Economy and Trade

A 20-year rollercoaster ride

By Li Xiang (China Daily)

Updated: 2011-06-01 10:56

|

Large Medium Small |

|

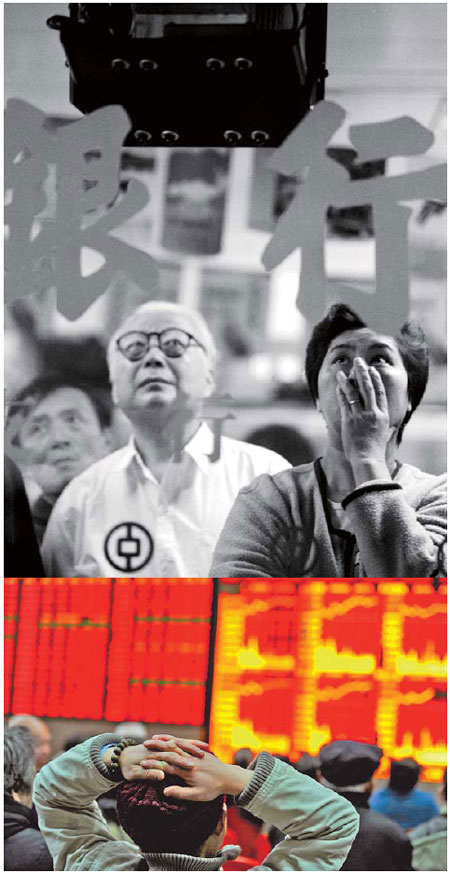

Top: Hong Kong investors watch the Hang Seng index during the Asian financial crisis on Aug 28, 1998, when the index dropped below the psychological level of 6600 points. Above: Investors look at the index screen at a stock brokerage in Shanghai on Jan 4, 2011. Top: Xu Jingxing / China Daily; Above: A Kai / for China Daily |

Jiang Zhikang's foray into China's fledgling stock market in the early 1990s was not only risky but required great patience. "I lined up at the small trading counter for a whole night in order to buy the stock subscription certificates,?Jiang, 62, says. "I thought that owning stocks may be better than just putting my money in a bank account.?

Jiang, who then worked for an oil company in Shanghai, says everyone had to take part in a lottery to buy a stock.

"I was lucky that I managed to get a total of 1,200 shares in a textile company at a price of 50 yuan a share."

Jiang, who was earning about 1,000 yuan a month then, spent almost his entire life savings to buy the shares.

It did not take long for the stock price to double and Jiang sold all of his stocks at about 200 yuan a share, pocketing a handsome profit.

The stock Jiang bought in 1992 is now trading at about only 6 yuan a share and the company faces the risk of delisting because it has been operating at a loss for years.

Like Jiang, the early stock investors in China were those with an adventurous spirit and who were willing to take risks.

In 1984, China saw the birth of its first stock with Shanghai Feilo Acoustics Co Ltd, an electronic equipment manufacturer, issuing 10,000 shares. For years, there were only a dozen stocks publicly trading in the market, with far more buyers than sellers.

The development of the stock market started to gather steam with the establishment of the Shanghai and Shenzhen stock exchanges in 1990 and 1991, which signaled China's resolve to develop its capital market.

Qi Jinhai was among the first group of brokers, nicknamed the "red vest", who witnessed the rapid expansion of stock exchanges and the ups and downs of the market.

"Whenever the stock index hit a fresh high, we would stamp our feet together on the wooden floor of the stock exchange," Qi says.

"There were very few brokerages, but many clients. It felt a bit privileged working as a broker because people would come to you and ask for favors.

"But the work was indeed stressful and we were often overloaded with orders."

The income of stock brokers soared from 1996, with the market entering a four-year bull run. By 2000, most of the brokers were earning 10 times more than public servants.

With the number of listed companies and investors steadily increasing, the stock market gradually transformed. The country's fast growing economy also created a growing middle class who discovered the thrills of stock trading.

But 2001 marked the beginning of a five-year slump, with the benchmark Shanghai Composite Index falling 55 percent from 2242 points to the historic low of 998. The slump was triggered mainly by the massive float of State-owned shares, which were previously non-tradable.

The Chinese stock market had also for years been plagued by a lack of transparency and the split equity ownership structure. Shares issued by a listed company were divided into State-owned, corporate and public shares. Only public shares, which accounted for about 30 percent of the total equity, could be publicly traded.

It was not until 2005 that China launched reforms to change its split equity ownership into fully floated share structures. It was the first time China's stock market began to meet international standards.

During the following three years, the A-share market experienced a rollercoaster ride, with the Shanghai index blasting through the 6000-point barrier in October 2007 and falling to 1664 points a year later.

The bursting of the bubble prompted the country's top securities regulator to temporarily suspend the approval of initial public offerings (IPOs) to control the supply of stocks.

Meanwhile, the volatile ride of the market was coupled with excessively high valuations of IPOs, which pushed stocks to even more irrational levels on debuts in the secondary market.

"The regulator should approve IPOs on a large scale in order to ease the situation where an IPO supply falls short of demand," says Wang Yawei, a fund manager at China Asset Management Co, the nation's biggest mutual fund company.

The securities regulator has vowed to rein in the high valuations of IPOs by adopting rules such as allowing underwriters to recommend selected institutional investors to reform the pricing mechanism and to make it more market-driven.

Last year, the Chinese stock market celebrated its 20th anniversary. The market has been transformed from small trading counters in the early 1990s to the world's second-largest market with a capitalization of 27.4 trillion yuan and 2,175 listed companies as of April 2011.

Shang Fulin, chairman of the China Securities Regulatory Commission, has said that China will continue to accelerate the development of a multi-layered market system.

In October 2009, China launched the Nasdaq-style board ChiNext in Shenzhen, which allows technology and innovation-driven start-up companies to raise funds in the capital market.

It will also soon take a major step forward to develop the over-the-counter (OTC) securities market this year to allow non-listed start-up companies to tap the capital market by expanding the OTC trading pilot program in Beijing's Zhongguancun Science Park to other major cities such as Shanghai and Tianjin.

More sophisticated investment instruments such as stock index futures and margin trading and short selling were introduced by the regulator last year, providing Chinese investors with the tools to short the market and hedge risks.

And China is expected to further open the capital market to foreign companies and institutional investors. Shanghai will soon set up an international board to allow foreign firms to float shares in the A-share market.

The board is part of China's plan to internationalize its currency by allowing foreign firms to issue stocks denominated in yuan and develop Shanghai into a global financial center.

HSBC Holdings Plc, Coca-Cola Co, General Electric Co and Wal-Mart Stores Inc may be among the first batch of foreign companies to seek listings on the Chinese market.

(China Daily 06/01/2011 page32)

| 分享按钮 |