Stock Connect turnover tipped to rise

Updated: 2014-12-16 05:59

By Felix Gao in Hong Kong(HK Edition)

|

|||||||

The effectiveness of the Shanghai-Hong Kong Stock Connect program cannot be measured by short-term market reactions although its quota usage is lower than expected, a JP Morgan economist said on Monday.

Zhu Haibin, JP Morgan's chief China economist, said the stock cross-trading scheme is beneficial to the mainland and Hong Kong economies. "The scheme is an important step in the opening up of the mainland's capital account. We could expect the launch of the Shenzhen-Hong Kong Stock Connect or even a global stock link in the near future," he said.

Zhu pointed out that, at present, the Qualified Domestic Institutional Investor, Qualified Foreign Institutional Investor and the Stock Connect schemes just account for 2 percent of the mainland stock and bond markets, and the room for expansion is huge.

Statistics from the first four weeks of the Shanghai-Hong Kong stock link showed that the average daily total turnover had been much higher than the daily quota usage allocated, according to Hong Kong Exchanges and Clearing Ltd (HKEx).

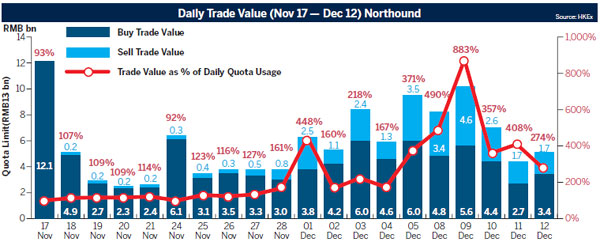

During the first three weeks of trading - from Nov 17, when the program was launched, to Dec 12 - the average daily turnover in Northbound trading, in which Hong Kong and international investors buy A-shares listed in Shanghai via the HKEx, was 5.8 billion yuan ($937 million). The average Northbound quota usage was 3.3 billion yuan, or 25.3 percent of the daily quota.

Within the same period, the average daily turnover in Southbound trading, in which mainland investors buy Hong Kong listed stocks via the Shanghai Stock Exchange, was 757 million yuan, with an average daily quota usage of 477 million yuan, or 4.5 percent of the daily quota.

The low quota usage was because of the narrow gap between the buy and sell trade value, according to HKEx. The stock quota is calculated on a net basis, whereby sell orders are offset against buy orders.

On Dec 9, the total turnover value of Northbound trading amounted to 10.2 billion yuan - almost nine times the quota usage of 1.2 billion yuan - offset by nearly equal buy and sell trade value that day.

"Like any new market infrastructure, we anticipate utilization will increase gradually as investors gain a better understanding of the program and assess the investment opportunities that are available to them for the first time," said HKEx Chief Executive Li Xiaojia.

Citigroup said it expects higher trading volumes to come after the connect system is proven to run smoothly and more brokerages or funds use it. The bank said further enhancement of the cross-trading scheme is expected next year.

felix@chinadailyhk.com

(HK Edition 12/16/2014 page9)