Volvo banks on 'premium brand' in mainland push

Updated: 2016-08-26 06:42

By Deng Yanzi in Hong Kong(HK Edition)

|

|||||||

|

|

|

Pinning high hopes on the Hong Kong market, Lars Danielson (second left) prepares to offer a toast to guests at the launch of new S60 Polestar model in the SAR on Aug 18. Provided to China Daily |

Global automaker sees car sales in SAR doubling this year as consumer confidence climbs

Despite China's slowing economy, as well as an industry transformation on a global scale, Swedish automaker Volvo says its confidence in the auto business remains unshakable.

The company, owned by Chinese automaker Geely, is banking on the country's robust premium market, while continuing its investment in technology to seek an edge in the global competition, says Lars Danielson, senior vice-president of Volvo Car Group and chief executive of Volvo Car Asia Pacific for China operations.

"In China, although the economy is slowing down, our confidence remains high. I believe there's an underlying consumer confidence, and the Chinese mainland's premium market continues to grow on par with, or even ahead of the US," he says.

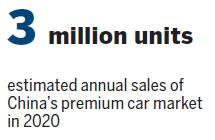

China is already the world's largest automobile market, with 19 million vehicles sold in 2012. The automobile industry forecasts that China will become the largest premium car market worldwide with projected sales of 3 million units by 2020, according to a report by global management consulting firm McKinsey & Co in 2013.

Danielson is optimistic with his forecast of double-digit growth in the mainland's premium market, and strongly believes that Volvo is poised to grow with the trend.

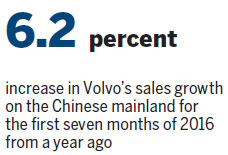

Volvo reported 5.8-percent sales growth in China in July this year, compared with a year earlier, with the number of vehicles sold reaching 6,171, as well as 6.2-percent growth in the country for the first seven months of 2016.

The China market plays a key role in delivering Volvo's long-term volume target, and to get a fair share in the China market, the brand will localize its product portfolio to satisfy what Chinese customers want, says Danielson.

"To achieve that, we will continue to roll out world-class premium products as a strong foundation has been laid with our new 90 cluster cars. We will further expand our dealer network in third-tier and fourth-tier cities, and build a stronger brand through great products and solid business performance."

Talking to China Daily at the grand opening of Volvo's newly renovated showroom in Hong Kong, Danielson also said he has high hopes for the SAR market.

He expects the company to double its sales in Hong Kong this year, compared to 2015. "With our grand opening and product renewal, we are in a good position to grow in Hong Kong."

Hong Kong's mature premium market, which accounts for almost half of the car market, can have a positive influence on the Chinese mainland market to some extent due to the close connections between Hong Kong and the mainland, he believes.

Describing China as the "second home market", Volvo has forged closer links with the country as a market and a manufacturing base, such as its recent expanded manufacturing power in Chengdu, Sichuan province.

Geely acquired Volvo from US auto giant Ford in 2010 for $1.5 billion. The new owner's hands-off approach has allowed the Swedish carmaker to boost its global presence.

"We have now become the truly global brand at sales, manufacturing and also engineering, which is a big, positive transformation happening in Volvo. Our business and our brand are healthier than five years ago," Danielson says.

He describes Geely as "insightful" in giving Volvo the opportunity to develop. The acquisition led to the separation of technology development from its former owner, which allowed Volvo to develop its technology on its own.

"We are more standalone but we also got the freedom to develop the product we really want. We are in the midst of a business transformation of Volvo, and our business is really moving in the right direction," Danielson remarks.

Volvo's focus on innovation and technology has been keeping the brand afloat amid a time of revolution in the global automobile industry, as the quest for sustainability and the advancement of technology is reshaping the industry landscape.

"Personally, I think sustainable mobility will shape the future of the automotive industry, and electrification and autonomous driving are two major enablers," Danielson envisages.

The industry's movement in the direction of electrification has been the biggest change in the past few years, he adds.

"This means that in the foreseeable future, a significant amount of hybrids and electric vehicles will go on the streets due to increasingly demanding emission requirements."

Volvo set forth its ambitious electrification strategies last year, promising to introduce the option of plug-in hybrids across the entire product portfolio in 2019, and to build a fully electric vehicle for sale by that year.

The carmaker has also announced it would sell one million electrified cars by 2025.

Aside from electrification, Danielson believes that autonomous driving will also be an important part of the future.

"A higher level of automated cars, or self-driving cars, will begin to be commercialized and it will be driven mainly by technological advancement, removal of regulatory barriers, as well as customers' quest for quality time in cars," says Danielson.

iris@chinadailyhk.com

(HK Edition 08/26/2016 page8)