|

BIZCHINA> Industries

|

|

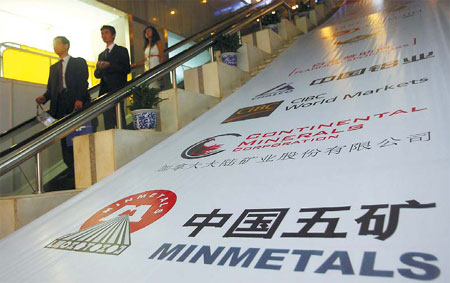

Energy: Minmetals to buy OZ Minerals

By Jiang Wei (China Daily)

Updated: 2009-02-17 08:09 Metal trader China Minmetals Corp is planning to buy Australian mining firm OZ Minerals Ltd for A$2.6 billion ($1.7 billion) in cash to ensure adequate supplies of non-ferrous metals.

The deal, scheduled for completion in June, is, however, subject to approval by Oz Minerals' shareholders and respective governments.

The offer has been recommended by the board of OZ Minerals, which is also the world's second-largest zinc miner. The acquisition of the Australian company, which owns copper, lead, zinc, gold and silver mines, is expected to help the Chinese company secure its supply of resources, said Jiao Jian, a senior Minmetals official. The Melbourne-based OZ Minerals operates the Century and Rosebery zinc and lead mines in Australia, the Sepon copper and gold project in Laos and the Golden Grove copper, gold and zinc project in Western Australia. It also owns the Prominent Hill copper and gold mine in South Australia and the Avebury nickel mine in Tasmania. The deal is expected to come as a boon to the debt-laden OZ Minerals. Its market valuation has decreased by A$6 billion since it was formed last July and is seeking to refinance A$1.2 billion of debt by Feb 27. "OZ Minerals has been working with its financiers and progressing on various funding options to repay debt and maximize value for shareholders while providing greater certainty to employees and suppliers," Chief Executive Officer Andrew Michelmore said in the statement. "This offer can resolve investor uncertainty." The company's shareholder meeting in May is expected to decide whether the deal would go ahead or not. Minmetals' decision to bail out a troubled Australian miner comes close on the heels of Aluminum Corp of China's decision to invest $19.5 billion in Rio Tinto Group. The company's sales revenue rose 28 percent year-on-year to $27.7 billion in 2008. The deal is also subject to approvals from Australia's Foreign Investment Review Board and Department and China's National Development and Reform Commission, the Ministry of Commerce, the State Administration of Foreign Exchange and the State-owned Assets Supervision and Administration Commission. OZ Minerals is being advised by Caliburn Partnership and Goldman Sachs JBWere. Minmetals is being advised by UBS Investment Bank. (For more biz stories, please visit Industries)

|

|||||