|

|

A photo of Chinese 100 yuan banknotes [Photo/VCG] |

China's cross-border capital flows are expected to stabilize in the fourth quarter, and major capital flight is unlikely, because the country's economic fundamentals are strong, the nation's foreign exchange regulator said on Friday.

Chinese banks saw a net foreign exchange of $28.4 billion in September, up by $18.9 billion from August, according to the State Administration of Foreign Exchange. Net forex sales stood at $243.4 billion in the first three quarters.

Wang Chunying, spokeswoman for the administration, said seasonal factors play major roles.

"Residents have higher demand for foreign currency for travel during the summer vacation and National Day holiday," she said.

Net sales specifically for travel increased by $13.2 billion in the third quarter over the second quarter, she said, which is "relatively the same level of increase of the last few years". The level of cross-border flows is "understandable and bearable", she added.

Although some external factors - mainly the rising expectation of an interest rate hike by the United States Federal Reserve by year's end - would have a short-term impact, an increase would not lead to a major fluctuation in cross-border capital flows, Wang said.

Xu Gao, chief economist at China Everbright Securities Co, held similar views, saying current capital outflow pressure is manageable and actually lower than in December. He played down the possibility of massive capital outflows triggered by worries about the nation's economic resilience and the exchange rate of the yuan.

"Economic fundamentals remain strong," he said after official data released on Wednesday showed overall economic growth at 6.7 percent, with some signs of an uptick appearing in industrial sectors.

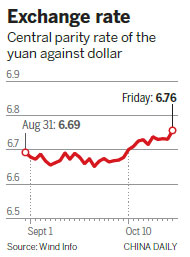

Xu said the recent depreciation of the yuan is natural in light of the recent strengthening of the US dollar, noting that the dollar index, which is the trade-weighted value of the dollar against a basket of major currencies, rose by 2.99 percent since the beginning of the month.

The People's Bank of China set the central parity rate at 6.7558 on Friday, hitting a six-year low.

Zhao Xueqing, an economist with the Institute of International Finance, said although the yuan is unlikely to strengthen in the near future, considering the headwinds and financial risks, the extent of yuan depreciation is manageable.

"Fluctuations in the yuan are quite natural, as the nation is on track with its market-oriented reforms," she said.