|

BIZCHINA> Top Biz News

|

|

Property developers trigger decline in shares

(China Daily/Agencies)

Updated: 2009-07-08 07:59

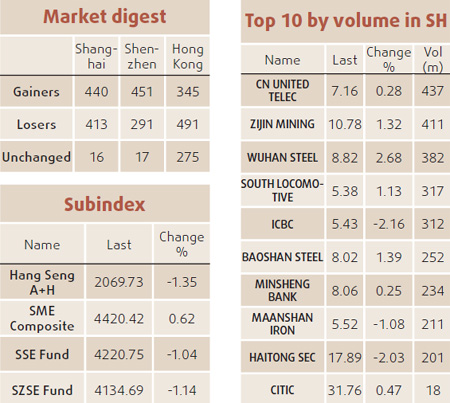

China's benchmark stock index fell for the first time in five days, led by developers, on concern regulators will tighten mortgage lending to cool housing prices. "Both property stocks and housing prices are high-flying now, which will easily lead to some concern about the government's crackdown," said Wu Kan, a Shanghai-based fund manager at Dazhong Insurance Co, which manages about $285 million. "The market is now turning cautious towards property stocks from being optimistic." The Shanghai Composite Index dropped 35.22, or 1.1 percent, to 3089.45 at the close. The CSI 300 Index lost 1 percent to 3340.49. Poly Real Estate, China's second-largest developer by market value, dropped 3.2 percent to 28.7 yuan ($4.20), extending Monday's 2.8 percent decline. Gemdale, the country's fourth-largest developer by market value, fell 3 percent to 17.74 yuan. China Vanke Co, the No 1 and listed in Shenzhen, slid 2.5 percent to 14.09 yuan. The China Se Shang Property Index of 24 real-estate companies slipped 3.4 percent, paring its annual gain to 151 percent.

Baoshan Iron & Steel Co gained 1.4 percent to 8.02 yuan after the spot price for the metal jumped the most in three months on Monday. Wuhan Iron & Steel Co added 2.7 percent to 8.82 yuan. The average price of China's domestic hot-rolled steel sheet rose 2.9 percent to 3,825 yuan a metric ton on Monday, the most since April 2, according to Beijing Antaike Information Development Co. Hang Seng declines Hong Kong stocks fell, dragging the benchmark index to a two-week low, led by mainland developers. China Overseas Land & Investment Ltd, a developer controlled by the country's construction ministry, slid 2.3 percent while Shui On Land Ltd declined 6.7 percent. Bank of Communications Co led mainland banks lower, shedding 1.5 percent, after the nation's banking regulator said rapid credit growth poses a risk to lenders. The Hang Seng Index slid 0.7 percent to 17862.27, its lowest close since June 23. The gauge climbed as much as 1 percent in the morning session. The Hang Seng China Enterprises Index lost 1.4 percent to 10674.67.

(For more biz stories, please visit Industries)

|

|||||