China's Financial Transition: Logic and Difficulty

2012-12-25

Zhang Chenghui

I. Inherent Logic for Financial Transition

1. China's economic transition constitutes the prerequisite and basis for its financial transition

Over the past decades since reform and opening up, Chinese economy has maintained a rapid growth thanks to industrialization driven by heavy industry, modernization led by the industries using and absorbing foreign technologies and urbanization pushed ahead by large-scale infrastructure investment. The fast growth in foreign trade after China's accession to WTO has turned into another major engine propelling China's economic development. The essential characteristics of the traditional development mode are as follows: one, gaining benefits of economies of scale by relying on large-sized enterprises, key projects and major bases; two, maintaining a high investment rate through cutting down on consumption; three, enhancing Chinese enterprises' competitiveness through export tax rebate and relevant measures; and four, attracting foreign investment through offering a portion of the domestic market and government interests like land revenue and tax income, and drawing on the advanced technology brought along by foreign investors.

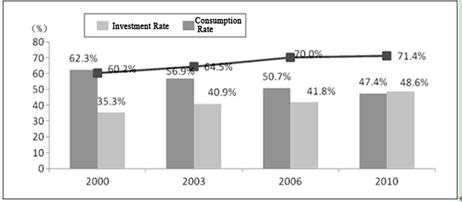

As reflected in Figure 1, during the 10 years from 2000 to 2010, the contribution of heavy industry to the overall industrial output increased from 60.2% to 71.4%; investment rate up from 35.3% to 48.6%, and the ultimate consumption rate down from 62.3% to less than 50%.1

Figure 1 China's Consumption Rate, Investment Rate and the Proportion of Heavy Industry from 2000 to 2010

Source: China Statistical Yearbook

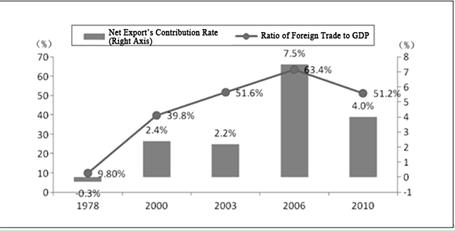

Figure 2 reveals that during the 32 years from 1978 to 2010, the net export's contribution to GDP increased from -0.3% to 4%, with the ratio of total foreign trade to GDP increasing from 9.8% to 51.2%. The foreign demand markedly increased after China's entry into WTO at the end of 2001, but showed signs of slowdown after the outbreak of the international financial crisis in 2008.

Figure 2 China's Foreign Trade Increase from 1978 to 2010

Source: China Statistical Yearbook

Since China emerged as the world's second largest economy after going through the phase of trying to rapidly catch up with developed countries by cutting down on consumption, it is hard to sustain the traditional development strategy and growth mechanism. The reasons are boiled down to the following aspects: one, the high consumption, serious pollution and high emissions caused by heavy industry far exceeds the carrying capacity of the resource environment; two, the international financial crisis has caused drastic shrinkage of foreign demand which is hard to be restored within a short time, so there is too much surplus in domestic production which is partially attributable to intensive investments made over the years; three, extensive and inefficient production mode can barely stand the pressure caused by the surging labor cost as well as competition pressure with other emerging countries; and four, the scope of introducing and drawing on foreign countries' advanced technologies is largely narrowed down. The central problem is as China ranks among the middle-income countries, some factors characterizing the old development mode could no longer satisfy the needs for development in the new stage, like the mechanism, system, production and consumption mode as well as the economic and social organization and management mode. Under such circumstances, it is pressingly imperative to transform the national development mode. The key to the transition lies in adjusting and innovating on the incentive mechanism, stimulating the vitality and creativity of the individual market players, uplifting the system's compatibility and the government's capability to cope with risks, so as to ultimately attain the goal of boosting the overall economic efficiency and national competitiveness. To realize such a transition, we must fulfill the following tasks:

(1) We should attach more importance to cultivation and development of small and medium- sized enterprises rather than rely on large enterprises and key projects;

(2) We should rely on coordinated development of the primary, secondary and tertiary industries rather than the secondary industry, the heavy industry in particular, to propel economic development, with a view of benefiting from both economies of scale and economies of scope;

(3) Instead of relying largely on investment and export to propel economic development, we should emphasize coordinated development among investment, consumption and export with particular attention to enhancing consumption's pull on economic development, protect and raise domestic demand;

(4) We should stress independent innovation rather than absorb international advanced technologies, and develop emerging industries;

(5) We should shift from government-oriented performance to market oriented performance, and better play out the market's regulatory and self-disciplinary role;

(6) We should transform from regional competition mode to balanced development between urban and rural areas, so as to promote favorable interaction among different regions.

Speaking from the relationship between finance and real economy, the real economy is the recipient of financial service as well as the basis for sustainable financial development. Transition of the real economy poses new requirements upon financial service and new challenges upon the traditional financing intermediary mode, providing more exciting opportunities for financial development as well.

2. The existing financial system cannot meet the needs for economic transition

In its most fundamental role, finance serves as a center in social capital transaction and distribution, channeling the limited resources to wherever they can be most efficiently utilized. But over a long time, China's financial system has been accustomed to the traditional development mode and established its own fixed pattern accordingly. Its characteristics are as follows: first, it is led by the government to conduct major projects by pooling resources, giving rise to indirect financing mechanism dominated by major banks; second, it tends to favor development of capital-intensive industrial sector, giving birth to the bank credit culture featuring mortgaging collaterals as the main way to forestall risks; and third, the management mode is basically the same for banks and the profit-making mode is mainly based on deposit and loan spreads. Under the current system, mechanism and credit culture, the capital is bound to flow into large manufacturing businesses and infrastructure while for the technology and the service industries it is hard to obtain banks' financial support due to lack of collaterals. Inaccessibility to bank loans and high financing cost for small and medium-sized enterprises have been two particularly prominent problems since last year. This reflects the deficiencies of the current financial system as a whole:

The incompatibility of the financial system is ultimately reflected in the low efficiency of financial service.

…

If you need the full text, please leave a message on the website.

1Though it is likely that the consumption rate is underestimated due to statistical factors, it is absolutely true that the consumption rate of the same category is decreased.