Subprime crisis exposure wakes up risk control

By Mao Lijun (China Daily)

Updated: 2008-03-17 11:44

Updated: 2008-03-17 11:44

Upgrade risk management

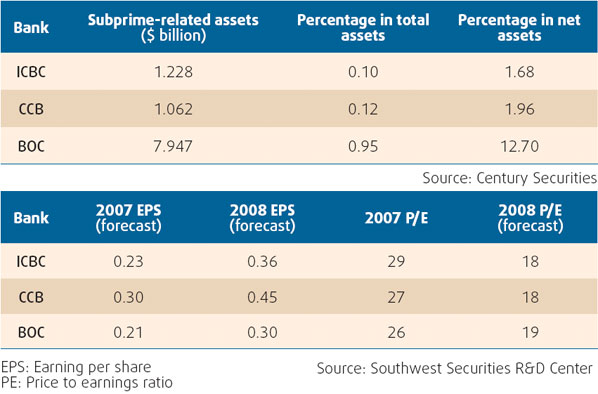

Although the three banks will remain largely unaffected by the US subprime crisis, it's a warning for China's banks to upgrade their market risk controls and crisis management techniques, economists say.

Lewis Alexander, the Global Chief Economist of Citigroup says he agrees with Chinese economists and analysts that the subprime crisis is not a big concern for Chinese banks.

But he says a combination of the slowing economies of US and Europe, a tightening monetary environment and the correction of the real estate sector will continue to pose a market risk for the banks.

They will face more sophisticated risks in the future as the global financial market becomes increasingly liberalized, Alexander says.

The subprime crisis has taught Chinese banks a lesson in risk management. The risk awareness should be emphasized and the risk management should be enhanced for Chinese banks, economists say.

Ryan Tsang, senior director at Standard & Poor's adds that Chinese banks should also be cautious in monitoring loan applications and build up their capital to meet any fallout and financial crisis in the future.