When will pump prices come down? There's still no answer!

Updated: 2016-06-14 07:49

By Luo Weiteng in Hong Kong(HK Edition)

|

|||||||||

|

A PetroChina gas station in South Bay, Hong Kong. The growing gap between the city's gasoline prices and plunging global crude-oil prices has rekindled debate over the city's pricing mechanism that has been branded unreasonable. Jerome Favre / Bloomberg |

As the gap between gasoline prices in Hong Kong and plunging global crude-oil prices continues to widen, it has rekindled debate over the city's pricing mechanism that has been branded unreasonable, with oil companies keeping their prices artificially high.

In its latest report last week, the Consumer Council pointed to the long-existing "less coming down" sign for local pump prices, while international prices of crude oil keep falling.

Crude oil prices worldwide have tumbled more than 60 percent - from HK$5.27 per liter in mid-2014 to HK$1.91 per liter in March this year - dwarfing the 19-percent drop in the SAR's auto-fuel pump price during the same period, the consumer watchdog said.

This has widened the gap between local pump and international crude oil prices by almost 13 percent to HK$6.21 per liter in the first quarter of 2016 - from HK$5.53 per liter in the first half of 2013.

The Environment Bureau says imported auto-fuel prices stand as a more appropriate benchmark as Hong Kong has no oil refinery, with all auto-fuels sold locally imported and there's, basically, a time lag for adjustments in global oil prices to be reflected in the market.

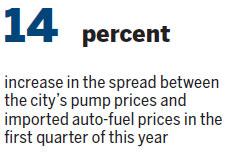

Somehow, the spread between the city's pump prices and imported auto-fuel prices also saw a rise, of 14 percent, in the first quarter of this year - from HK$4.36 per liter to HK$4.96 per liter.

"The 'less coming down' phenomenon has long been an open secret in Hong Kong," says Iris Pang, a senior economist for Greater China at Natixis in Hong Kong. "This is especially so as the downward pressure and growing volatility in global crude-oil prices persist, and this is when oil companies make easy money," she told China Daily.

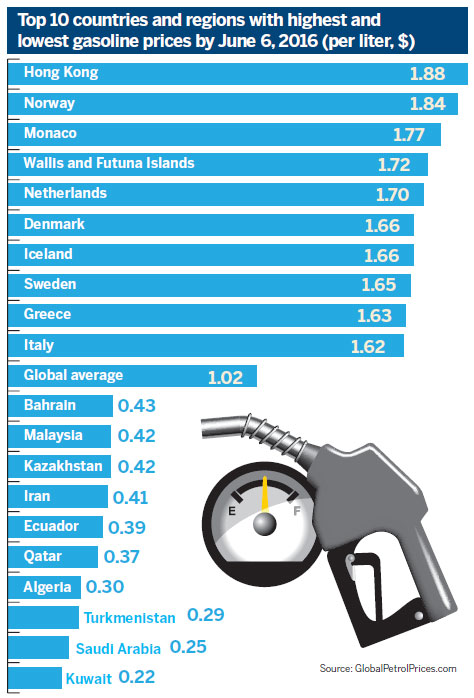

Hong Kong takes the top spot with the most expensive gasoline in the world, followed by Norway and Monaco. The financial hub is the only market in Asia in the top 10 rankings.

According to GlobalPetrolPrices.com data, Hong Kong drivers pay just shy of $1.9 for a liter of petrol - nearly a full US dollar more than the global average price of $1.02 per liter and $0.97 per liter on the Chinese mainland.

Even if the city's high fuel tax of up to $0.78 per liter is struck out, Hong Kong's pump prices are still well above the global average.

"The fuel tax should be blamed for Hong Kong's expensive gasoline, but the culprits are still the local oil companies with the power to determine prices," notes Pang.

Oil giants, including Royal Dutch Shell, Chevron and Sinopec, have brushed off criticisms of profiteering, claiming that soaring operational costs like land premium, land rent, inflation, transportation and changes in wages should be taken into account. These factors, they argue, naturally slow down any cuts in local auto-fuel pump prices.

"In the context of low inflation, I don't think such claims make any sense," retorts Pang.

William Chung, director of the energy and environmental policy research center at the City University of Hong Kong, said that despite a sustained campaign by local industry groups and taxi drivers for the government to crack down on high gasoline prices, there's nothing much consumers can do, at least for the time being, unless the city's five oil companies are forced to disclose their operational data for the past two years.

The Consumer Council has painted a somewhat different picture from that of oil companies. Over the past two years, the land cost per liter of auto-fuel sold has somehow posted a slight decline - from HK$1.3 to HK$1.25 last year.

Although the total annual land cost had registered a 4-percent rise in the past three years to HK$765.2 million in 2015, it had been very much offset by an 8.7-percent increase in the total sales volume of oil companies during the same period.

"Operational data from oil companies are, by and large, unavailable, but I think the general data in the local retail fuel market are enough to speak a lot," says Cao Kanghua, an associate professor of the Department of Economics at Hong Kong Baptist University.

According to the Census and Statistics Department, the gross surplus in the city's retail fuel market surged 35 percent in 2014, while operating expenses dived 3 percent. The number of licensed auto-fuel vehicles locally climbed 14 percent from about 490,000 in 2013 to some 560,000 last year. This means that strong demand has driven up overall unleaded auto-fuel sales in the market by an average of 4 percent annually.

"Such robust demand, however, may be another excuse for pump prices to stay high," warns Pang.

Oil companies have come up with another "excuse" - the discounts which, they claim, have pulled down the actual pump price that consumers pay for gasoline.

"The discount pricing system, which offers different discount rates to different groups of consumers via different payment methods, doesn't work for the retail auto-fuel market," argues Chung. "Auto-fuel is the utility, something that's so essential and fundamental to daily life. It shouldn't be touted in the market like general consumer products, and it's unfair to charge customers different prices."

Pang believes the market needs a more scientific and reasonable pricing mechanism. Otherwise, the Consumer Council's report is a mere scrap of paper although the watchdog throws the issue of high pump prices back into the spotlight from time to time.

The report says up to 80 percent of the days between 2013 and 2015 saw exactly the same pump prices charged by the city's five oil companies, underpinning lingering concern over their collusion in fixing prices.

"Based on my research, the situation seems even worse, with three out of the five oil firms meting out almost exactly the same pump prices nearly every single day in the past two years," says Chung.

Is there any possibility of the newly launched Competition Commission stepping in to deal with the problem? Pang believes there's hardly any. The commission began operation in December last year after the long-awaited Competition Ordinance came into force.

"The point is that there's no monopoly in the market at the moment. And oil companies do have a certain degree of transparency in setting prices," Pang observes. "That's why the Consumer Council ended its report only by calling for greater transparency." She reckons there's no dearth of economists at Hong Kong universities who can help the SAR government develop a more reasonable pricing model, but she has no idea why the government hasn't set about doing it.

Chung thinks the government is worried that energy may become too cheap and may want to tighten its grip on domestic gasoline prices in response to relatively low diesel prices.

Hong Kong's diesel prices have remained low at $1.4 per liter, compared with $1.63 in Norway and $1.59 in the United Kingdom. "There's, possibly, a lack of incentives for the government to pull down gasoline prices. Or, at least right now, it doesn't want to be in a rush," says Chung.

sophia@chinadailyhk.com

(HK Edition 06/14/2016 page9)