|

|

|

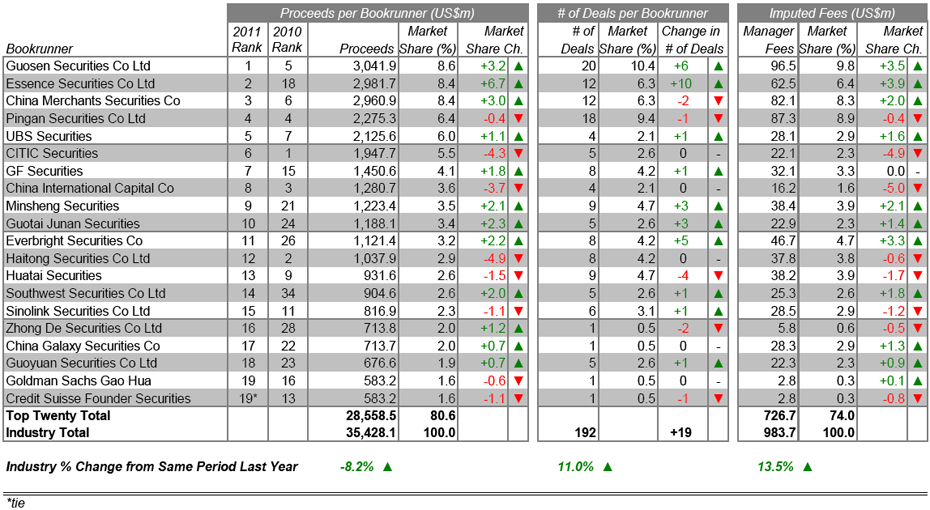

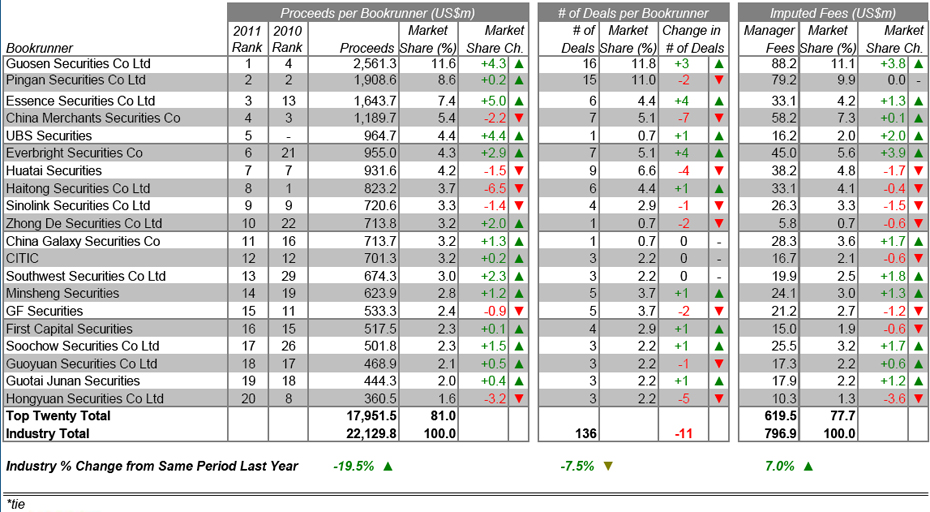

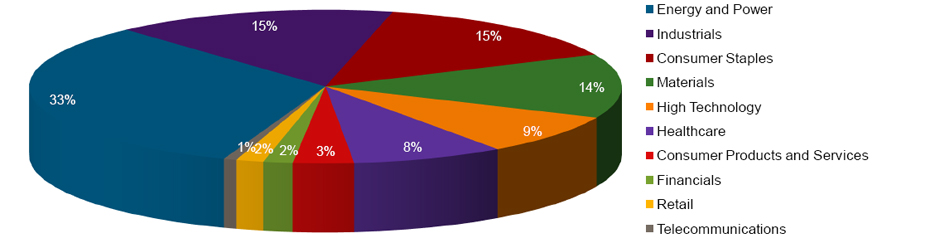

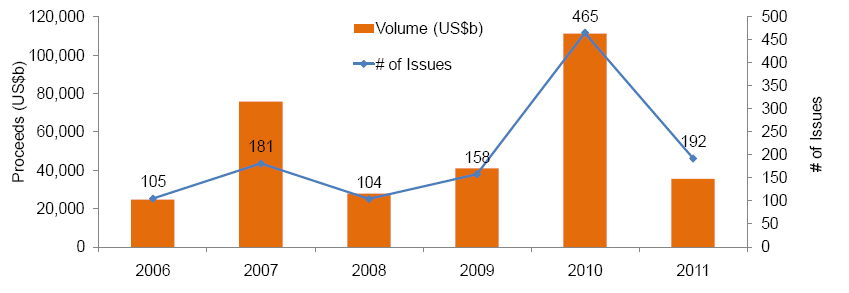

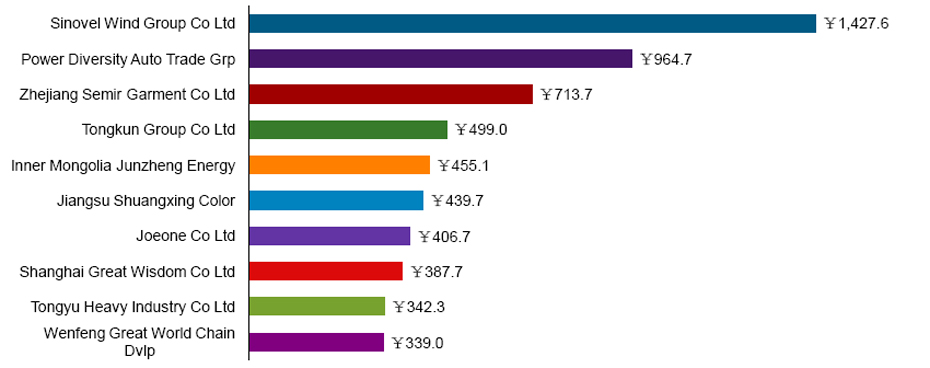

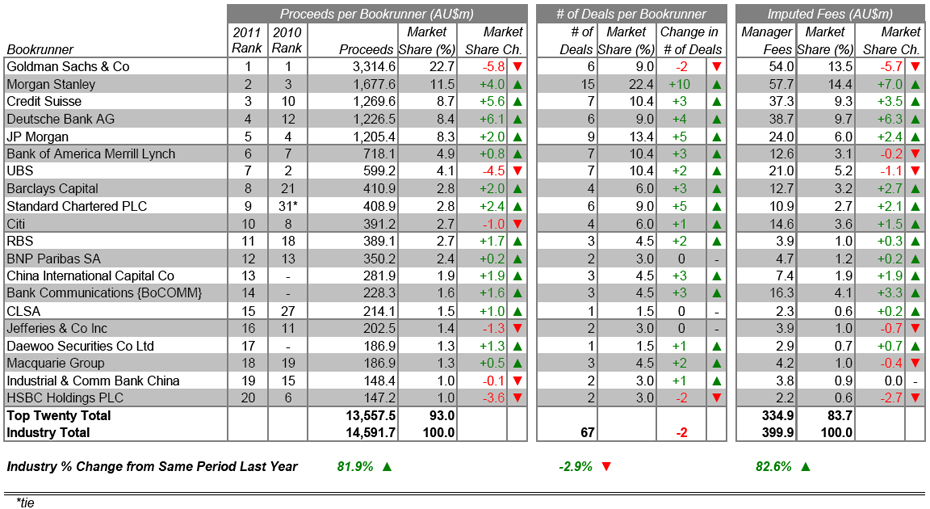

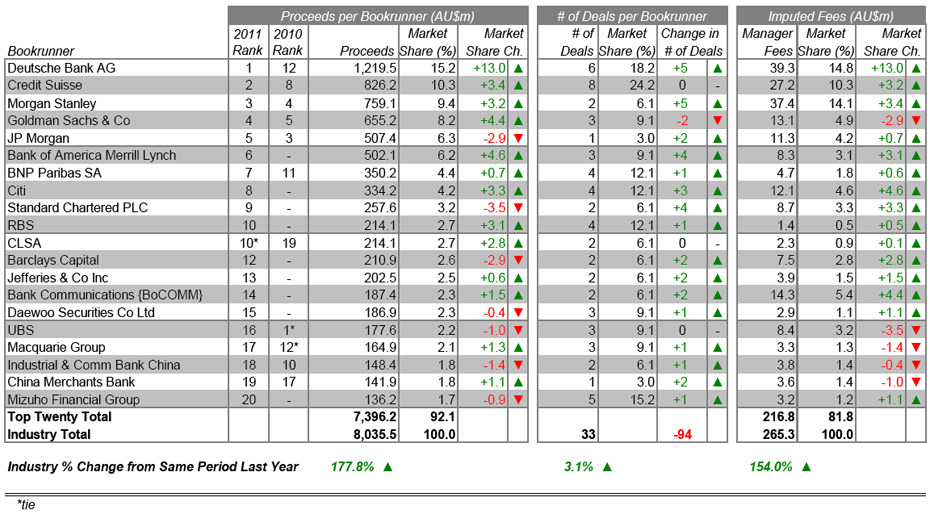

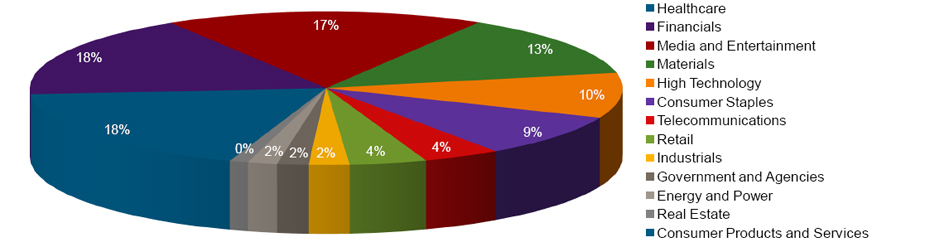

Editor's note: A total of 136 companies launched their initial public offerings (IPOs) on China's A-share market during the first five months of this year, according to statistics by Thomson Reuters. The IPOs raised a total of $22.13 billion, down 19.5 percent from the same period last year. The total underwriting of the top 20 book runners (lead underwriters) reached $17.95 billion, accounting for 81 percent of the total. Guosen Securities Co, Pingan Securities Co and Essence Securities Co ranked at the top of book runners for China's A-share IPOs in terms of funds raised. Guosen Securities raised $2.56 billion (11.6 percent of market share), Pingan Securities raised $1.91 billion (8.6 percent) and Essence Securities raised 1.64 billion (7.4 percent). China's total A-share equity and equity related financing reached $35.43 billion, down 8.2 percent from a year ago. The financing involved 192 deals, 19 more than last year. According to Thomson Reuters' rankings (in terms of funds raised), the No 1 book runner was Guosen Securities Co, responsible for raising $3.04 billion and accounting for 8.6 percent of the market share. Essence Securities climbed from No 18 in last year's ranking to No 2 this year with $29.82 billion in proceeds (8.4 percent of market share). China Merchants Securities was No 3 with $29.61 billion. Equity and equity related financing in the energy and power industries accounted for 33 percent of the total, more than any other industries. Consumer staples and high technology industries each accounted for 15 percent. Consumer products and services accounted for 14 percent. From Jan 1 to May 31, the three biggest IPOs in China's A-share market were Sinovel Wind Group Co, Power Diversity Auto Trade Group and Zhejiang Semir Garment Co. |

|

|