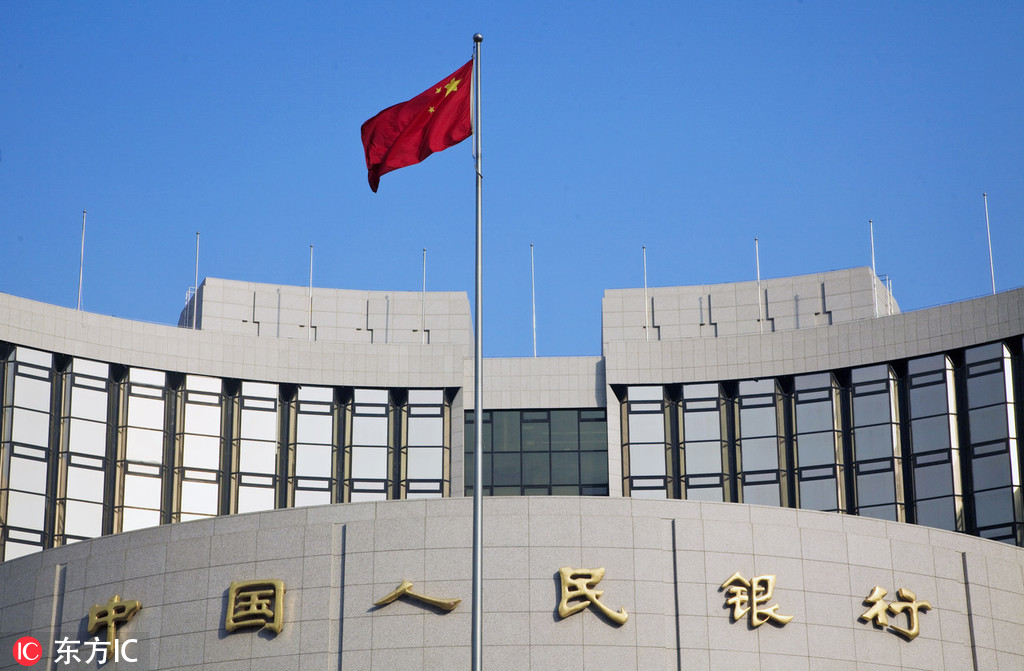

BEIJING - Authorities have made public a guideline to improve the supervision of financial institutions that carry systemic importance in the country's financial system.

The guideline, posted Tuesday at the website of the People's Bank of China (PBOC), the central bank, aims to improve China's framework for supervising systemically important financial institutions, prevent systemic risks, and maintain the prudent performance of the financial system.

"[The guideline] specifies the policy orientation for supervision of systemically important financial institutions, improves the areas of weakness in financial supervision, gives guidance to large financial institutions on prudent operations, and forestalls systemic financial risks," the PBOC said.

The guideline was jointly released by the PBOC, the China Banking and Insurance Regulatory Commission and the China Securities Regulatory Commission.

- China's central bank skips open market operations for 23 days

- China's central bank skips open market operations for 22 days

- PBOC Shanghai Head Office issues supportive measures for private businesses

- China's central bank urges financial sector to serve real economy

- PBOC official highlights risk awareness