Credit Suisse's buy small caps in the new year

Updated: 2010-02-11 07:37

By Li Tao(HK Edition)

|

|||||||||

HONG KONG: Investment bank Credit Suisse has forecast that the Hang Seng Index will rise to 24,600 by the year's end, while small caps are expected to perform well in 2010, despite a slowdown in the pace of economic recovery.

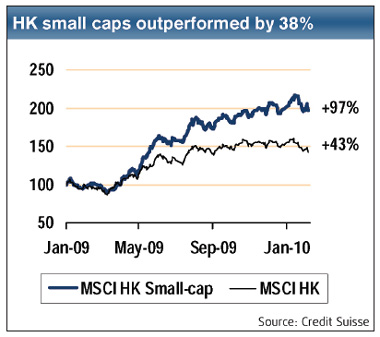

In a report entitled "How to Spend Your Lai See" released yesterday, Credit Suisse analogized small caps as " Hello Kitty in the year of the tiger". It said small companies were likely to continue their cyclical out-performance in comparison to the more expensive large caps in the Hong Kong market in 2010.

"The current small-cap out-performance is a cyclical trend that occurs after every economic downturn. In addition to better earnings recovery potential due to smaller size, the price/earning discount of small caps versus large caps is a major driver of their out-performance," said Kenny Lau, Credit Suisse's head of Small-cap Research.

Lau also noted that small caps are no longer trading at distressed valuations.

But Credit Suisse also warned that the market in this tiger year will be volatile, unlike the previous one-way-up bull year.

Cusson Leung, Credit Suisse head of Hong Kong Research said he is positive from a 12-month viewpoint, expecting the Hang Seng Index to close at 24,600 by the year end.

"The Hong Kong market is likely to see a challenging first-half 2010. The main concern at present is the potential tightening in the mainland's monetary policy, but this uncertainty will likely end in the second half," said Leung.

Leung favors consumer, capital goods, industrial and transportation sectors because of the gradual pick-up in trade growth in the mainland and globally. He is also optimistic about the domestic consumption sector due to a recovery in income growth, and focus on mass residential property developers this year, as potential upside in the luxury segment is likely to be capped by reduced liquidity from the mainland.

Given that the recent sharp correction was mainly driven by concerns over the country's macro-economy, Credit Suisse forecasts that the Hang Seng China Enterprises Index and Shanghai A-share Index will hit year-end targets of 15,000 and 3,300 respectively.

Vincent Chan, Credit Suisse head of China Research, said that although it seems difficult for the central government to achieve its new loan target, as the "stop-and-go" process of issuing new bank loans will likely continue, he believes this issue can be resolved if the central government takes the lead. Chan said the first step would be to contain the size of the problem, which would mean a meaningful slowdown in infrastructure investment.

(HK Edition 02/11/2010 page2)