Analysis of Market Price Performance in the First Half of This Year and Basic Judgment on the Macroeconomic Situation

2005-09-01

Ren Xingzhou, Deng Yusong& Qi Yunlan, Institute of Market Economy of DRC Research Report No.147, 2005

I. The Features of Market Price Changes in the First Half of the Year

1. Consumer price rose mildly and service and residential price went up sharply

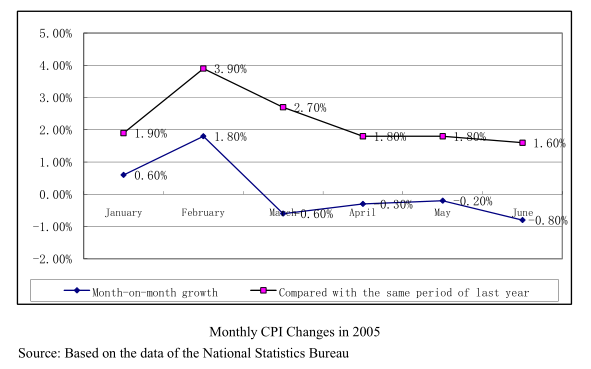

In the first six months of 2005, the personal consumer price index (CPI) rose mildly. It went up 2.3 percent over the same period of the previous year, but the rate was 1.3 percentage points lower. Except for February, the monthly growth rate had been declining gradually, and the month-on-month growth rate after March was negative. But the rate of decline was increasingly smaller (see figure).

The rise of food prices was visibly lower over the same period of last year, becoming a key factor that affected the declining rate of the CPI hike. From January to June, food prices rose 4.4 percent or 5.1 percentage points lower than in the same period of 2004 and contributing 1.5 percentage points to the CPI rise. In particular, the growth of grain prices was 23.3 percentage points lower over the same period of last year, becoming a key factor that contributed to the downslide in the rate of the CPI hike.

The growth of services and residential prices continued to expand. In the first six months, service prices went up by 3.7 percent or 1.7 percentage points higher than a year earlier. Its contribution to the CPI hike was 0.4 percentage points higher than in the same period of 2004. Residential prices went up 5.7 percent, or 2 percentage points higher than a year before.

The prices of general consumer goods continued to fall, but less drastically. In particular, the prices of durable consumer goods bottomed out compared with those a year earlier.

2. The prices of means of production continued to rise unabated, but began showing some structural changes

In the first five months, the ex-factory prices of the means of production nationwide were respectively 7.8 percent, 7.2 percent, 7.6 percent, 7.9 percent and 8.2 percent over the corresponding months of 2004. These rates were all higher than those in the same period of last year. The prices of energy and chemical raw materials went up more steeply, while those of steel products and nonferrous metals rose at visibly slower paces. Statistics of the China Association of Iron and Steel Enterprises indicate that the composite price level on June 10 was 6.5 percent lower than that on April 1.

3. The rise of housing prices slowed down visibly after the second quarter and policy regulation began showing results

In the first four months and first five months, the average prices of commodity houses nationwide were respectively 12.5 percent and 8.9 percent higher than the corresponding periods of 2004. In particular, the prices of residential houses went up by 13.6 percent and 11.3 percent respectively over the corresponding previous periods. From May on, housing prices rose at a clearly slower pace and the month-on-month growth decline was even more conspicuous. In Shanghai, Jiangsu, Zhejiang and other places where housing prices had been rising excessively fast, price increases began declining steadily. But housing prices in Beijing and Tianjin were fairly strengthened.

4. The market demand for automobiles warmed up in the second quarter with the prices being relatively stable

Car sales picked up as from the second quarter, with the production and sales in May being respectively 1.08 percent and 22.41 percent higher than a year before. At the end of May, the composite price index of the car market was 87.38, which was 0.46 percent lower than at the end of the first quarter. But the margin of decline was clearly small, and the prices were relatively stable. Car prices in May as a whole picked up slightly, up 1.95 percent month-on-month.

II. Analysis and Forecast of the Market Price Trends in the Second Half of the Year

Based on the analysis of all affecting factors, the consumer price index will continue to rise moderately in the second half of the year and the increase rate for the whole year will be within three percent. The increase of the prices of means of production will drop slightly, and grain prices are very likely to continue to fall and therefore should deserve high attention.

1. There are both factors to drive up the consumer price index and contain price hikes in the second half of the year

The main factors to drive up the consumer price index: First, service prices will continue to move up. From the second quarter on, some regional governments raised the price levels for personal use of water, coal gas, rental and public transport and therefore service prices and residential prices both face considerably strong pressure to go up. Second, the price increases of energy and raw materials will be further transmitted to the prices of the downstream industrial consumer goods and thus constitute a push for the consumer price index to go up. With regard to the factors that will contain the overall price levels, the decline of stable grain prices will slow down the continuous rise of the consumer price index. With the increase in the output of summer crops and a promising bumper harvest of autumn crops, grain output for the whole year will continue to increase, which will narrow the supply shortage and force grain prices to continue to decline. As a result, the stable prices of main non-stable foodstuffs will also begin to fall, further forcing down the rise of the consumer price index.

Analyses indicate that the consumer price index will continue to rise mildly in the third quarter of the year but the margin of the price hikes will be clearly smaller than in the same period of last year. The price tail-perking factor last year will contribute about 1.3 percentage points to the price rise in the third quarter. If new factors driving up prices are added, the price rise in the third quarter is expected to be about 2.5 percent, and that for the whole year will be within three percent.

…

If you need the full text, please leave a message on the website.