Daryl Guppy

Finding a silver lining in futures

By Daryl Guppy (China Daily)

Updated: 2011-02-21 13:43

|

Large Medium Small |

Cheaper precious metal outshines its yellow rival with prices rising 72% in six months

Silver tarnishes but gold never loses its luster. This is a factor for investors who have physical holdings of these commodities but investors in silver markets find that silver can outshine gold.

Silver tarnishes but gold never loses its luster. This is a factor for investors who have physical holdings of these commodities but investors in silver markets find that silver can outshine gold.

Between July 2010 and January 2011 the COMEX gold price for a Troy ounce rose by 22 percent. The rise started near $1,160 and peaked around $1,420. Between July 2010 and January 2011 the COMEX silver futures price for a Troy ounce lifted by 72 percent from $18 to $31. Silver outperformed gold by more than three times. Silver has played second fiddle to gold for most investors, but this inattention has meant they miss out on substantial profits.

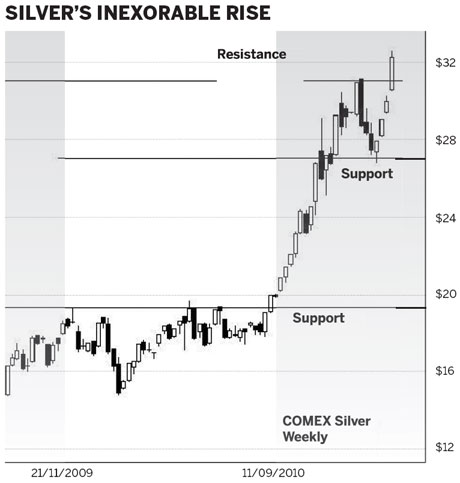

The trend behavior of the silver market is different from the trend in the gold price. The silver market was dominated by a strong historical resistance level near $19.

This capped the trend rise starting in October 2008. Silver first encountered this resistance level in December 2009 and then tested the level several times in 2010 before developing a breakout in July 2010.

The rise from $19 to $31 was a smooth continuous trend that carried the price into blue sky territory. Blue sky describes the situation where the price is making new all time highs. Investors cannot use historical price activity to establish support and resistance levels, or new profit targets.

The retreat from the peak found support near $27. This was also a small consolidation area in the trend in November 2010. The current price rebound from $27 has resistance near $31, based on the previous peak high. This price activity is developing a consolidation band and this chart pattern provides a method for projecting future price targets.

The width of the consolidation band is measured, and this value is projected upward. This gives a potential target near $35. This is a rise of 16 percent from current values. This acceleration of breakout activity and the better rate of return is attracting investors who want better returns. This leverage effect is increased by trading in silver mines and silver producers.

Historically the demand for silver has been driven to a significant extent by the growth of the photography industry. Photographic film has been replaced with digital images leading to the collapse of traditional film suppliers. This destruction of silver demand has not acted as a brake on the recent upward trend developments.

This disconnection between any obvious changes in physical demand for silver and the price of silver points the way to a speculative bubble. This suggests that silver is a useful trading instrument, but it is unwise to look on it as a long-term commodity investment.

| ||||

The pattern may develop into a broadening top, or a megaphone pattern. This is where the range of volatility increases with repeated rally, retreat and rebound behavior.

This pattern of behavior is different from the trend behavior in the gold price. Gold developed a triple top near $1,420. This resistance level was tested in November and December, and again in January. Silver does not have this resistance behavior.

Gold developed a pull-back retreat to $1,320. This was a minor support area. Using the same method of consolidation-band calculation, a gold breakout above $1,420 has an upside target near $1,520. This is a 10 percent rise from current values. Gold has a much stronger resistance barrier near $1,420 with the triple top pattern. This makes it more difficult for gold to move to the breakout target.

The resistance near $31 on the silver chart is a single point. This makes it much easier for the price of silver to break above $31 and achieve the projected upside target. In this market condition silver will continue to outshine gold.

The author is a well-known international financial technical analysis expert.

| 分享按钮 |