Despite sharp increase in supply, housing prices continue to soar

Updated: 2011-01-22 07:18

By Oswald Chen(HK Edition)

|

|||||||

City property completions rise to highest level since 2006

Despite new home completions in the city rising to their highest level since 2006, it appears to be having little impact on property prices.

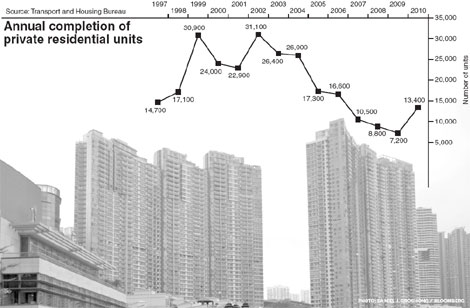

Figures released by the Transport and Housing Bureau Friday showed that a total of 13,400 private units were completed in 2010, up 86 percent from the 7,200 units constructed in 2009 - the lowest since records began to be kept in the early 1980s.

The government has been attempting to boost home supply in a bid to curb soaring prices. In November, it laid on additional taxes and policies as it intensified its battle. Home values have risen more than 55 percent since the beginning of 2009 on record low mortgage rates, a lack of new supply, and an influx of mainland buyers.

"This means supply is getting more in line with demand," said Wong Leung-sing, research director at Centaline Property Agency Ltd, in reference to the government's home completion figures. The number will probably rise to about 14,000 units this year and 2012, Wong added.

Hong Kong's government, the main supplier of land for development in the city, partially resumed regular land auctions in 2010 after they had been halted in 2004 to support falling home prices.

"With the government initiating more public land sales and land premium payments accelerating, the construction and completion of private residential units has rebounded from the low levels of 2008 and 2009," said Buggle Lau, chief analyst at Midland Realty.

The measures to curb speculation in the property market have been "pretty effective", Financial Secretary John Tsang said on December 2, shortly after anti-speculative measures aimed at the property market were put in place in mid-November. Statistics proved the financial secretary correct as the value of total home sales in the city fell 32 percent to HK$39.9 billion in December, a seven-month low.

However, transactions "have picked up considerably" in the first two weeks of January as buyers and investors expect prices to recover to last year's level after the lunar new year holiday in February, Midland Holdings Ltd Director Andy Ho said in a January 16 press release. Meanwhile, Centa-City Leading Index, which measures the price movement of flats in the resale market, reached 90.5 last week - its highest level since 1997.

Separately, some members of the Legislative Council queried the long-term effectiveness of the government's anti-speculative measures Friday, in particular the Special Stamp Duty as prices start to rise again. The government introduced a punitive stamp duty of 15 percent on buyers who resell their homes within six months of purchase.

"Though the measures may scare away property speculators, genuine buyers and long-term investors still find property purchases an attractive option due to the low interest rate environment in the city," said legislator Lee Wing-tat. "So prices are rising again."

Real estate and construction industry legislator Shek Lai-him added that home owners are more likely to rent out their places these days than sell them, so the market is still very much short of supply and this is boosting prices.

Bloomberg contributed to this story.

China Daily

(HK Edition 01/22/2011 page2)