Coal prices press power producers, State tariffs

Updated: 2011-05-17 07:05

By Joy Li(HK Edition)

|

|||||||

|

Chinese miners process coal from a mine in Anhui province. Power-station coal prices at Qinhuangdao port, a benchmark in China, hit the highest in more than two years after advancing consecutively for seven weeks. AFP Photo |

Record-high coal prices will hurt power producers' first-half profits but the negative effects may be tempered since power shortages across the mainland have added urgency to calls for raising electricity prices, analysts said Monday.

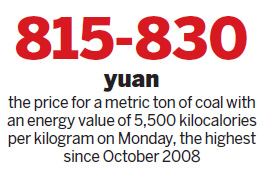

Power-station coal prices at Qinhuangdao port, a benchmark in China, hit the highest in more than two years after advancing consecutively for seven weeks. According to the China Coal Transport and Distribution Association, coal with an energy value of 5,500 kilocalories per kilogram increased 0.6 percent to 815 - 830 yuan ($125.22 - $127.53) a metric ton on May 16 compared with a week earlier, the highest since October 2008.

"Both supply and demand played their roles in the latest round of price surge," said Leo Wu, an analyst with Guotai Junan (HK) Securities.

In April, deliveries at Daqin railway were disrupted due to maintenance, dragging inventories down 25 percent in one month. Meanwhile, power demand has already soared before the summer peak season, especially in coastal provinces, Wu noted.

"The rising coal prices will certainly erode power generators' near-term profitability; however, as some of the power plants fall into the tariff-favored areas, their full-year performance will not necessarily be worse than last year," said Wu, adding that although the trend of coal prices was upward, it had shown signs of peaking.

Ivan Lee, an analyst with Nomura International (Hong Kong) Ltd, said he saw no quick relief for power producers, as the summer peak season would definitely worsen the power deficit and the transportation bottleneck of the railways would linger on for a while.

"For the IPPs (independent Power Producer), their chances depend much more on electricity prices," said Lee.

In April, it was reported that the National Development and Reform Commission (NDRC), the top economic planner, raised on-grid coal-fired power tariffs by an average 1.2 cents per kWh for 16 provinces.

According to a utility industry report by Gaohua Securities Research, Goldman Sachs's China partner, the last consecutive tariff rises in July and August 2008 followed the peak levels of inflation during February - April 2008.

As for Hong Kong-listed IPPs, analyst Franklin Chow said the magnitude of these rises "is insufficient to raise the profitability of the IPPs to a more sustainable level".

Lee from Nomura said he expected more tariff increases, as otherwise "a vicious circle will be self-fulfilled".

With continuous losses, IPPs will find it harder to afford dearer coal and build more power plants, leading to more biting power deficits, Lee said.

Rising coal prices have been a headache for coal-fired power generators, as they are stuck between market-driven raw material prices and state-capped electricity tariffs.

China Resources Power Holdings Co, the Hong Kong-listed blue chip electricity producer, reported a 21.4 percent unit fuel cost increase over last year, leading to a slump in net profits.

Wang Yujun, the company's president, said in March when reporting annual results that voices calling for a review of the capped price system would be extremely strong this year.

On April 15, the NDRC said the country faced tight electricity supply and some areas might have a "relatively large" shortfalls this summer.

China Daily

(HK Edition 05/17/2011 page2)