Japan paying high price for PM's rhetoric

The recent provocative remarks by Japanese Prime Minister Sanae Takaichi on China's Taiwan island have not only pushed Sino-Japanese relations to a dangerous level but also inflicted serious economic damage. What began as political posturing has turned into a harsh economic reality for Japan. The country's fisheries, export-oriented agriculture and service industries are already feeling the shock waves, amplifying the strain on its fragile economy.

Japan's three economic engines -consumption, investment, and exports — are all sputtering simultaneously. Weak external demand and sluggish domestic consumption have exposed the country to both near-term and structural challenges. The absence of robust industrial support, combined with the limitations of "Takaichi Economics" as an extension of "Abenomics", risks pushing Japan into another recessionary cycle.

Declining exports are the main factor behind Japan's economic deceleration. With US tariffs impacting trade, Japan's real GDP fell 0.4 percent quarter-on-quarter in the third quarter of 2025, the first decline since the first quarter of 2024. In October 2025, Japan's exports to the US dropped 3.1 percent year-on-year, marking seven consecutive months of decline. The automotive sector -the backbone of Japan's trade — suffered a 7.5 percent decrease in exports.

There was a time when automakers absorbed tariff costs by lowering prices to maintain shipment volumes. But this strategy ate into profits and put pressure on companies to raise prices, which in turn would drag down exports and economic growth. Meanwhile, Japan's attempts at "China decoupling" in supply chains, semiconductor controls, higher import substitution in China and Beijing's restrictions on seafood imports have significantly reduced Japan's exports to China. Takaichi's remarks threaten to accelerate this downward trend, with growth in the fourth quarter of 2025 likely to remain negative.

To add to its woes, rising prices have constrained domestic consumption in Japan. Core inflation rose 3 percent year-on-year in October 2025, marking the 50th consecutive month of increase in prices. Although Japan has defeated long-term deflation, the current inflation is not because of a healthy increase in demand but due to rising input costs. This dampens the recovery prospects of a country weighed down by high government debt and a rapidly aging population.

Rising prices reduce real disposable income, suppressing consumption growth. Real wages continued to decline in the third quarter of 2025, while personal consumption increased by only 0.1 percent quarter-on-quarter, down from 0.4 percent in the second quarter. For now, the asset-driven income from rising stock and property prices is fueling consumption, but if these bubbles burst, domestic demand could weaken further.

Falling investment adds to Japan's economic headwinds. Despite growth in corporate equipment investment, declining exports and profit pressures are prompting more cautious investment decisions. For instance, Japan's seven largest automakers reported a roughly 30 percent drop in net profits between April and September 2025.Asset bubbles in prime urban areas further heighten the potential impact of a market correction.

Japan's stock, bond and currency markets have experienced severe turbulence in recent weeks. The Nikkei 225 has erased all gains since Takaichi took office, 30-year government bond yields have reached historic highs, and the yen is approaching the 160-dollar level that typically triggers the intervention alarm. Concerns over rising government debt, persistent inflation, uncertain interest rate policy and worsening trade relations with China are driving a wave of sell-offs.

The Takaichi cabinet is relying on debt-financed stimulus while the Bank of Japan has reduced bond purchases. The limited room for currency intervention and rapid unwinding of yen carry trades suggest that the ongoing turbulence will continue. Former BOJ Deputy Governor Hirohide Yamaguchi has warned that US financial risks and anticipated rate hikes could burst the asset bubble in Japan.

The series of countermeasures China implemented in response to Takaichi's remarks are already weighing on the Japanese economy. These measures include suspending imports of Japanese seafood, freezing discussions on Japanese beef exports and tightening controls on cultural and tourism exchanges.

The seafood import suspension alone affects 172 Japanese companies. China accounts for 47.8 percent of their exports, according to Teikoku Databank. Japan's seafood exports fell 7.5 percent in 2024. The new measures will accelerate the "de-Japanization" of seafood supply chains.

Japan's strategy to expand export-oriented agriculture also faces problems. The agreement with China on animal health and quarantine that took effect in July had raised hopes for beef exports, but subsequent regulatory processes have stalled.

Japan's tourism has been the worst hit. China's advisories against travel to Japan have led to massive cancellations — 904 flights were scrapped in December alone — hitting Japan's inbound tourism sector. Analysts estimate that halving Chinese tourist numbers could cost Japan nearly the same as losing all US tourists. Cultural exports are also affected as film releases and performances are delayed or canceled, undermining the ambitious "Cool Japan" strategy.

For Japan, the cost of high-risk diplomacy is mounting, and the road to recovery appears steeper than ever.

The author is a researcher at Institute of Japanese Studies, Chinese Academy of Social Sciences.

The views don't necessarily reflect those of China Daily.

Today's Top News

- 'Kill Line' the hidden rule of American governance

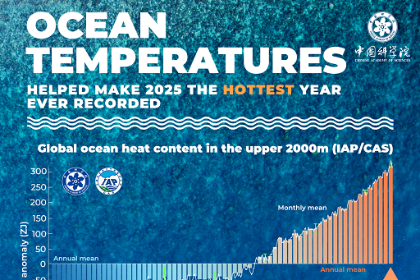

- Warming of oceans still sets records

- PBOC vows readiness on policy tools

- Investment boosts water management

- Chinese visitors to South Korea soar, topping Japan

- China, Africa launch year of people-to-people exchanges