|

BIZCHINA> Top Biz News

|

|

Related

Power producers looking at losses

By Si Tingting (China Daily)

Updated: 2008-12-15 08:08

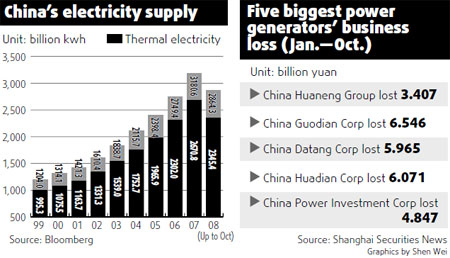

China's thermal power producers, which expected to lose more than $10.2 billion this year, may face an even tougher 2009 because of slower growth in electricity demand, industry officials warned.

The world's second-largest energy consumer may use only 3 percent more electricity next year as the economy cools, compared with a double-digit growth rate annually over past years, says Pan Ersheng, a researcher with the State Grid Corporation of China.

China's economy expanded at the slowest pace since 2008 in the third quarter as export orders shrank and industrial production waned. China's exports went down by 2.2 percent in November from the same period last year, according a report released by the General Administration of Customs last Wednesday. It was the first time since June 2001 when China's monthly exports were down by 0.6 percent from a year earlier," said the report. Figures from China Electricity Council shows that 37 percent of the country's electricity demand are from four coastal provinces and a municipality, namely Shandong, Jiangsu, Zhejiang and Guangdong provinces and Shanghai, all of which are the country's biggest exporters. The Chinese government unveiled a 4-trilion-yuan stimulus plan to spur the economy as the world slowed down into a recession. However, the stimulus plan will not put an immediate stop to the power generators' losses. "The stimulus package may take some time to show effect in boosting power consumption and the recent financial crisis may have an extended impact," Pan says. China's power demand may rise by 5 percent under the most optimistic scenario, according to Pan. China's power generation fell by 4 percent to 264.5 billion kilowatt-hours in October, the first decline in more than three years, as a slowdown in the world's fourth-largest economy erodes demand, according to the National Bureau of Statistics. One comparative example was China's power market during the 1997-1998 Asia financial crisis, according to Pan: the country's electricity demand rose by merely 0.9 percent in the first six months of 1998 even though the government pledged an infrastructure spending of 2.4 trillion yuan to boost the economy at the time. The power demand growth recovered to 4.5 percent for the second half of 1998 and it took the power industry two years to fully recover. "We are facing a similar situation now, and must get fully prepared for 2009," Pan says. The nation's five biggest power companies including China Huaneng Group and China Datang Corp. posted a loss of 26.8 billion yuan in the first ten months this year because of higher coal costs, a company official says. "The five power companies may risk losing all the profits they have earned since their establishment in 2002," Zhu Ning, an engineer with the China International Engineering Consulting Corporation, says. Datang International Power Generation Co., the Hong Kong-listed unit of China's second-biggest power producer, said in October it posted a loss of 432.9 million between July and September due to higher coal prices. Its parent China Datang Corp. may miss its full-year output target because of slowing demand and delays in expansions, the company said on October 24. In addition to demand, coal prices are another factor that will have a direct impact on the power companies. China's power producers rely on both the term contracts and spot markets for their supplies of coal. Spot coal prices reached a record 1,030 yuan a ton at the Qinhuangdao port, China's largest coal port, in July. To help narrow generators' losses and ease China's power shortages, the government raised the price of electricity sold to grid operators by 6 percent starting August 20, the second tariff increase this year. However, the adjustment was not enough to offset rising coal costs. Until now, spot coal prices at the Qinghuangdao port have fallen more than 40 percent, but that still cannot ease power producers' burden. "Prices of the fuel on the spot market may fall to some extend next year, but it won't be enough to offset pressure posed by weaker demand for generators", says Hao Xiangbin, a director at the China Transport and Distribution Association. The contractual prices of coal, however, still have room to increase because they are still lower than the spot level, Hao says. Some coal producers may cut output in order to reverse a decline in prices, Hao says. Some provinces are cutting power prices, instead of raising them, in order to help some industrial users, but industry experts warned this "short-sighted" act may be "suicidal" for the local economy in the long run. The Inner Mongolia autonomous region said last month it will reduce electricity tariffs for some ferrous-metal and metallurgical makers by as much as 0.8 yuan a kilowatt-hour. The move will mean heavier pressures for power producers and is not sustainable, China International Engineering's Zhu says. "In Inner Mongolia, where pollution is already severe enough, the cheaper power for polluting factories will worsen such a situation and will not help the local economy over the long term," Zhu says. "None of our power producers, distributors nor coal miners are willing to see the reduced power prices."

(For more biz stories, please visit Industries)

|