From coal mining to tourism

Southwestern city seeking economic structural adjustment with the help of State-owned lender

As China reduces excessive capacity in the coal mining, steelmaking and power generation sectors, coal-rich Guizhou province in Southwest China is digging further into eco-friendly drivers of economic growth with the help of Agricultural Bank of China Ltd, which is making the same adjustments to its direction of lending.

"We're turning toward green finance by offering loans to support the development of tourism, water infrastructure, livestock breeding and farming. The projects selected by our bank include Chinese herb planting and the expansion of a leading processing plant for cili, a fruit known as the king of vitamin C," said Xiao Yong, president of ABC's subbranch in Panzhou, a county-level city in mountainous Guizhou.

Panzhou once had more than 120 coal mining companies. But the majority of them are now either closed or have merged with others to form larger entities whose annual coal production capacity is at least 2 million metric tons, according to Xiao.

The Panzhou subbranch of ABC, the third-largest State-owned commercial lender by assets in China, has cut its lending to coal mining companies such as Panjiang Coal-Power (Group) Co Ltd, a large State-owned coal enterprise in Guizhou, by 20 percent a year in the last two years.

Diverting part of its loans from the coal mining sector to the tourism industry, the bank approved the granting of a 260 million yuan ($38.9 million) loan for a period of 15 years to State-owned Guizhou Panzhou Tuole Ancient Ginkgo Tourism Investment and Development Co Ltd, at a lending rate of 6.23 percent.

"To maximize risk control, we are cautious about choosing tourism development projects. We calculate the cash flow of the companies running the projects to see whether they are able to repay the principal and interest of our loan, and we also evaluate the assets they can offer as collateral," Xiao said, noting that collateral is the most challenging part of granting loans to the eco-tourism industry.

A company running a tourist attraction rated AAAA or higher by China's Ministry of Culture and Tourism, such as the Tuole Ancient Ginkgo Scenic Spot, can use its right to collect admission fees as collateral to obtain loans from ABC.

Otherwise, the company has to use its land and other assets as collateral to apply for a loan with a maturation period of 10 to 15 years, or seek help from qualified guarantee firms to apply for a working capital loan to finance its short-term operational needs, he said.

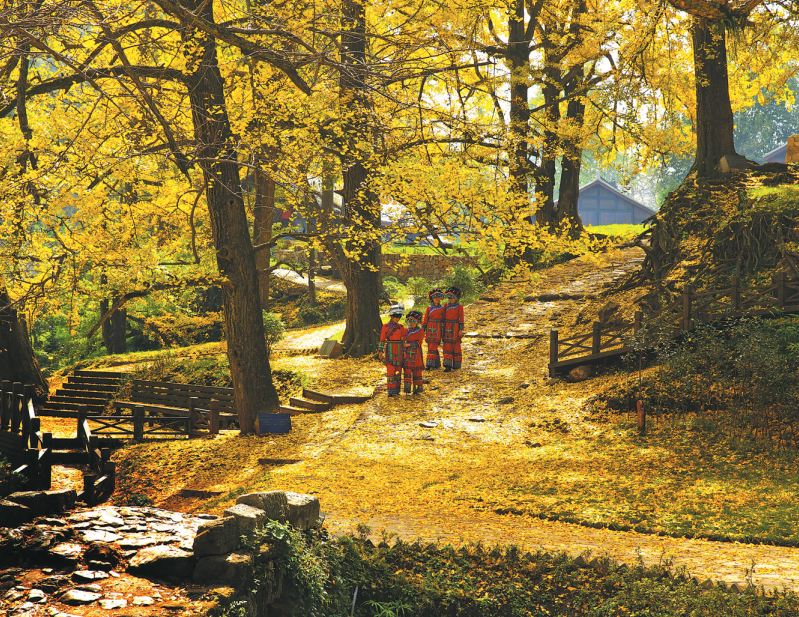

Located in Tuole village of Shiqiao town in Panzhou, the core area of the scenic spot boasts an ancient ginkgo forest of more than 1,450 contiguous trees over 600 years old. The eldest tree is more than 1,500 years old.

About 320,000 people visited the scenic spot in 2017, bringing revenues totaling 10 million yuan to Guizhou Panzhou Tuole Ancient Ginkgo Tourism Investment and Development Co. The number of tourists is expected to rise to 500,000 this year, and total revenues are estimated to reach 13 million yuan.

The company is waiting for government approval to increase the admission price from 30 yuan to 80 yuan later this year, said Duan Heng, general manager of the company.

Other income includes an 18 million yuan subsidy a year since 2016 from the Panzhou government.

Eyeing opportunities for business and investment in member states of the Association of Southeast Asian Nations, the China-ASEAN International Production Capacity Cooperation Forum has been held every year since 2016 in the ancient ginkgo scenic spot, where the company built a convention center and facilitating infrastructure for the event.

Panzhou started making the transition from coal mining to tourism in 2012 and has so far built nine well-developed scenic areas, Duan said.

By the end of 2017, the balance of loans related to agribusiness, farmers and rural areas hit 104 billion yuan at the ABC Guizhou branch, up 11.5 billion yuan from the beginning of the year.

The balance of loans related to county tourism reached 2.51 billion yuan. New loans delivered to county tourism increased by nearly 40 percent to 1.09 billion yuan, according to the bank.