Companies

Minmetals to buy more assets

By Zhang Qi (China Daily)

Updated: 2011-03-02 10:04

|

Large Medium Small |

|

|

|

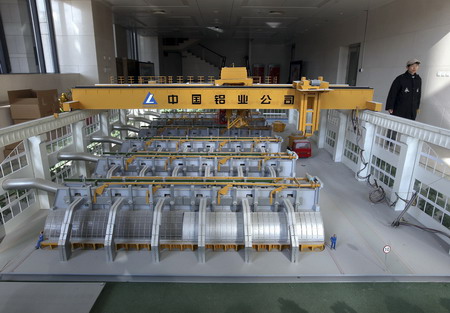

A model of an Aluminum Corp of China Ltd plant inside the company's headquarters in Beijing. [Photo / Bloomberg] |

BEIJING - China Minmetals Corp, one of the country's top mining companies, is planning to expand its ferrous resources tenfold during the next five years, to supply the rising demand for raw materials, a company executive said.

The Beijing-based company, which is also the country's largest metals trader, aims to acquire more mining resources to increase its proportion of upstream resources and to become a global mining conglomerate.

As one of the six major strategic business divisions of China Minmetals Corporation Limited (CMCL), Minmetals Mining Holdings Limited is a consolidated platform for ferrous resource development both in and outside China, said Zhang Ye, executive director of Minmetals Mining.

"We aim to multiply ferrous mining assets by tenfold during the next five years, with overseas mining assets accounting for more than 50 percent," Zhang said.

In December, Minmetals announced that it would inject its main assets into a new umbrella company, CMCL, to accelerate the pace of its corporate restructuring.

The move is regarded as preparation for a listing of the entire China Minmetals company. CMCL currently has six divisions: ferrous metals, non-ferrous metals, logistics, real estate, financing and a science and technology division.

Minmetals Mining also has two of the country's largest iron ore producers as subsidiaries; Minmetals Hanxing Mining (previously known as the Hanxing Metallurgical Mine Administration) and Minmetals Luzhong Mining, which was Luzhong Metallurgical Mining Group Corporation. The two companies hold iron ore reserves close to 1 billion tons.

|

||||

The establishment of Minmetals Mining Holdings Limited, in the ferrous sector, underlined the group's ambition to acquire overseas assets in ferrous resources.

Minmetals Holdings is looking for iron ore, chromium, manganese and coal, mainly in Australia, Canada, the Middle East and South Africa.

Zhou Zhongshu, president of Minmetals, said at the company's annual conference in January that the company would speed up the exploration of its iron ore project in Mauritania in west Africa and finish a feasibility study of a chromite mine in Townlands, South Africa.

Minmetals' peers, such as The Aluminum Corporation of China, or Chinalco, and Wuhan Iron & Steel Group, have been at the forefront in investment in a number of iron ore assets overseas as a means of reducing the country's reliance on expensive imports.

Chinalco and its partner, the Anglo-Australian miner Rio Tinto Plc, have agreed to jointly develop the Simandou iron ore project, in west Africa, with Rio Tinto. Wuhan Steel said it has iron ore reserves of 3 billion tons across the world.

Luo Bingsheng, former vice-chairman and current special consultant to the steel lobby, the China Iron & Steel Association, said the country has an annual 150 million tons of iron ore resources in overseas countries.

He urged steelmakers to seek 40 percent of iron ore imports from Chinese-invested resources by 2015.

| 分享按钮 |