HK keeps IPO crown in 2016 H1

Updated: 2016-06-23 07:40

By Luo Weiteng in Hong Kong(HK Edition)

|

|||||||

HKEx beats New York, London bourses and likely to maintain lead for second half

Despite deals having floundered worldwide amid lackluster investor appetite, Hong Kong has managed to retain its status as the world's top initial public offering (IPO) market, both in terms of funds raised and the number of listings in the first six months of this year.

And, the SAR is also on track to maintain the top spot for the whole of 2016.

For the first half of the year, there had been 38 IPOs, raising a total of HK$43.5 billion, marking the most floundering first half since 2013, according to the latest report by Deloitte. That follows a relatively strong first half last year, with 46 deals raising more than HK$129 billion.

|

In June - traditionally one of the busiest months for the city's IPO (initial public offering) market - only two companies debuted on the Main Board of the Hong Kong Stock Exchange, and another on the Growth Enterprise Market, making it the worst June on record since 1995. Edmond Tang / China Daily |

The world's red-hot IPO markets showed signs of cooling down. The New York Stock Exchange came in second, with 12 companies raising as much as HK$29.7 billion with their new offerings, followed by the London Stock Exchange which had 31 deals raising HK$28 billion.

Amid growing uncertainties over the direction of US interest rates, the inclusion of mainland shares in the MSCI benchmark indexes, as well as Britain's possible departure from the European Union, Hong Kong's IPO window has been virtually shut since late last month.

In June - traditionally one of the busiest months for the city's IPO market - only two companies debuted on the Main Board of the Hong Kong Stock Exchange (HKEx), and another on the Growth Enterprise Market, making it the worst June on record since 1995.

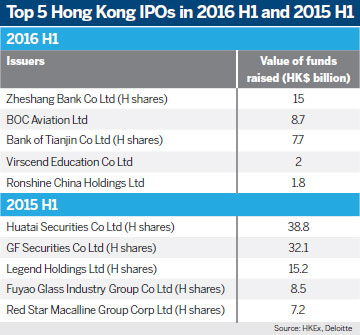

In the first six months, the top five deals included new listings of mid-sized mainland commercial lenders China Zheshang Bank and Bank of Tianjin, and aircraft-leasing unit of Bank of China, BOC Aviation, which collectively raised HK$35.2 billion. That represents a 65-percent drop compared with HK$101.8 billion raised in the first half of 2015, according to Deloitte.

The second half may fare much better, however, with a cluster of positive news, including the upcoming Shenzhen-Hong Kong Stock Connect and a possibly delayed US interest-rate hike boosting market sentiment and encouraging more companies to float, said Edward Au, Hong Kong-based partner of audit at Deloitte China.

Uncertainties that have long rattled investors are also likely to fade in the second half of this year, he said.

Au noted that the city's stock market typically bets big to reaffirm its leading position in global capital markets with an expected seven to eight IPOs all year around from mainland financial service institutions.

New listings from mainland financial service institutions contributed more than 70 percent of the funds raised in the first half of 2016, with the top 3 mega deals involving mainland financial service institutions.

Other eye-catching deals lined up include those of the Postal Savings Bank of China Corp, which is reportedly eyeing what could be the biggest IPO in the world this year, aiming to raise more than $7 billion in Hong Kong.

Deloitte expects up to 115 companies to make their Hong Kong stock market debut this year, raising a total of HK$200 billion.

Au believes that many companies on the mainland, where a logjam of 800 IPOs are awaiting clearance in no less than three years, may reconsider Hong Kong as their listing destination. The SAR has just 105 IPO deals in the pipeline that will take no more than two years to be cleared up.

Although higher valuations in mainland stock markets have triggered take-private offers for at least 10 Hong Kong-listed mainland enterprises since the end of last year, including Dalian Wanda Commercial Properties and Evergrande Real Estate Group, the country's second-largest property developer by sales, it may not go so far as to become a market trend, said Dick Kay, Shanghai-based co-leader of national public offering group at Deloitte.

"After all, not all Hong Kong-listed mainland companies can afford such a lengthy period of delisting from Hong Kong and waiting in a long IPO queue on the mainland," he said.

sophia@chinadailyhk.com

(HK Edition 06/23/2016 page8)