Mainland aviation market poised for take-off: Boeing

Updated: 2015-08-05 08:43

By Emma Dai in Hong Kong(HK Edition)

|

|||||||

The Chinese mainland's commercial aviation market is poised to take off, led by low cost carriers (LCCs) and air cargo business, as a growing middle-class population fuels air travel demand, according to Boeing's regional sales chief.

"To fully satisfy air traffic demand in China, you need a fleet the size of that of the US. But it's not there yet. That's why we'll see more growth in China than in matured markets," Ihssane Mounir, senior vice-president of sales for Northeast Asia, Boeing Commercial Airplanes, told China Daily.

According to Mounir, while China's population is about four times that of the US, the country's entire fleet of airlines is only about one-third that of the US. And, the mainland's middle-class population today - the driver of air travel - is already as big as America's population. "There's still plenty of demand to be satisfied," he said.

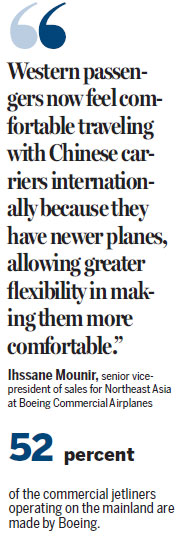

The Seattle-based airplane manufacturer has seen revenue soar by 45 percent on the mainland - from $6 billion to $11 billion - in the past three years. At present, about 52 percent of the commercial jetliners operating on the mainland are made by Boeing.

The US company also forecasts that in the next two decades, the mainland will need 6,020 new airplanes, worth more than $870 billion, making China its largest commercial airplane customer.

With the pie growing, mainland carriers are gaining a bigger slice of it. "Last quarter, for the very first time, Chinese carriers moved more passengers between China and the US than US carriers. This is becoming the norm," Mounir said.

"Western passengers now feel comfortable traveling with Chinese carriers internationally because they have newer planes, allowing greater flexibility in making them more comfortable," he said, adding that the average age of Chinese jetliners is five to six years, compared with 12 to 13 years in the US.

As major airlines expand their operations to cover long-haul routes, more than 30 new routes beyond 5,000 km have been launched in the past three years, with the market share of domestic carriers boosted by 70 percent.

Mounir expects LCCs to take the game to a whole new level.

"We see LCCs growing fast in China. This is very natural as it's the next phase of growth in many markets. In Europe, the economic take-off happened when Ryanair and Easyjet came to the market," he said.

"Demands cannot be satisfied by sticking with legacy carriers," Mounir said. "But a low-cost structure allows LCCs to connect more cities out of the mainstream. All of a sudden, it becomes affordable for more people, especially the middle class, to travel by air and at a higher frequency. All the people and traffic would have a snowball effect on economic growth."

"To drive economic growth, you have to promote LCCs. Currently, the mainland's propensity of travel on a per head basis is 10 times lower than in the US. LCCs will connect mainstream provinces and take care of point-to-point leisure travelers in the region," he added.

On the air-cargo sector, Mounir said airfreight fuels the growth of commercial aviation. "The air cargo business is explosive in China because of economic growth and consumerism. Once domestic consumption becomes the primary driver of the economy, the need for express planes would be huge, let alone the e-commerce trend."

And, as the mainland becomes a major exporter of high-tech goods, such as Samsung and Apple products, demand for air cargo is lifted, according to Mounir.

"As the country has the manpower and the policy support to take over high-tech manufacturing, I foresee a big spur in the air-cargo business," he said.

emmadai@chinadailyhk.com

(HK Edition 08/05/2015 page7)