|

|

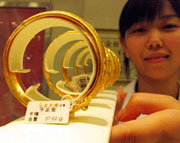

| Golden ornaments are on display at a market in

Nanjing, East China's Jiangsu Province. Shanghai Gold Exchange is

currently seeking ways to attract foreign gold

traders.(newsphoto) |

An executive of Shanghai Gold Exchange yesterday

said that China's sole national gold bourse

has made submissions to the central bank to attract

foreign gold traders.

"We are striving to invite qualified international banks and gold firms

to directly conduct transactions in our exchange," said Wang Zhe, general

manager of the gold exchange.

"The move will build more channels for us to integrate with the

international gold market," Wang said yesterday at an international forum

on global gold outlook, infrastructure support and market development in

Beijing.

At present, there are 128 domestic membership traders in the gold

exchange, including commercial banks and gold producers and processors,

which conduct spot transactions using renminbi.

The exchange was launched in late 2002, marking a substantial step

towards liberalization of China's gold market. Previously, domestic gold

producers had to sell all of their gold to the central bank.

"However, the gold exchange is close to the international gold market

without engagement of foreign traders. Domestic gold prices don't move

fully in line with international prices," Wang said.

Integration with the international market will pave the way for the

gold exchange to open individual gold investment businesses, he said.

The Shanghai branch of the China Industrial and Commercial Bank started

pilot individual gold investment business at the gold exchange in October.

Albert Cheng, managing director of the World Gold Council's Far East

operations, yesterday suggested Chinese regulators should permit

commercial banks to carry out gold investment business quickly to meet

market demand.

"The construction of an over-the-counter gold trade platform at

commercial banks is an important alternative to extend the gold trade

platform," Cheng told the forum.

"For the general public, such a trade platform is reliable and

convenient, and it can provide extended financial services. For gold

producers, this platform can put product sale and business credit together

into their own development strategy. These are advantages that are not

seen on any other platforms," he said.

The gold council predicts that gold demand in China will grow to 600

tonnes annually in coming years with the opening of gold investment

businesses from around 200 tonnes now.

"However, gold investment does not mean speculating in money. We must

make sure that we develop the gold investment market in China for the

purpose of providing the Chinese people with a safer means of keeping the

value of assets. For a healthy development of China's gold investment

market, we should weaken the awareness of speculation," Cheng said.

Paul Walker, chief executive officer of GFMS Ltd, the London-based

precious metals consultancy, yesterday said that world gold prices will

range between US$390 and US$455 per ounce during the second half of this

year.

World gold prices recently reached a 18-year record high of US$455 per

ounce mainly due to the weakening US dollar. "GFMS' base case prophesies a

slump in the dollar and surge in (gold) investment likely to continue,"

Walker said.

Gold trade volume in the Shanghai Gold Exchange rose by 39.53 per cent

year-on-year to 257.72 tonnes in the first 10 months of this year.

(China Daily) |