|

BIZCHINA> Center

|

|

Related

Foreign operators ready to ride China's 3G wave

By Wang Xing (China Daily)

Updated: 2008-10-23 11:37 With the restructuring of China's telecom industry gearing up, foreign operators are pulling out all stops to seal local partnerships and position themselves for the 3G (third generation) era of the world's largest telecom market. "China's telecom restructuring gives us an opportunity to bring our mobile business to the country, as our domestic partners can get access to the wireless market after the restructuring," said Wang Chao, vice-president of Orange Business Service (OBS), a business service subsidiary under France Telecom. "After the restructuring, we hope to enter China's domestic service market by establishing strategic joint ventures with Chinese companies."

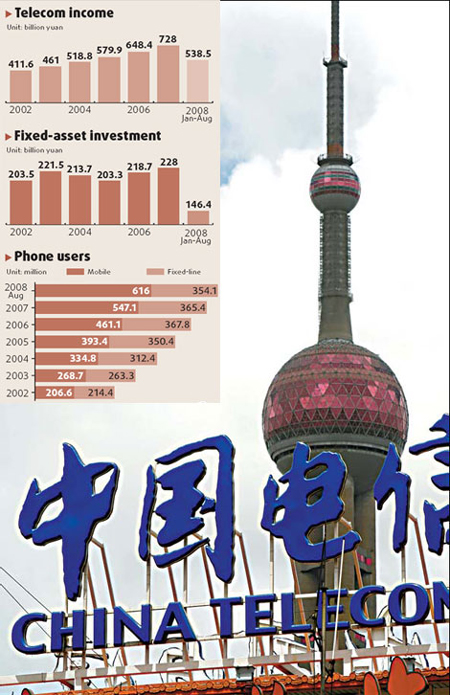

Entering the Chinese market in 2001 by partnering with Chinese fixed-line operator China Netcom, OBS has established a significant presence in the country's telecom market. But the company's business has long been limited by regulatory restrictions and most of their customers in China were restricted to multinational companies. Wang said OBS plans to attract more domestic customers as the country's telecom restructuring completes. "We plan to boost our revenue from local customers to account for half of our total revenue in the next three years", he said, noting that the company will increase its employees in the country by 20 percent by the end of this year. Many foreign telecom operators have the same idea. Telefonica, Europe's second-largest phone company, announced last month it would pay as much as 1.1 billion euros to boost its stake in China Netcom, the country's fixed line carrier that will be merged with China Unicom, the country's second largest mobile phone carrier. South Korean telecom operator SK telecom, which held 6.61 percent of China Unicom's total equity before the telecom industry reorganization, also said it is seeking suitable opportunities to raise its stake in the company. "China's telecom restructuring creates a great opportunity for us," says Lily Zhang, China head of Pacnet, the Asia telecoms service provider formed by a merger of Asia Netcom and Pacific Internet earlier this year. "We plan to enter some of the local telecom services in the near future as we have already gained government licenses," added Zhang, whose company established a joint venture with Chinese Internet service provider Zhong Ren Telecom in July in order to expand its business in China. As if to reward these moves, the Chinese government announced on Sept 12 it would relax access to its telecom industry for foreign investors -by cutting minimum required investments by as much as 50 percent. Wang Yuquan, a senior consultant from research firm Frost & Sullivan China, said the government's deregulation may trigger a foreign investment boom in the Chinese telecom sector. "China has nearly completed its telecom restructuring and most of the Chinese telecom operators need huge investment to upgrade their existing networks after the restructuring," Wang said. China launched its long-awaited telecom restructuring in May, in which the country's current six telecom operators will be merged into three firms, offering both mobile and fixed line services. The Chinese government promised to issue 3G licenses after the restructuring, which was due by the end of the year. The proposed restructuring and 3G licensing are expected to create a huge thirst for capital among Chinese telecom operators who are actively expanding and upgrading their existing networks in order to gain a favorable position in the country's upcoming 3G environment. China Unicom, for example, announced in August it would invest 100 billion yuan from 2009 to 2010 in 3G-related networks and services. China Telecom also said it will invest 80 billion yuan to expand and upgrade its CDMA network. However, Wang Yuquan said that, although the government reduced the foreign investment cap by 50 percent, it does not mean that the country has loosened its control over its telecom industry. "Many foreign operators' moves to increase their stakes in Chinese operators are due to their desire to have controlling rights to run the basic telecom business in China," he said. "But they will never achieve their goals as the Chinese government, like thsoe in most other countries, will not allow a foreign company to have the major stake in its domestic telecom business." According to figures from the Ministry of Industry and Information Technology, the number of mobile phone users in China reached 608.4 million by the end of July, an increase of 10 percent over the end of last year. The country's telecom market turnover also increased 9.1 percent to 467.8 billion yuan by July. (For more biz stories, please visit Industries)

|