Businesses call for more tax cuts

Updated: 2011-01-26 07:03

By Joy Li(HK Edition)

|

|||||||

HKGCC warns that a failure to do so would erode HK's competitiveness

The government must take prompt action to introduce tax reforms, such as slashing profits tax rate and introducing two-tiered tax structure, the Hong Kong General Chamber of Commerce (HKGCC) said Tuesday.

Issued just ahead of the government's annual budget, the HKGCC argued that a failure to do so would further erode the city's competitiveness.

It called for a further 1 percentage point deduction in the headline corporate profits tax rate to 15 percent. The HKGCC claimed that this move will reduce HK$6.6 billion in tax revenue for the government.

Hong Kong has maintained its simple taxation regime for the past decade, with the headline corporate profits tax remaining steady at 16.5 percent. However, other economies in the region are quickly catching up to narrow the gap, it said. For example, Singapore has reduced its profits tax rate from 26 percent to 17 percent and South Korea from 30.8 percent to 17 percent.

"We no longer enjoy a 10-percentage-point advantage over Singapore as we did a decade ago. Instead, we are just one-half percentage points ahead on the headline figures," said HKGCC Chief Executive Officer Alex Fong.

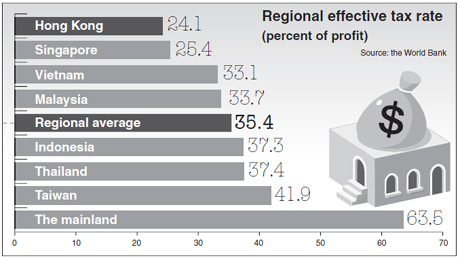

According to the World Bank's rating, Hong Kong's effective profits tax rate stands at sixth place among 15 East Asian economies. The total tax rate (percent of profit) in Hong Kong is 24.1 percent, according to the World Bank Doing Business annual report 2011.

Among other factors, the lack of group loss relief and loss carry-back raises the effective tax rate and undermines Hong Kong's competitive position.

Unlike many other jurisdictions, operating losses in Hong Kong cannot be carried back to offset against taxable profits in prior years or transferred between group companies. As a result, companies are likely to face higher costs and less favorable cash flow.

"Companies new to the region may give greater weight to headline tax rates when selecting a regional operating center, but those already here know that it is the effective rate that matters," said HKGCC Chairman Anthony Wu.

Hong Kong has been well-known for its simple taxation regime, but the HKGCC urged the government to introduce a two-tiered taxation structure to support and invest in small and medium-size enterprises. The HKGCC calls for a 10 percent rate on the first HK$500,000 of assessable income for small companies whose annual gross income is below a certain amount, for example, at HK$2 million.

The business community in Hong Kong has a pretty negative outlook regarding the city's competitive edge, according to a business prospects survey conducted by the chamber. Among the 250 chamber members who took part in the survey, 41.2 percent said the city's competitiveness declined in the last 12 months and 51.3 percent said it remained the same. Asked whether the city's competitiveness will improve in the next three to five years, 63.5 percent responded "No" and 36.5 percent "Yes".

David O'Rear, chief economist at the HKGCC, said that in previous years more than 40 percent of respondents gave the affirmative answer.

"This year's result is pretty discouraging," said O'Rear.

The survey revealed that 78.3 percent of respondents think compliance costs regarding regulations is the "very important" challenge they face, followed by a lack of long-term government planning (73.7 percent) and rising competition from other economies (71.5 percent).

China Daily

(HK Edition 01/26/2011 page2)