HSBC to stay the course in China, India

Updated: 2011-05-20 07:17

By Emma An(HK Edition)

|

|||||||

Lender to invest despite money losing operations

HSBC Holdings Plc, Europe's largest bank by market value, said it will hold on to its retail banking businesses on the mainland and India despite losing money from them, citing the strategic importance of the two markets to the London-based banking giant.

At the bank's informal shareholder meeting held Thursday in the city, Stuart Gulliver, HSBC Group chief executive officer and HSBC Asia-Pacific chairman, said the bank will continue to invest on the mainland and in India.

"We want to maintain our position as the top foreign bank in China", said Gulliver.

"We need to get the renminbi deposit base", he added.

The CEO said that he sees significant opportunities from the further internationalization of the yuan, the basis on which HSBC has already launched a wide range of new services.

While keeping its retail banking business afloat in China and India, HSBC had earlier announced that it will wind down its retail banking business in Russia, with similar moves about to be taken in 39 more markets where retail banking business has yet to achieve scale.

Additionally, the bank is reviewing its credit card business in the US, which has been far less successful than that in the UK and Hong Kong. Cutting back on retail banking and ditching its US credit card business could help save HSBC $3.5 billion in costs and help restore flagging profitability.

Nevertheless, Gulliver said HSBC remains "100 percent committed" to its retail banking businesses in Hong Kong and the UK, where the bank has been running "successful scale retail banking businesses", and will continue to "invest 100 percent" in both markets.

HSBC is also banking on the rise of emerging markets, particularly in Asia, to drive a sizable part of its growth going forward.

"Asia is at the heart of all macro economic trends," Gulliver said, adding that the region will remain "the heartland of HSBC Group".

The bank sees great growth potential for its retail banking businesses in Asian markets including Singapore, Indonesia and Malaysia.

It also said it would consider moving its headquarters from London and did not rule out the possibility of relocating to Hong Kong.

And having had its CEO move recently to Hong Kong from London, where the bank remains based, HSBC is keen to become the second yuan clearing bank in Hong Kong after the Bank of China (Hong Kong).

Gulliver said that the bank has done everything it can do to get listed on the Shanghai Stock Exchange. This, if successful, will help "improve HSBC's familiarity" on the mainland as a brand and "create anther pool of investors in HSBC shares".

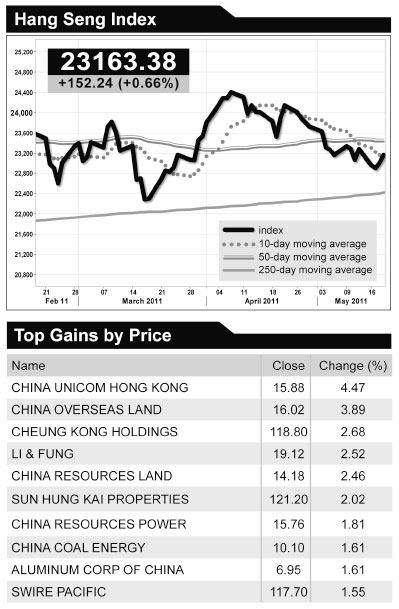

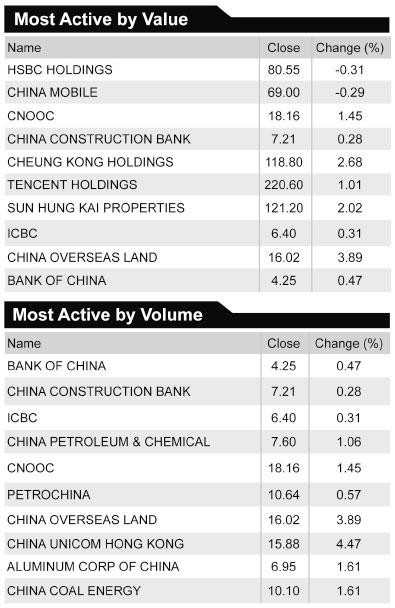

But for the existing pool of HSBC shareholders, a higher share price on the back of increased profitability may be the most desirable goal. The bank's share price has remained at around HK$80 for some time now. And the new CEO has pledged to "run the bank profitably" ,thus giving a potential boost to its share price.

Over the past four years, HSBC has paid a total of $31 billion in dividends, second only to Industrial and Commercial Bank of China Ltd as the top dividend payer, according to HSBC Group Chairman Douglas Flint.

"Our aim is to maintain eminent progression on dividends," said Flint.

At a press conference held after the shareholder meeting, HSBC said that Executive Director Vincent Cheng will remain an adviser to the CEO after his retirement later this month.

China Daily

(HK Edition 05/20/2011 page3)