Companies

Wenzhou firms seek new wealth ways

By Yu Ran (China Daily)

Updated: 2011-05-04 15:05

|

Large Medium Small |

Calling it quits

There is no juggling of interests for Zheng Bangguo. After three years of making industrial valves, he became one of the first manufacturers to give up his enterprise for full-time real estate investment. That was 18 years ago, and he has since retired from seeking new investments.

"Since I found it harder and harder to make money from manufacturing . . . I decided to shut the factory down and invest all my savings of 2 million yuan in the real estate market in 1993." That was when property opened up for investment, and Zheng saw it as a big chance to make money in a short time.

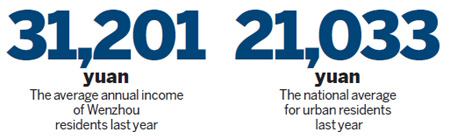

He said profits from his manufacturing operation topped out at 5 percent, but the return on his real estate investments in his first three years was more than 50 percent. "I concentrated on residential block investments in Wenzhou, where the price per square meter has risen from 6,000 yuan to 50,000 yuan."

Figures from a local real estate agent show that the average overall deal price in the final quarter last year was about 28,000 yuan per square meter, highest in the nation.

Zheng said he quit that endeavor last year because he is 61 now and not as willing to handle high risks.

Going underground

Financial experts in Wenzhou said underground banks have been raising their interest rates to attract new money to fund their increased lending activities. It was widely reported that some gray market profits were used in hoarding pork, maize and garlic, causing shortages and staggering price fluctuations.

Gray-market lenders are particularly active in Wenzhou. The most recent figures available from the Wenzhou branch of People's Bank of China, from last year's second quarter, showed that 89 percent of families or individuals and nearly 57 percent of enterprises had either borrowed from or made deposits to non-bank finance companies.

Despite the lack of legal standing to enforce repayments, underground banks hire debt collectors to claim loans from debtors in arrears, generally by visiting the debtor's apartment daily until the money is repaid, Zheng said. "These debt collectors use methods that can be most persuasive."

Private capital

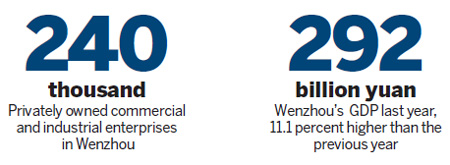

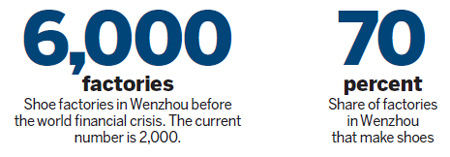

Zheng's shift away from manufacturing reflects a common situation affecting China's private capital. Due to pressures from escalating labor costs, inflation and excess cash, manufacturers are looking for other ways to earn, spend and increase their money. In 2009, more than one-third of private capital in China was invested in real estate.

"Private businesses in Zhejiang now allocate their money this way: one-third for manufacturing, one-third for real estate and one-third for financial investment," said Zhou Dewen, chairman of the Wenzhou Council for Promotion of Small and Medium-Sized Enterprises.

The profit margin in real estate has been running at 30 percent or more. Financial investment also generates handsome returns. By contrast, profits from manufacturing have been squeezed paper-thin.

"It is not surprising at all that private businesses are shifting from manufacturing, because capital chases profits in nature," Zhou said.

The Wenzhou administration for industry and commerce reports that more than 300 registered companies are listed as financial services companies, private loan agencies and the like, with up to 150 billion yuan invested in medical equipment, tourism, consulting and guarantee agencies.

| 分享按钮 |