Jumpy stock market seen to worsen woes

Updated: 2015-10-09 09:32

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||

Besides the three pillars of growth, domestic consumption is also a vital driver of the Hong Kong economy. As a free economy, Hong Kong's domestic consumption is heavily dependent on the performance of the local asset markets. Resilient domestic demand is regarded by the administration as a buffer for local growth against tumbling global demand.

Greater equity market volatility due to the A-share market slump and yuan depreciation, as well as dampening of property market sentiment amid a slowing mainland economy and imminent US interest rate hike, has curtailed domestic consumption through negative wealth effect.

Wealth effect refers to the willingness of people to spend more when their financial asset values increase.

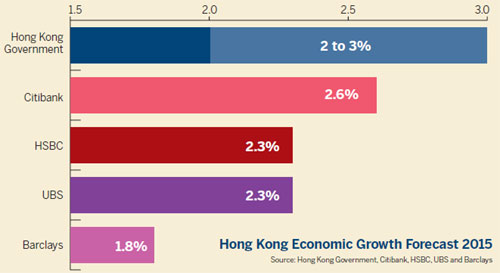

"Our regional study of wealth effects indicates a 10 percent decline in Hong Kong stock prices would lower real consumption by 0.88 percent in the short term plus a long-run elasticity of 0.14 percent," Citibank analyst Adrienne Lui forecast.

oswald@chinadailyhk.com

|

The SAR government has revised its growth forecast upward but analysts are still warning of dire fallouts in the event of a worst-case scenario. |

(HK Edition 10/09/2015 page8)