Yu'e Bao's bid for HK market 'won't be smooth sailing'

Updated: 2014-10-15 08:23

By Celia Chen in Hong Kong(HK Edition)

|

|||||||

|

Alibaba Group Holding Ltd's headquarters in Hangzhou, Zhejiang province. Analysts are skeptical about the mainland e-commerce giant's plan to introduce online market fund Yu'e Bao to Hong Kong amid tough financial restrictions on both sides of the border. AFP |

Introduction of mainland's popular fund could hurt HK's money market

Tough financial curbs on both sides of the border may prove to be the biggest stumbling blocks in Alibaba Group Holding Ltd's bid to bring Yu'e Bao - the mainland's biggest online market fund - to Hong Kong.

Alipay.com Co - Alibaba's financial affiliate which offers the product - would need a Hong Kong banking license as well as the green light from the central bank, the People's Bank of China, and the State Administration of Foreign Exchange for funds to be transferred from Hong Kong to the mainland.

Yu'e Bao, which has taken the mainland by storm since its launch in June last year, has reportedly drawn more than 100 million investors so far, with an annual interest rate of about 6 percent compared with just 0.35 percent a year for deposits at traditional banks.

UK's Financial Times reported earlier that Alibaba, which made headlines recently with its record $24-billion initial public offering in New York, plans to expand its money-market services by taking Yu'e Bao to Hong Kong following the product's huge success on the mainland.

However, a spokesman for the e-commerce giant, who preferred to remain anonymous, poured cold water on the report, saying that the potential market on the mainland is massive enough to cast aside any plans for Alibaba to set foot on the SAR, according to the mainland financial website Donews.

"They (Alipay) would have to become a licensed bank, but Hong Kong's existing licensing regime is very strict," an official from the Hong Kong Monetary Authority was quoted as saying.

Ming Shu, an Alipay executive in charge of micro-finance and small and medium-enterprise financing, however, said the group expects to launch Yu'e Bao in Hong Kong early next year. "If we can send the funds back to the mainland, it can make a big difference, and we're pushing hard," he said.

Matthew Kwok, chief strategist at Tanrich Financial Holdings Ltd in Hong Kong, took a cautious approach. "The idea of taking Yu'e Bao to Hong Kong is encouraging, but I believe the move to get it started here by next year is too radical as Hong Kong financial regulators always adopt a conservative attitude in issuing banking licenses," he told China Daily.

Pessimism also came from Andrew Wong, chairman and CEO of Andrew Timmas Securities (HK) Ltd. He reckoned that Alibaba's the target launch date for Yu'e Bao in Hong Kong is next to impossible.

"Besides strict local regulations for the entry of such financial products, the channels for investing in the yuan offshore market for Yu'e Bao are also limited," he told China Daily.

The appropriate way is through the Renminbi Qualified Foreign Institutional Investor (RQFII) program, but regulators have not included money-market funds in the program, which covers only equity exchange-traded and bond funds.

"If Alipay could secure millions of quotas under the RQFII, then, it would be beneficial. Otherwise, there are less legal channels for offshore yuan for investors," Kwok added.

Wong also said he expected creating a version of Alipay in Hong Kong to be a difficult task. "I believe it's hard to change Hong Kong people's consumption habits in the short term as, generally, they would already have opened accounts at some local and foreign banks," he said.

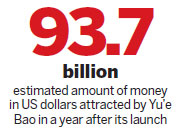

Another big issue confronting Yu'e Bao's launch in the SAR is financial security as the risks for investors will be higher with regard to Internet financial tools. Wong believes that there's a funds shortage on the mainland, as products like Yu'e Bao are draining too much money from banks. Yu'e Bao had attracted more than 574 billion yuan ($93.7 billion) just a year after its launch on the mainland.

"It's impossible for Hong Kong regulators to ignore the negative effects of Internet finance when the mainland is already experiencing an acute shortage of funds," said Wong. "Even if the Hong Kong-dollar version of Yu'e Bao gets started here successfully, it would draw money from local banks. Therefore, the existing low deposit rates will be raised, thus Hong Kong's mortgage rates will also go up. All in all, it would exert great pressure on the city's banks and the property market."

Asked what he thought is the reason for Alibaba's plan to take Yu'e Bao to Hong Kong, Wong replied: "Alipay may believe there's a big market for the development of Yu'e Bao here, with higher returns compared with the relatively low bank deposit rates in Hong Kong."

"The most convenient way for Yu'e Bao's launch in Hong Kong is to buy a Hong Kong bank and secure a local banking license," he said.

celia@chinadailyhk.com

(HK Edition 10/15/2014 page9)