Market volatility cooling down local IPO, bond issuance activity

Updated: 2010-11-25 08:10

By Oswald Chen(HK Edition)

|

|||||||

Bluestar Adisseo, China Datang unit to delay listings

The volatility seen on the local equity market in the past few weeks has taken a toll on initial public offerings and bond issuances. And news of hostilities breaking out on the Korean peninsula, more tightening measures taken by the Central Government to tackle inflation, and the ongoing European sovereign debt crisis, has spooked investors further.

Companies are either canceling or scaling down their IPO and bond issuance plans. And the share price of market debutantes hasn't been too impressive lately either, often falling below their IPO prices.

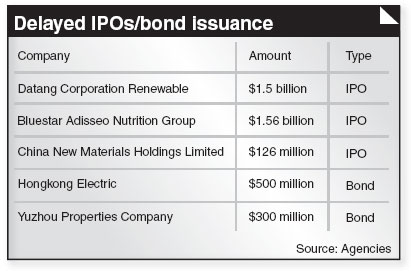

China Datang Corp, the parent of Datang International Power Generation Co Ltd as well as the country's second-largest power producer, has postponed plans to raise up to $1.5 billion through a Hong Kong share float of its renewable energy unit (Datang Corp Renewable) as market uncertainty will affect company valuation, banking sources said Wednesday.

"Datang Corp Renewable is still in pre-marketing and will hold a meeting at the weekend to decide on the IPO schedule," one source said. The source said this was due to falls in Asian markets and tension on the Korean peninsula.

The company had planned to sell 2.14 billion shares in a global share offer to fund wind power projects in China and repay bank loans, according to a term sheet published last week.

Meanwhile, French animal-nutrition feed additives producer Bluestar Adisseo Nutrition Group and chemical material producer China New Materials Holdings Limited also have pulled out of their IPO plans on Wednesday due to the recent market volatility.

Bluestar Adisseo, which had been expecting $1.56 billion in its IPO, won't list its shares on November 30 as originally planned, and also delayed its pricing plans, according to a source who refused to be identified as the information is confidential. Blackstone, the world's largest private-equity company, has a 20 percent stake in China National Bluestar Group Corp, which owns Bluestar Adisseo, according to the company's IPO prospectus.

The recent market jitters are also prompting some companies to scale down their IPOs, including the mainland's second-largest wind turbine maker, Xinjiang Goldwind Science & Technology Co. It has cut the size of its issue by about a quarter last month, citing fragile investor sentiment and concern about overcapacity in the sector.

Meanwhile, the local bond market also felt the pinch as well. Local utility firm Hongkong Electric joined junk-rated Fujian-based Yuzhou Properties Co in delaying its US dollar bond offerings. The size of these two delayed bond issuances amounted $800 million. This trimmed the sale of US dollar, euro or yen bonds in Asia-Pacific outside Japan this month to $10.6 billion compared with $12.9 billion in the same period of October, according to data compiled by Bloomberg.

"Some borrowers are being very picky on pricing and while they probably could get a sale away, they're choosing to wait until market conditions improve," said Pierre Faddoul, a credit analyst at Aberdeen Asset Management Asia Ltd.

One local fund manager expects that the current bearish mood in the IPO sector may last some time.

"We expect the local IPO market will not improve until the first quarter of 2011 at the earliest as the market is exhibiting too many policy risks which are unforeseen by investors," said BMI Fund Management President Patrick Shum.

Bloomberg and Reuters contributed to this story.

China Daily

(HK Edition 11/25/2010 page2)