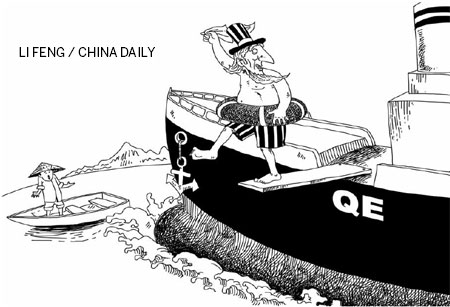

Prepare for exit-QE shockwaves

The three main economic issues discussed at the fifth Sino-US Strategic and Economic Dialogue in Washington last week were increasing bilateral trade, facilitating structural reforms and enhancing cooperation in financial markets. The most important financial issue for the world's two largest economies, however, is how to deal with the possible effects of the withdrawal of the US' quantitative easing (QE) policy.

The US economy is showing signs of stable recovery. In 2012, the housing market performed much better, with the Federal Home Loan Mortgage Corporation (Freddie Mac) making a profit of $10.98 billion, the first since 2006. The employment rate, too, has improved in the US.

Besides, the impact of QE on the US' economic recovery is waning and its ill-effects - creating a property bubble - is becoming more evident by the day. That's why the US might taper it off. But the tapering off of the QE policy could trigger huge capital flows and lead to another debt crisis - just like its introduction did - and the emerging market economies will be first to suffer its impact.