Economy

All roads lead to China

By Ding Qingfen (China Daily)

Updated: 2010-09-07 09:27

|

Large Medium Small |

|

|

|

President of Brazilian firm Kasinski, Claudio Rosa, poses for pictures in Rio de Janeiro. Chinese firm Zongshen Power Machinery spent $80 million last year to take over Kasinski and produce 90,000 motorbikes a year in Manaus, Brazil. More and more foreign companies are now looking to set up joint ventures in China. Sergio Moraes / Reuters |

XIAMEN, Fujian - China will continue to be an attractive destination for foreign investors and gain significantly from the overall improvement in the investment climate, a report released by the United Nations Conference on Trade and Development (UNCTAD) said on Monday.

Analysts said the UN report clearly indicates that the nation's economic fundamentals and investment policies are on the right track. Complaints by multinational companies of the investment environment becoming hostile no longer hold water, they said.

Labor competitiveness and rising domestic consumption are the mainstay of foreign direct investment (FDI) and that is what will continue to propel investments from abroad, they said.

Global FDI flows have started to recover from this year and the growth will gain momentum during the 2011-12 period, said the 2010 World Investment Prospects Survey (WIPS).

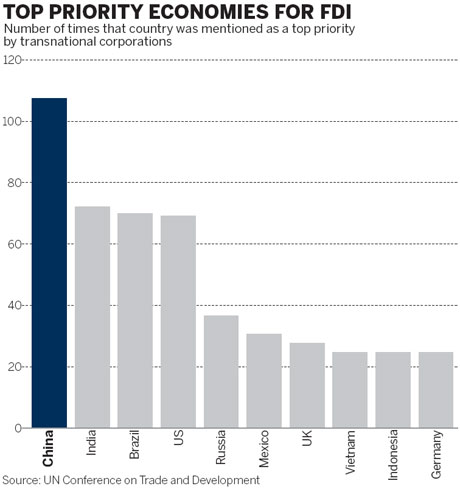

Global recovery is driven by the surging FDI flows into developing and transitional economies. China is one of the top destinations for FDI from 2010 to 2012, said the survey.

"China is leading the process of FDI recovery, and the nation's FDI growth has outpaced other countries," said James Zhan, director of the Division on Investment and Enterprises under UNCTAD.

The WIPS is considered to be one of the most reputed surveys on global FDI prospects and was first launched by the UNCTAD in 1995.

China has been selected as the most attractive destination worldwide for several years, and is also the second-largest FDI recipient after the United States.

Last year, China's FDI fell by just 2.6 percent from a year earlier, while global FDI declined nearly 40 percent. During the first seven months of this year, the nation's FDI rose 20.7 percent year-on-year to $58.35 billion. Ministry of Commerce officials are of the opinion that FDI in China will reach $100 billion this year.

Wang Zhile, director of the Research Center on Transnational Corporations under the ministry, said China scores over its peers in several aspects. Though labor costs are rising, the quality of labor has also risen. Domestic consumption capacity is set to gallop on the back of the recent government stimulus measures, he said.

On Monday, ministry officials said at the China Import Forum that domestic consumption this year could be around $2 trillion, due to the huge population and other measures to stimulate imports.

"There is no reason why UNCTAD should prioritize China, if it believes that the investment environment is not good enough," Wang said.

More optimism

The 2010 WIPS said global FDI prospects are rebounding after a torrid time last year. The recovery has started and is expected to go from strength to strength in the next two years, it said.

|

|||||||

Though the global FDI levels have fallen, the amount of investment flowing into developing nations and transitional economies has been increasing.

Nine of the top 15 priority FDI destinations till 2012 are from these regions, with BRIC nations - Brazil, Russia, India and China - occupying four of the top five slots.

The WIPS findings are based on interviews with 236 international companies and 116 investment promotion agencies.

In its earlier World Investment Report 2010, UNCTAD had predicted global FDI flows would reach $1.3-$1.5 trillion in 2011 and $1.6-$2 trillion in 2012, up from an estimated $1.2 trillion in 2010. Rebounding cross-border mergers and acquisitions will be a major driver of this growth, it said.