|

BIZCHINA> Top Biz News

|

|

Steel firms to talk mergers

By Yu Liang (China Daily)

Updated: 2009-02-20 08:01 Major State-owned steelmakers, such as Baosteel, Angang Steel and Wuhan Iron and Steel Group, are expected to take the lead in industry consolidation this year. Shanghai Securities News said the government would take new measures to encourage restructuring in the steel industry citing details of a stimulus plan for the sector.  The stimulus plan, which was approved by the State Council, or the Cabinet, in January, said the government would encourage restructuring of steel makers, without providing any details. The newspaper said the government expects to foster several globally competitive large steel groups, each with a production capacity of 50 million tons per year.

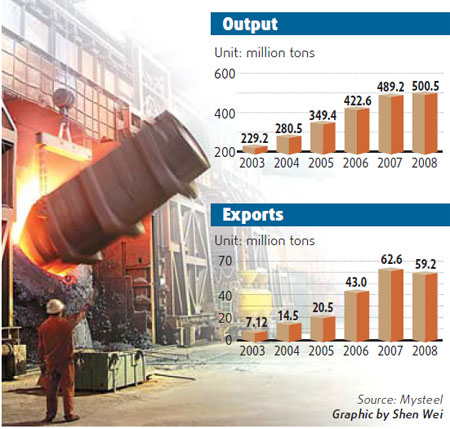

Government institutions, including the Ministry of Industry and Information Technology, the National Development and Reform Commission and the Ministry of Finance, are working on measures to support the move. China's steel industry has been in the red since last October when demand in both domestic and overseas markets decreased and mills suffered from high iron ore prices. According to the China Iron & Steel Association, 62 percent of the 71 large and medium-sized steel producers had losses that totaled to 29.1 billion yuan in December 2008. The stimulus plan by the central government aims to help steel producers overcome the impact of the global financial crisis. Meanwhile, a Reuters report said the country will also limit its crude steel output from 2011 to 500 million tons a year. The figure roughly equals the output of last year's. China had over 100 million tons in surplus capacity in 2008. The plan would also require 40 percent of steelmaking capacity to be located in coastal areas, up from 35 percent now, but the government would put a mechanism in place to help companies assist those losing their jobs, it said. That move could put more steelmakers in the most economically developed areas of China and within reach of imported iron ore, coking coal and other materials.

(For more biz stories, please visit Industries)

|

|||||