Opinion

Realty trouble in the offing

By Zheng Yongnian (China Daily)

Updated: 2010-07-24 14:32

|

Large Medium Small |

If housing prices are not checked and land issues not resolved they could threaten social stability and the national economy

Housing prices in major Chinese cities apparently increased at a slower pace in June thanks to the central government's strenuous efforts since March to cool the overheated property market. Some government departments have said the slower price rise shows the policies to rein in the property market are working.

But China's realty problems, accumulated over the years, cannot be solved in a short period. In fact, under the false appearance of "initial success" an even greater crisis is brewing, which will not only have complex implications for the national economy, but also be of far-reaching political and social significance.

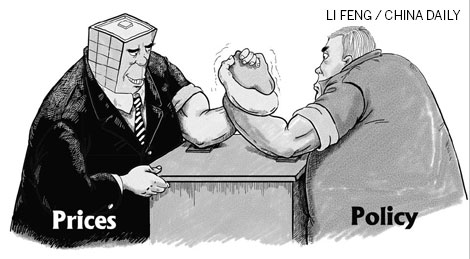

The "seesaw battle" between the central government and various vested interest groups reflect the nation is suffering from "real estate disease".

After seeing how difficult it is to implement tougher property policies, the public has realized that the vested interest groups have become powerful enough to resist or tamper with the central government's property-control policies.

Speculators, banks and property developers all are gambling with the prospect of rising housing prices. By putting off the sale of new houses, prices have been controlled for now, while rentals have increased unexpectedly in recent months. But in many cities, such as Shanghai, Hangzhou, Shenzhen and Nanjing, banks never stopped providing loans to people buying a third house.

The real estate industry, which accounted for only a small part of China's GDP in the 1990s, has become a pillar industry in just a few years because of the machinations of vested interests.

From the economic structure's point of view, real estate is a basic industry because it involves so many upstream and downstream sectors, and the construction boom did contribute immensely to China's recovery from the global economic crisis.

So, a downturn in the housing market will not only hurt related industries, but also drain local revenues, which depend heavily on land transfer fees and the real estate.

In essence, similar to the financial industry in the United States, China's real estate sector is "too big to collapse". Therefore, it would not be an exaggeration to say that the real estate sector has hijacked the Chinese economy.

The vested interest groups actually are using all the skills at their disposal to increase housing prices. The higher the prices, the more profit property developers, banks and investors (speculators) make and the more revenue local governments can collect.

Driven by this interest chain, the housing market bubble is getting bigger and bigger. But the value of no property can rise infinitely, especially in China.

The country's real estate market has deviated from the state of "a balance between supply and demand" in the economic sense. On one hand, a large number of commercial houses are lying unoccupied. On the other, prices in major cities are making property increasingly unaffordable for the majority of the population.

The skyrocketing housing prices are the outcome of artificial speculation. Real estate is essentially a kind of social product and depends on purchases and accommodation of the majority of the population. Once speculators start dictating terms in the housing market, the property industry cannot maintain sustainable development.

Amid the recent calls for strengthening control over the housing market, some local governments proposed property taxes. But their aim is not to cool down the realty market but to collect more revenue.

Seeing an imminent end to land-based revenue, local governments have realized the need to open up new sources of revenue. Many analysts have already said local governments will play a leading role in introducing new or higher taxes on property.

|

||||

Though the real estate industry can bring huge profits for some groups in a short time, it has become a big hurdle on the road to sustainable economic development and rising housing prices have become the main cause of public dissatisfaction. The bloated real estate sector is destroying the base on which society could develop because Chinese, in general, believe "dwellers should hold the dwellings".

More importantly, the real estate bubble, if not defused in time, may become a political crisis. In the short run, more and more people won't be able to afford a house or even rent a room. In the long run, it could sharpen social conflicts and lead to social unrests.

A deformed growth of the real estate industry will squeeze the space for maneuverability and development of other sectors. As a result, the government's tax base will shrink. And once faced with a fiscal crisis, the government will make every effort to milk the people.

The possibility of social instability is becoming real as the housing and related land issues worsen by the day.

The author is professor and director of East Asian Institute, National University of Singapore.

China Forum