Key to curbing housing price rises

To curb housing price rises, local authorities should end obstruction from corrupt vested interest groups, according to a Beijing Youth Daily article. Here are excerpts:

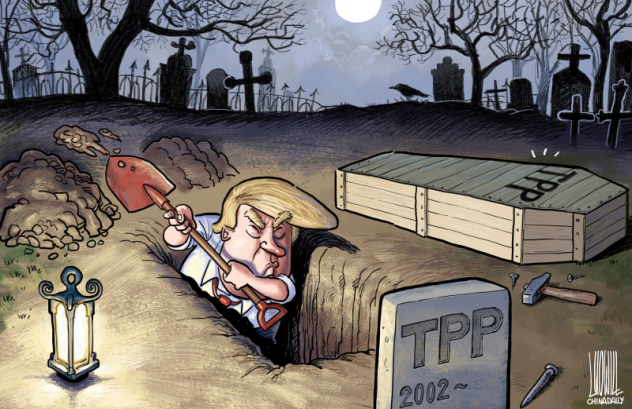

On Feb 20, the State Council launched five new measures on real estate market control, reinstating purchasing curbs, to keep housing price rises in check.

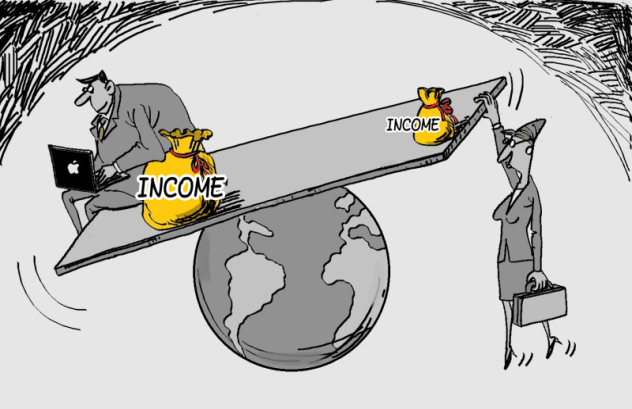

Since 2010, when the government introduced real estate market controls, speculative forces that once dominated the property market have been driven out. But housing prices are still too high for the average wage-earner. More importantly, since the second half of last year, housing prices in many cities have rebounded.

In the past three years, the government has made great efforts to reduce housing prices, but up to now the effect of the measures has been quite limited.

The real reason behind high housing prices is that local authorities regard the real estate market as an economic engine to increase income.

Regular control measures, such as increasing the loan rate and the rate of down payments, cannot curb prices, but only place restrictions on the demands for housing.

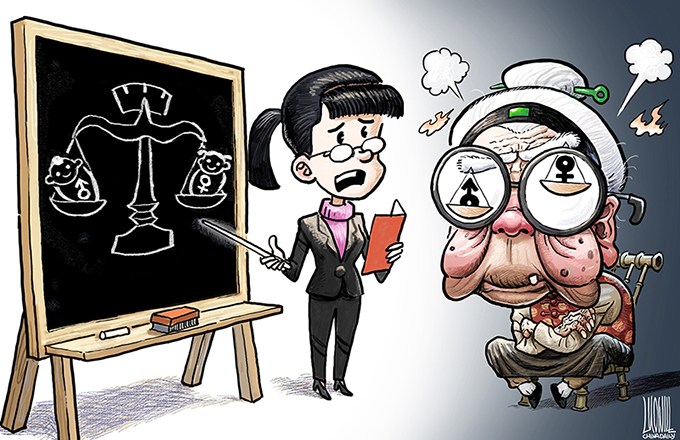

The media have exposed many officials who have dozens of houses despite strict limits placed on property purchases. When such scandals have been exposed on the Internet, local authorities have covered up for corrupted officials in the name of protecting privacy. It indicates there are vested interest groups who impede housing price controls, which is also the main reason for high housing prices.

Curbing housing prices should be combined with the fight against corruption. To realize the goal of curbing high prices, local authorities should tackle corrupt vested interest groups.