Economy

Trade surplus plunges, easing pressure on yuan

By Ding Qingfen (China Daily)

Updated: 2010-05-11 07:00

|

Large Medium Small |

Exports 'to gear up in 2nd half'

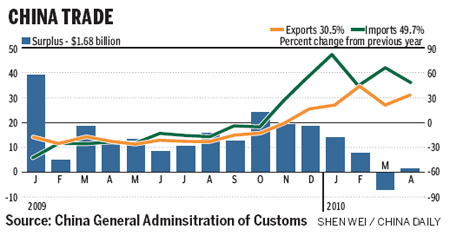

BEIJING - China's trade surplus nosedived 87 percent from a year earlier to $1.68 billion in April, a drop analysts said will ease the pressure on revaluation of the yuan.

Exports surged 31 percent to $119.9 billion while imports soared 50 percent to $118.2 billion. Total trade volume grew 39 percent to $238.2 billion.

The trade surplus will continue to narrow in the months ahead due to weak overseas demand, analysts predicted.

"We are highly likely to see trade deficits for May and June because domestic demand will stimulate import growth while global uncertainties, such as the Europe debt crisis, will weaken overseas demand," said Liu Wei, president of the School of Economics at Peking University.

The trend is "good for the stability of China's foreign exchange policy in the short term and will alleviate the pressure to appreciate the yuan", he added.

The Ministry of Commerce said recently that the foreign trade picture will not be very rosy this year because of rising raw material costs, mounting trade protectionism and a grim outlook for global markets.

Yan Jinny, economist at Standard Chartered Shanghai, said the sovereign-debt crisis in Europe, where one-fifth of Chinese exports go, helped ease the pressure on the yuan.

"If not for the Greek fallout, China would have been under bigger pressure," Yan said.

But the pressure will mount after Chinese exports turn robust later this year, analysts said. Exports will see a rebound but import growth will sag when demand for commodities and infrastructure materials decreases in the third quarter, Yan said.

Dong Xian'an, chief economist at Industrial Securities, said the Greek debt crisis is not likely to spread to the whole continent and EU demand for Chinese goods will perk up in the second half.

That will be the time for China to appreciate its currency, which the United States and some other countries believe is undervalued, both Yan and Dong said.

Later this month, the value of the yuan will be at the top of agenda at the second round of the Strategic and Economic Dialogue between China and the US to be held in Beijing.

Chinese leaders have repeatedly asserted that the nation will not bow to foreign pressure.

Chinese exporters are now focusing more on the domestic market to avoid being hit by the appreciation.

"If the yuan rises 3 percent, we would reap no profit," said Zheng Rixiao, general manager of Yawin Mechanical and Electrical Equipment Import and Export, an exporter based in Fujian province.

However, currency appreciation "is a matter of time, so we have shifted focus to creating high value-added products", he said.