Energy Production Expanded Rapidly, but Supply Remains Short (Abridged)

2004-12-13

Deng Yusong Research Report No 110, 2004

III. Energy Market Forecast for the Second Half of 2004

With national macroeconomic control efforts gradually delivering their effect, the growth of GDP is expected to slightly slide back in the second half of this year, and that of fixed assets investment and net industrial value to continue declining. This, to some extent, will restrain the breakneck growth of energy demand. Because of a big impact of season and climate factors on demand, the overall demand for energy is predicted to remain rampant in the third quarter and to drop slightly in the fourth quarter.

1. Coal supply and demand will be basically balanced in the second half of the year, and prices will remain stably high

Fixed assets investment in the coal industry reached RMB 41.368 billion in 2003, increasing by 43.3% over the previous year. In the first five months of 2004, fixed assets investment in coal exploitation and wash industry increased by 54% compared with the same period of 2003, ensuring a rapid increase of coal throughput. Based on current coal throughput and potential for growth, raw coal output for this year is expected to increase by 15% or so compared with 2003, that is, it will reach about 1.92 billion tons. In addition, because of changes in China’s coal export policy, estimated coal export of this year will decrease by 10 million tons or so compared with 2003, whereas coal import will maintain quick growth. Coal imported from Indonesia and Vietnam will continue to increase in the second half of the year.

In terms of demand, the national macro-control measures targeting high energy-consumption industries, such as steel, cement and electrolytic aluminum, will continue to work, and growth of coal demand in such major coal-consumption industries as metallurgy, construction materials and chemistry is predicted to slightly slide back. Thanks to great increase in water power in 2004 coupled with already high quantity of fossil fuel power utilization hours in 2003, it is expected that the growth rate of fossil fuel power will be slightly lower in the second half compared with the first half. As a whole, coal supply and demand will basically remain balanced.

Since this June, coal prices have shown sign of stabilizing, and some regions and coal products have seen declines in producer prices. Under the basic balance between coal production and demand, only the main provinces from where coal is transferred, such as Shanxi, Inner Mongolia and Shaanxi, can sustain relatively safe production scales. There, the coal market price is expected to be at a stable high level. In view of scaling of coal market price since the second half of 2003, it is expected that the coal price will witness a slower growth in the second half of this year, compared with the first half.

2. Tension between power supply and demand will be aggravated in the third quarter, but will ease in the fourth quarter

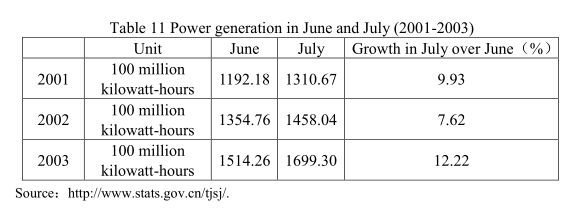

In the first five months of 2004, national newly built generators totaling 8,756,500 kilowatts came on line, and this year it is predicted to be approximate by 40,000,000 kilowatts. Although generator capability has increased rapidly, due to heavy load of fossil fuel power in the second half of 2003, there is little space for existing fossil fuel power generators to keep on adding generating hours. Power generation is expected to witness a slower growth in the second half, compared with the first half. And power generation this year will increase by 14% compared with 2003.

3. Oil supply and demand will maintain a general balance, and the price will probably fluctuate widely in the second half of this year

Because domestic oil resources are deficient, the rapid increase in oil demand can only be met through increasing imports, making the country’s oil supply increasingly dependent on the international market. Although international oil demand has increased slightly due to global economic recovery, the basic structure that global oil throughput exceeds demand does not change. It is expected that the external environment for our country’s acquiring oil from the international market will not change much in the second half. At present, domestic oil refining capability has reached 270 million tons, able to meet the increase of gasoline and diesel oil demand, so the domestic oil market as a whole will maintain a balance in the second half.

Compared with that of other products, international oil prices are subject to many and more complicated factors, and many of these factors are greatly uncertain themselves. These days, uncertain factors such as Middle East situation, OPEC policy and strength of the dollar remain changeable, so international oil price may fluctuate widely. Given that domestic oil price depends on the international oil price, if international oil prices fluctuate widely, domestic oil price will be adjusted accordingly.

...

If you need the full context, please leave a message on the website.