Shenzhen moves to shore up rental market

Updated: 2016-08-16 07:44

By Zhou Mo in Shenzhen(HK Edition)

|

|||||||

|

Residential properties in Futian district are among the most expensive in Shenzhen. The city government has pledged to develop the rental housing market by encouraging State-owned enterprises and property brokerages in a bid to attract more young talents to the city. Parker Zheng / China Daily |

SOEs, brokerages encouraged to rent out apartments as part of efforts to check soaring property prices

Soaring property prices in Shenzhen are pushing the city government to promote the rental market, along with a string of incentives, but industry insiders have reservations as the rental yield from residential properties has been on the wane in the past year, which may dampen developers' and homes owners' interest in putting up their apartments for lease.

In its latest report, the Shenzhen government pledged to develop the rental housing market by encouraging State-owned enterprises (SOEs) to become rental supply platforms. It said support would be offered, including preferential loans, financial subsidies and efforts to cut administration costs.

Property brokerages will also be encouraged to make homes rental their prime business.

The move is among various measures taken by the Shenzhen government to check skyrocketing real estate prices. Last month, average prices for new homes in the city reached 56,720 yuan ($8,500) per square meter, according to Centaline Property. Although prices have dropped 8.2 percent compared with a month earlier, they are still beyond many people's reach.

Industry insiders say developing the rental housing market can help solve the problem of supply-demand imbalance in Shenzhen's real estate market and promote the healthy growth of the industry, but warn that declining rental yields could impede its development.

"The rental housing market is not a market that is naturally formed, but one that needs policy support and protection," said Song Ding, director of the Tourism and Real Estate Industry Research Center at Shenzhen-based think tank China Development Institute.

"The government's move means that enterprises focusing on the rental business will get more preferential policies. This is beneficial to the whole market, as people will be able to live in apartments with less financial burdens, while landlords can also get proper profits."

A number of large property developers and brokerages, including Vanke, Shum Yip Group and Worldunion Properties, have already launched long-term rental products in the market. Vanke had introduced more than 1,000 apartments for long-term rental in the first quarter of this year, and plans to launch another 2,000 such units. Shum Yip Group also plans to provide 3,000 apartments by the end of this year.

He Qianru, director of the research center at Midland Realty in Shenzhen, believes that stable rents can help retain talents in the city.

"The demand for accommodation by a large number of people will be met if the rental housing market can be developed. With stable rents, more talents will be willing to stay here," she said.

However, He pointed out that low rental yields could hinder the market's development.

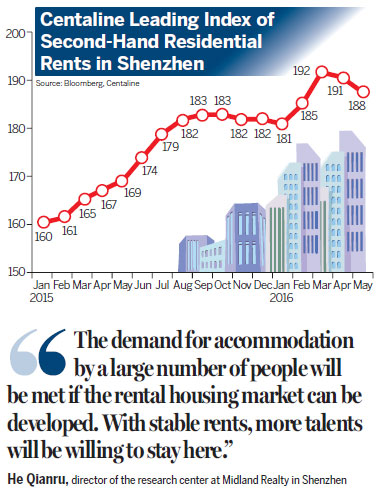

According to Centaline, average rents in the city had fallen from 6,143.43 yuan per unit in June to 5,856.21 yuan last month. The rental yield has kept declining - from 2 percent in August 2015 to 1.56 percent last month.

Shum Yip Group Vice-President Dong Fang said the company has entered the long-term rental business not for profits, but as a social responsibility. Their apartments will be rented out at prices lower than those in the market.

sally@chinadailyhk.com

(HK Edition 08/16/2016 page11)